Question: 1. Explain in detail the difference between the security market line and the capital market line. 2. The market A has only two risky assets,

1. Explain in detail the difference between the security market line and the capital market line.

2. The market A has only two risky assets, J and K and a risk free asset F. The risky assets have an equal market capitalization. Using the above find the variance of the market ^2_A and the covariance of the market with J and K. Compute the of asset J and K.

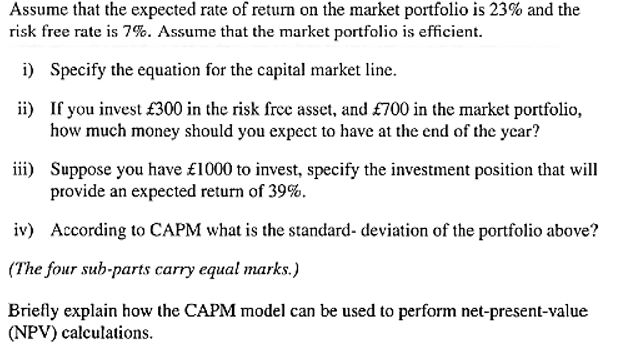

Assume that the expected rate of return on the market portfolio is 23% and the risk free rate is 7%. Assume that the market portfolio is efficient. i) Specify the equation for the capital market line. ii) If you invest 300 in the risk free asset, and 700 in the market portfolio, how much money should you expect to have at the end of the year? iii) Suppose you have 1000 to invest, specify the investment position that will provide an expected return of 39%. iv) According to CAPM what is the standard deviation of the portfolio above? (The four sub-parts carry equal marks.) Briefly explain how the CAPM model can be used to perform net-present-value (NPV) calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts