Question: 1. Explain why the quick ratio is a better measure of a firm's liquidity than the current ratio? Under what situation current ratio of a

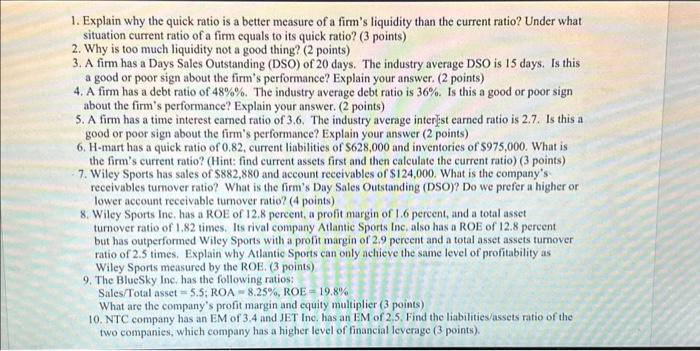

1. Explain why the quick ratio is a better measure of a firm's liquidity than the current ratio? Under what situation current ratio of a firm equals to its quick ratio? ( 3 points) 2. Why is too much liquidity not a good thing? ( 2 points) 3. A firm has a Days Sales Outstanding (DSO) of 20 days. The industry average DSO is 15 days. Is this a good or poor sign about the firm's performance? Explain your answer. (2 points) 4. A firm has a debt ratio of 48%%. The industry average debt ratio is 36%. Is this a good or poor sign about the firm's performance? Explain your answer. ( 2 points) 5. A firm has a time interest eamed ratio of 3.6. The industry average inter [ist earned ratio is 2.7 . Is this a good or poor sign about the firm's performance? Explain your answer ( 2 points) 6. H-mart has a quick ratio of 0.82 , current liabilities of $628,000 and inventories of $975,000. What is the firm's current ratio? (Hint: find current assets first and then calculate the current ratio) (3 points) 7. Wiley Sports has sales of $882,880 and account receivables of $124,000. What is the company's receivables tumover ratio? What is the firm's Day Sales Outstanding (DSO)? Do we prefer a higher or lower account receivable tumover ratio? ( 4 points) 8. Wiley Sports Inc. has a ROE of 12.8 pereent, a profit margin of 1.6 percent, and a total asset tumover ratio of 1.82 times. Its rival company Atlantic Sports Inc, also has a ROE of 12.8 percent but has outperformed Wiley Sports with a profit margin of 2.9 pereent and a total asset assets turnover ratio of 2.5 times. Explain why Atlantic Sports can only achieve the same level of profitability as Wiley Sports measured by the ROE. ( 3 points) 9. The BlueSky Inc, has the following ratios: Sales/Total asset =5.5,ROA=8.25%,ROE=19.8% What are the company's profit margin and equity multiplier ( 3 points) 10. NTC company has an EM of 3.4 and JET Ine, has an EM of 2.5. Find the liabilities/assets ratio of the two companies, which company has a higher level of financial leverage ( 3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts