Question: 1. Explain why the US financial structure is different and U.S. banks are more regulated along dimensions of branching and services than their foreign counterparts

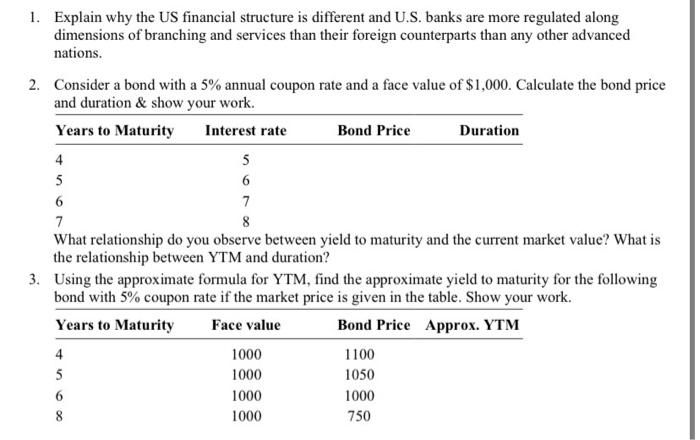

1. Explain why the US financial structure is different and U.S. banks are more regulated along dimensions of branching and services than their foreign counterparts than any other advanced nations. 2. Consider a bond with a 5% annual coupon rate and a face value of $1,000. Calculate the bond price and duration & show your work. Years to Maturity Interest rate Bond Price Duration 4 5 5 6 6 7 7 8 What relationship do you observe between yield to maturity and the current market value? What is the relationship between YTM and duration? 3. Using the approximate formula for YTM, find the approximate yield to maturity for the following bond with 5% coupon rate if the market price is given in the table. Show your work. Years to Maturity Face value Bond Price Approx. YTM 4 1000 1100 5 1000 1050 6 1000 1000 8 1000 750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts