Question: 1. Explain the difference between value at risk and expected shortfall. 2. Consider a position consisting of a $100,000 investment in asset A and a

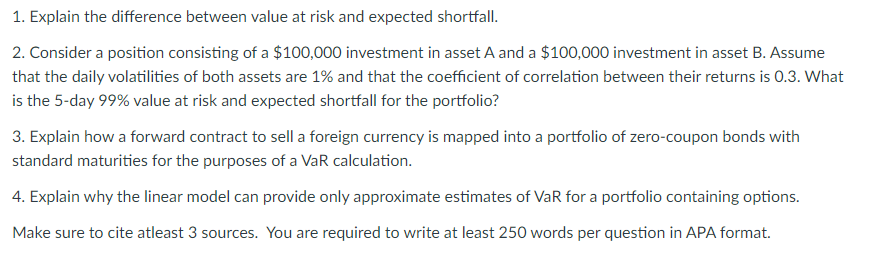

1. Explain the difference between value at risk and expected shortfall. 2. Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3 . What is the 5-day 99% value at risk and expected shortfall for the portfolio? 3. Explain how a forward contract to sell a foreign currency is mapped into a portfolio of zero-coupon bonds with standard maturities for the purposes of a VaR calculation. 4. Explain why the linear model can provide only approximate estimates of VaR for a portfolio containing options. Make sure to cite atleast 3 sources. You are required to write at least 250 words per question in APA format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts