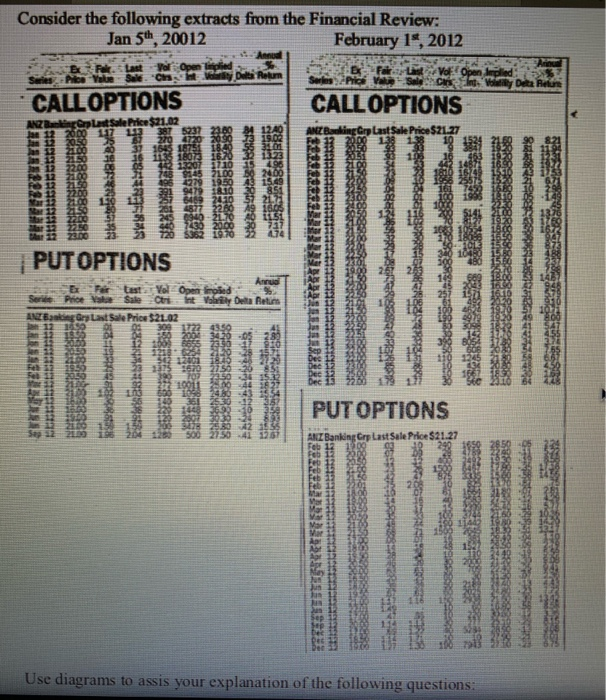

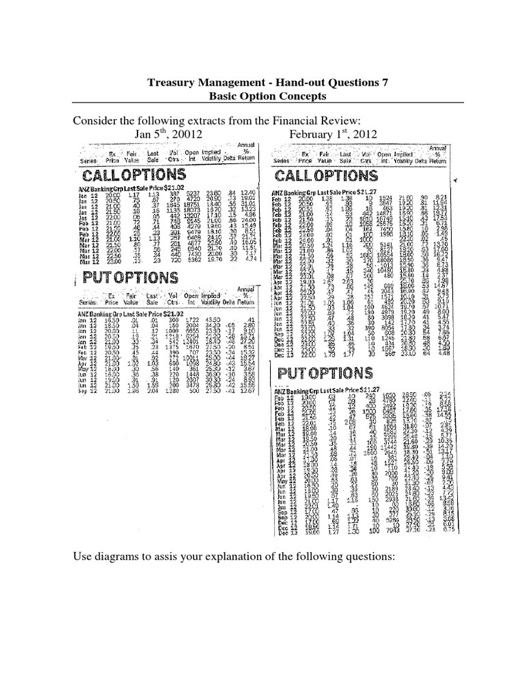

Question: 1. Explain why ANZ call options expiring in March 2012 with exercise prices of $20.50 and $22.50 had fair values of $1.24 and 17c respectively

Annud Anun Consider the following extracts from the Financial Review: Jan 5th, 20012 February 15, 2012 Bk Last Yol Open Tipe Regum CALL OPTIONS CALLOPTIONS ANZSale Price $21.02 Pico Valve Sale Series Willy Delta Reliure 2000 111 2030 TO 3872 3716 16 119 ANZ Banking Cry Last Sale Price $21.27 FB Fel 70 55 2101 113 10 15 2196 00 24.00 50 15.00 10 851 10 57 2120 NEM Pes 12 Pe 12 Feb 12 PUT OPTIONS Annud Per tast Yol Open froked Seri Price ale Sale Criint Vay Delta Return Zing Gry Last Sale Price $21.02 12 12 309 177243 12 -05 13 23 1200118410 X STO 2750 363 107 036 1522 11 0182 BE123 1023 334 2530 12 PA 889894893 8888888 8888 PUT OPTIONS ANZ Banking Crp Last Sale Price $21.27 Feb 12 Feb 12 2002 Feb 11 2015 52 Feb 12 mar Mar Dar Sep 12 SP Use diagrams to assis your explanation of the following questions: Treasury Management - Hand-out Questions 7 Basie Option Concepts Consider the following extracts from the Financial Review: Jan 5, 20012 February 1", 2012 Tele lastel Open inged CALL OPTIONS CALL OPTIONS Ana Sebe Value Sweeth Volly Data Recon Be Fal Open Brod $ Sasce Y Santos Deta Hebam ANZ Bankingplast Sole Price $21.02 ANZ Banking Go Last Sale Price51137 382 RRAN RANNS 58888888888888 SERRES PUT OPTIONS sex bebe Yol Opere Series Prise Vue Way Delane ANE Bankia GroList Sale Price 21.12 BESEST: 355 WS CANON SEX PUT OPTIONS Cepat SEA88 SUN Use diagrams to assis your explanation of the following questions: Annud Anun Consider the following extracts from the Financial Review: Jan 5th, 20012 February 15, 2012 Bk Last Yol Open Tipe Regum CALL OPTIONS CALLOPTIONS ANZSale Price $21.02 Pico Valve Sale Series Willy Delta Reliure 2000 111 2030 TO 3872 3716 16 119 ANZ Banking Cry Last Sale Price $21.27 FB Fel 70 55 2101 113 10 15 2196 00 24.00 50 15.00 10 851 10 57 2120 NEM Pes 12 Pe 12 Feb 12 PUT OPTIONS Annud Per tast Yol Open froked Seri Price ale Sale Criint Vay Delta Return Zing Gry Last Sale Price $21.02 12 12 309 177243 12 -05 13 23 1200118410 X STO 2750 363 107 036 1522 11 0182 BE123 1023 334 2530 12 PA 889894893 8888888 8888 PUT OPTIONS ANZ Banking Crp Last Sale Price $21.27 Feb 12 Feb 12 2002 Feb 11 2015 52 Feb 12 mar Mar Dar Sep 12 SP Use diagrams to assis your explanation of the following questions: Treasury Management - Hand-out Questions 7 Basie Option Concepts Consider the following extracts from the Financial Review: Jan 5, 20012 February 1", 2012 Tele lastel Open inged CALL OPTIONS CALL OPTIONS Ana Sebe Value Sweeth Volly Data Recon Be Fal Open Brod $ Sasce Y Santos Deta Hebam ANZ Bankingplast Sole Price $21.02 ANZ Banking Go Last Sale Price51137 382 RRAN RANNS 58888888888888 SERRES PUT OPTIONS sex bebe Yol Opere Series Prise Vue Way Delane ANE Bankia GroList Sale Price 21.12 BESEST: 355 WS CANON SEX PUT OPTIONS Cepat SEA88 SUN Use diagrams to assis your explanation of the following questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts