Question: 1. Financial Leverage and Capital Structure (8 points) a) (4 points) Break-Even EBIT There are two different capital structures. The first option consist of 20,000

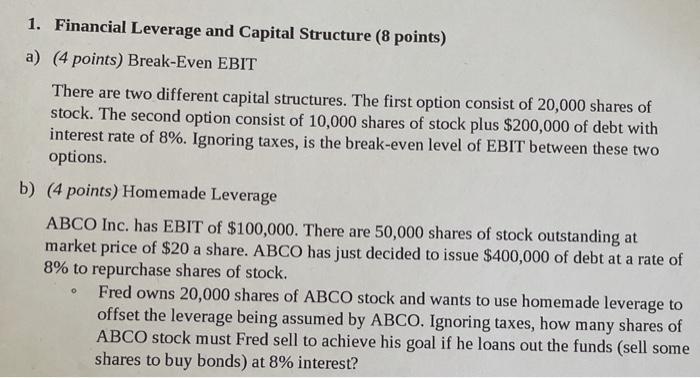

1. Financial Leverage and Capital Structure (8 points) a) (4 points) Break-Even EBIT There are two different capital structures. The first option consist of 20,000 shares of stock. The second option consist of 10,000 shares of stock plus $200,000 of debt with interest rate of 8%. Ignoring taxes, is the break-even level of EBIT between these two options. b) (4 points) Homemade Leverage ABCO Inc. has EBIT of $100,000. There are 50,000 shares of stock outstanding at market price of $20 a share. ABCO has just decided to issue $400,000 of debt at a rate of 8% to repurchase shares of stock. Fred owns 20,000 shares of ABCO stock and wants to use homemade leverage to offset the leverage being assumed by ABCO. Ignoring taxes, how many shares of ABCO stock must Fred sell to achieve his goal if he loans out the funds (sell some shares to buy bonds) at 8% interest? O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts