Question: 1 . Fin B . ( age 5 0 ) and Rylee S . ( age 4 8 ) Johnson are married and live at

Fin Bage and Rylee Sage Johnson are married and live at Mockingbird Ln Charlotte, Nc Fin is employed as a human resource manager for Toys Unlimited, Inc., a fullservice wealthplanning firm. Rylee is a selfemployed architect. They are calendar year, cashbasis taxpayers.

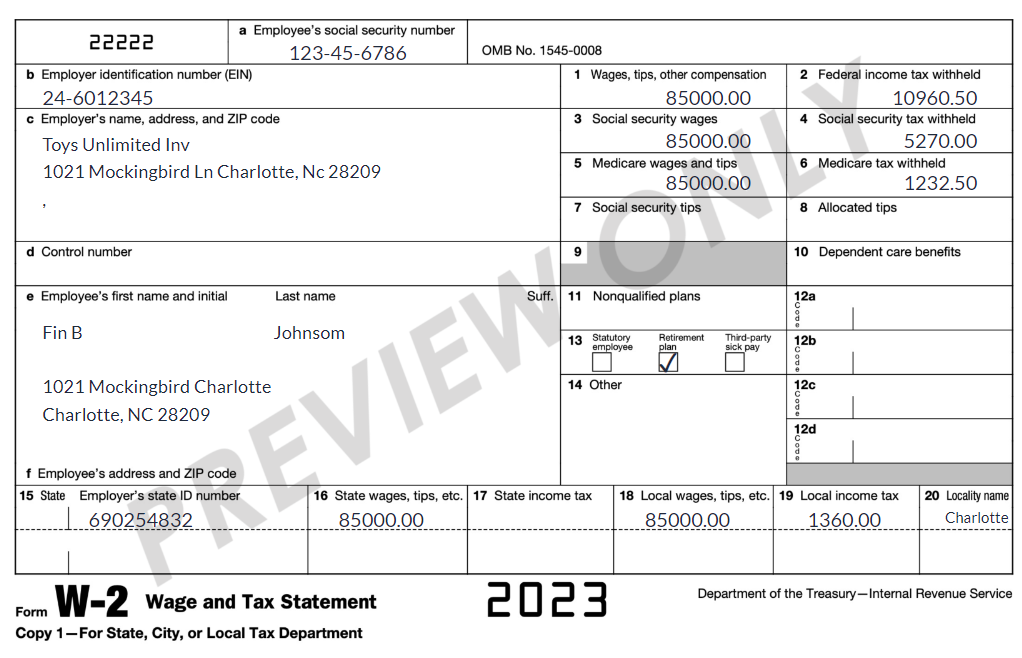

Fin received a Form W from Toys Unlimited, Inc. that contained the following

information:

Rylee is a licensed architect who works parttime on a consulting basis. Her professional activity code is Her primary clients are real estate developers for whom she prepares structural design and construction plans. She also advises on building code requirements regarding the renovation and remodeling of existing structures. Rylee does her work at the clients location. Rylee collected $ in consulting fees during This total includes a $ payment for work she performed in and does not include the $ she billed in December for work performed in late Her business expenses for are:

Advertising: $

Supplies:

Drafting supplies: $

Reproduction materials eg molds, models, photos, blueprints, copies: $

Professional license fee: $

Other business expenses:

Onsite work clothing eg hip boots, safety glasses, safety helmet: $

Subscriptions to professional journals: $

Dues to professional organizations: $

In addition, Rylee drove her car miles on her job assignments. She uses the standard mileage method to deduct business costs related to her vehicle. In Rylee made estimated federal income tax payments of $ and paid state income tax of $

In addition to the items previously noted, the Johnsons had the following receipts for :

Gift from Fins father: $

Interest income on US Treasury Bond: $

Interest income of Harrisburg City Bond municipal bond: $

Interest income from First Bank of America: $

Life insurance proceeds on the death of Rylees mother: $

PA state income tax refund: $

Rylee won $ in the state lottery. She has been playing the lottery for years $ in lottery tickets every week $ in total that she saves to keep track of the numbers she plays

Fin entered a contest sponsored by a radio station and won tickets to the touring Broadwaystyle production of Wholesome. The value of the tickets was $ each.

Fin and Rylee incurred the following medical expenses during :

Transportation to Philadelphia for Fins medical treatment: miles.

Unreimbursed hospital charges for Rylee: $

Unreimbursed prescription drug charges for Fin and Rylee: $

Unreimbursed physician charges for Fin and Rylee: $

Unreimbursed prescription glasses for Rylee: $

Laser hair treatment for Rylee so that she will no longer need to shave her legs: $ Medical insurance premiums insurance offered by Fins employer: $

Fin and Rylee paid $ of interest payments on their primary residence acquisition debt of $ They also paid $ of interest expense on Fin car loan and $ of interest on their Visa card.

Fin and Rylee paid $ of real estate taxes on their home. They also paid $ in sales tax on Fins car and other purchases

Fin and Rylee made the following contributions during :

American Red Cross: $

Political contributions: $

United Way: $

Community college: $

Food for the family of Hannah Barbara a neighbor who suffered a tragic car accident this past year: $

Stock transfer to Penn State Altoona originally purchased for $ in : $

The Johnsons maintain a household that includes their two children, jack age and Kate age Jack is a junior in high school. Kate graduated from high school on June and is undecided about college. She is an accomplished vocalist and during earned $ performing at various events eg weddings, funerals Kate placed most of her earnings in a savings account for future use and kept only a small amount to spend on herself.

Relevant Social Security numbers are noted below:

Name Social Security Number

Fin B Johnson

Rylee S Johnson

Kayla J Johnson

Matthew W Johnson

Requirements

The Johnsons hire you to prepare federal income tax return for them. Prepare an income tax return

for the Johnsons for using the following guidance:

The Johnsons choose to file a joint income tax return

Complete the Tax accounting Form Schedule Schedule Schedule A Schedule B Schedule C Schedule SE Schedule and credit limit worksheet Form Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock