Question: 1. Explain the difference between cash and stock dividends. 2. What are the strategies companies use to control the market prices of their shares. 3.

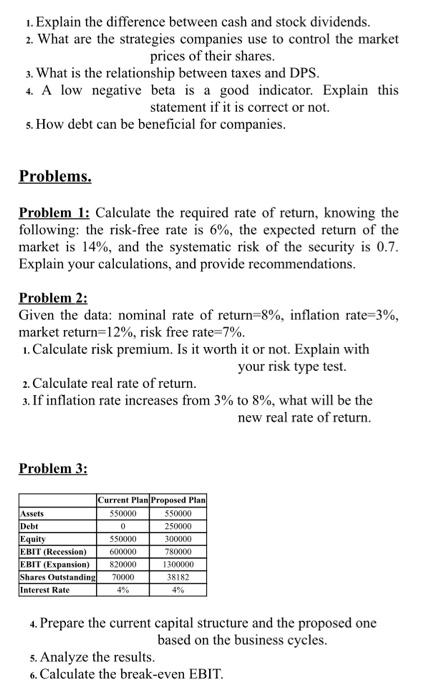

1. Explain the difference between cash and stock dividends. 2. What are the strategies companies use to control the market prices of their shares. 3. What is the relationship between taxes and DPS. 4. A low negative beta is a good indicator. Explain this statement if it is correct or not. s. How debt can be beneficial for companies. Problems. Problem 1: Calculate the required rate of return, knowing the following: the risk-free rate is 6%, the expected return of the market is 14%, and the systematic risk of the security is 0.7. Explain your calculations, and provide recommendations. Problem 2: Given the data: nominal rate of return=8%, inflation rate=3%, market return=12%, risk free rate=7%. 1. Calculate risk premium. Is it worth it or not. Explain with your risk type test. 2. Calculate real rate of return. 3. If inflation rate increases from 3% to 8%, what will be the new real rate of return Problem 3: Current Plan Proposed Plan Assets 550000 550000 Debt 0 250000 Equity S50000 300000 EBIT (Recession) 60000 780000 EBIT (Expansion) 820000 1300000 Shares Outstanding 70000 38182 Interest Rate 4% 4% 4. Prepare the current capital structure and the proposed one based on the business cycles. 5. Analyze the results. 6. Calculate the break-even EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts