Question: 1. Financial managers should select the capital structure that: A) produces the highest cost of capital. B) maximizes shareholders' wealth C) minimizes taxes. D) maximize

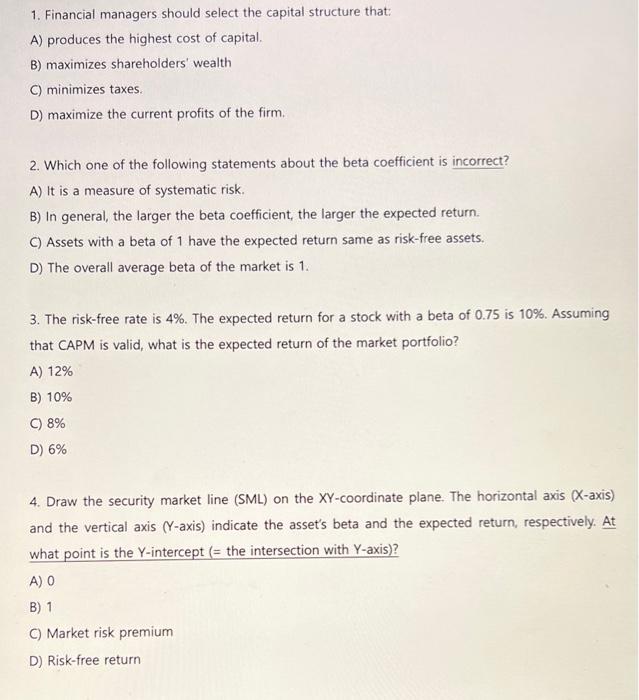

1. Financial managers should select the capital structure that: A) produces the highest cost of capital. B) maximizes shareholders' wealth C) minimizes taxes. D) maximize the current profits of the firm. 2. Which one of the following statements about the beta coefficient is incorrect? A) It is a measure of systematic risk. B) In general, the larger the beta coefficient, the larger the expected return. C) Assets with a beta of 1 have the expected return same as risk-free assets. D) The overall average beta of the market is 1 . 3. The risk-free rate is 4%. The expected return for a stock with a beta of 0.75 is 10%. Assuming that CAPM is valid, what is the expected return of the market portfolio? A) 12% B) 10% C) 8% D) 6% 4. Draw the security market line (SML) on the XY-coordinate plane. The horizontal axis (X-axis ) and the vertical axis ( Y-axis) indicate the asset's beta and the expected return, respectively. At what point is the Y-intercept (= the intersection with Y-axis)? A) 0 B) 1 C) Market risk premium D) Risk-free return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts