Question: 1) Fabozzi, 10th edition, Chapter 6 , Problem #12 (15 points) You are a financial consultant. At various times you have heard comments on interest

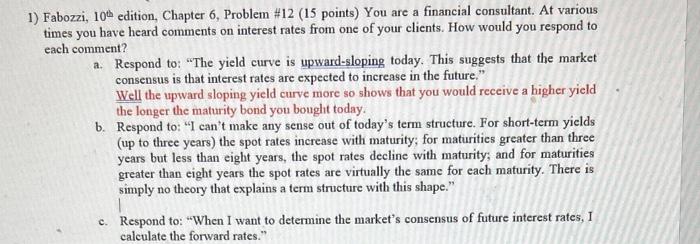

1) Fabozzi, 10th edition, Chapter 6 , Problem #12 (15 points) You are a financial consultant. At various times you have heard comments on interest rates from one of your clients. How would you respond to each comment? a. Respond to: "The yield curve is upward-sloping today. This suggests that the market consensus is that interest rates are expected to increase in the future," Well the upward sloping yield curve more so shows that you would receive a higher yield the longer the maturity bond you bought today. b. Respond to: "I can't make any sense out of today's term structure. For short-term yields (up to three years) the spot rates increase with maturity; for maturities greater than three years but less than eight years, the spot rates decline with maturity; and for maturities greater than eight years the spot rates are virtually the same for each maturity. There is simply no theory that explains a term structure with this shape." c. Respond to: "When I want to determine the market's consensus of future interest rates, I calculate the forward rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts