Question: 1. Fact: MNEs often can access additional & less costly sources of funding beyond their home markets. Examples? II. Firms located in countries with illiquid,

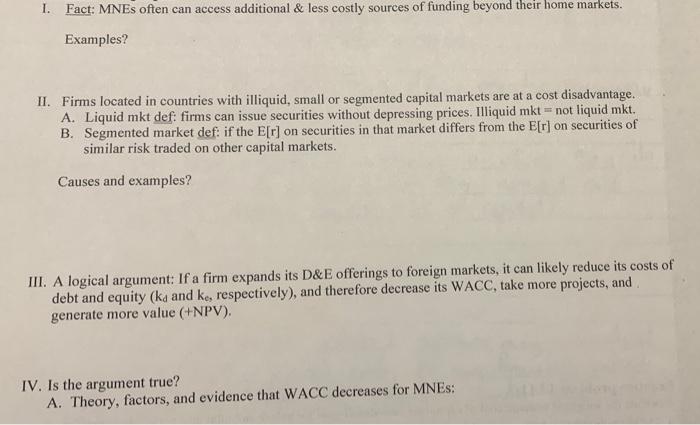

1. Fact: MNEs often can access additional & less costly sources of funding beyond their home markets. Examples? II. Firms located in countries with illiquid, small or segmented capital markets are at a cost disadvantage. A. Liquid mkt def: firms can issue securities without depressing prices. Illiquid mkt - not liquid mkt. B. Segmented market def: if the E[r) on securities in that market differs from the E[r) on securities of similar risk traded on other capital markets. Causes and examples? III. A logical argument: If a firm expands its D&E offerings to foreign markets, it can likely reduce its costs of debt and equity (ka and ke, respectively), and therefore decrease its WACC, take more projects, and generate more value (+NPV). IV. Is the argument true? A. Theory, factors, and evidence that WACC decreases for MNES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts