Question: 1. Explain why the following statements are true or false. (a) [5] Personal taxes have an indirect impact on the firm's weighted average cost of

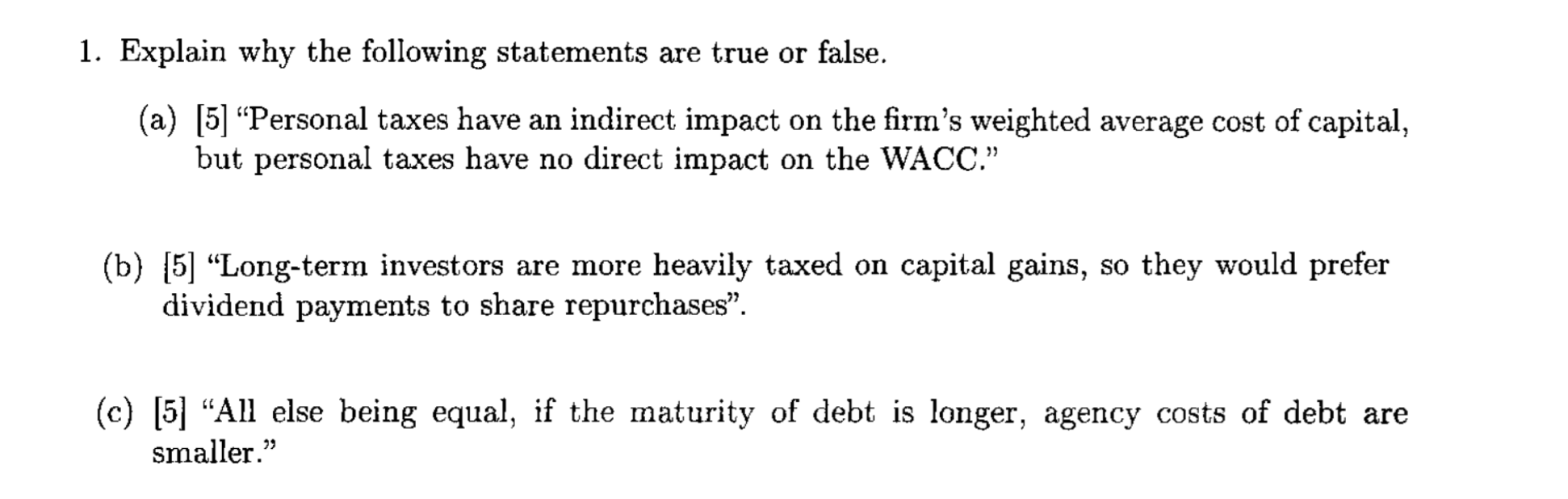

1. Explain why the following statements are true or false. (a) [5] "Personal taxes have an indirect impact on the firm's weighted average cost of capital, but personal taxes have no direct impact on the WACC. (b) [5] Long-term investors are more heavily taxed on capital gains, so they would prefer dividend payments to share repurchases". (C) [5] All else being equal, if the maturity of debt is longer, agency costs of debt are smaller.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock