Question: 1. Explain the difference between monetary unit assumption and the economic entity assumption. 2. Transactions made by Ahmed & Co., for the month of April

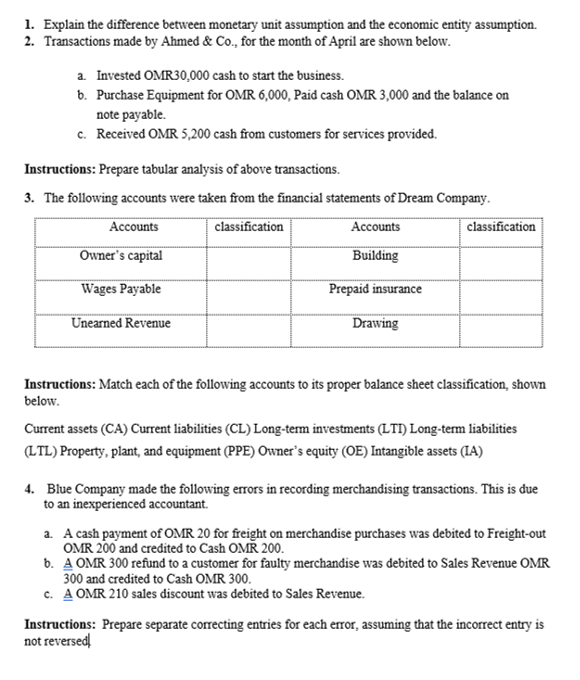

1. Explain the difference between monetary unit assumption and the economic entity assumption. 2. Transactions made by Ahmed & Co., for the month of April are shown below. a. Invested OMR30,000 cash to start the business. b. Purchase Equipment for OMR 6,000, Paid cash OMR 3,000 and the balance on note payable. c. Received OMR 5,200 cash from customers for services provided. Instructions: Prepare tabular analysis of above transactions. 3. The following accounts were taken from the financial statements of Dream Company. Accounts classification Accounts classification Owner's capital Building Wages Payable Prepaid insurance Unearned Revenue Drawing Instructions: Match each of the following accounts to its proper balance sheet classification, shown below. Current assets (CA) Current liabilities (CL) Long-term investments (LTI) Long-term liabilities (LTL) Property, plant, and equipment (PPE) Owner's equity (OE) Intangible assets (IA) 4. Blue Company made the following errors in recording merchandising transactions. This is due to an inexperienced accountant. a. A cash payment of OMR 20 for freight on merchandise purchases was debited to Freight-out OMR 200 and credited to Cash OMR 200. 6. A OMR 300 refund to a customer for faulty merchandise was debited to Sales Revenue OMR 300 and credited to Cash OMR 300. C. A OMR 210 sales discount was debited to Sales Revenue. Instructions: Prepare separate correcting entries for each error, assuming that the incorrect entry is not reversed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts