Question: 1. Find the BTCF 'SV' (Actual $) at EOY2 and EOY4 2. Find the BTCF 'Working Capital' (Actual $) at EOY0 3. Find the Total

1. Find the BTCF 'SV' (Actual $) at EOY2 and EOY4

2. Find the BTCF 'Working Capital' (Actual $) at EOY0

3. Find the Total BTCF (Actual $) at EOY1, EOY3, EOY4

4. Find the BTCF 'Operations' at EOY2

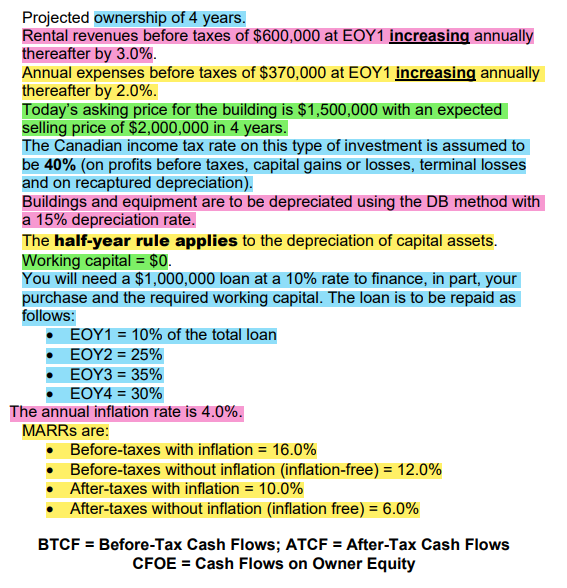

Projected ownership of 4 years. Rental revenues before taxes of $600,000 at EOY1 increasing annually thereafter by 3.0%. Annual expenses before taxes of $370,000 at EOY1 increasing annually thereafter by 2.0%. Today's asking price for the building is $1,500,000 with an expected selling price of $2,000,000 in 4 years. The Canadian income tax rate on this type of investment is assumed to be 40% (on profits before taxes, capital gains or losses, terminal losses and on recaptured depreciation). Buildings and equipment are to be depreciated using the DB method with a 15% depreciation rate. The half-year rule applies to the depreciation of capital assets. Working capital = $0. You will need a $1,000,000 loan at a 10% rate to finance, in part, your purchase and the required working capital. The loan is to be repaid as follows: EOY1 = 10% of the total loan EOY2 = 25% EOY3 = 35% EOY4 = 30% The annual inflation rate is 4.0%. MARRs are: Before-taxes with inflation = 16.0% Before-taxes without inflation (inflation-free) = 12.0% After-taxes with inflation = 10.0% After-taxes without inflation (inflation free) = 6.0% BTCF = Before-Tax Cash Flows; ATCF = After-Tax Cash Flows CFOE = Cash Flows on Owner Equity Projected ownership of 4 years. Rental revenues before taxes of $600,000 at EOY1 increasing annually thereafter by 3.0%. Annual expenses before taxes of $370,000 at EOY1 increasing annually thereafter by 2.0%. Today's asking price for the building is $1,500,000 with an expected selling price of $2,000,000 in 4 years. The Canadian income tax rate on this type of investment is assumed to be 40% (on profits before taxes, capital gains or losses, terminal losses and on recaptured depreciation). Buildings and equipment are to be depreciated using the DB method with a 15% depreciation rate. The half-year rule applies to the depreciation of capital assets. Working capital = $0. You will need a $1,000,000 loan at a 10% rate to finance, in part, your purchase and the required working capital. The loan is to be repaid as follows: EOY1 = 10% of the total loan EOY2 = 25% EOY3 = 35% EOY4 = 30% The annual inflation rate is 4.0%. MARRs are: Before-taxes with inflation = 16.0% Before-taxes without inflation (inflation-free) = 12.0% After-taxes with inflation = 10.0% After-taxes without inflation (inflation free) = 6.0% BTCF = Before-Tax Cash Flows; ATCF = After-Tax Cash Flows CFOE = Cash Flows on Owner Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts