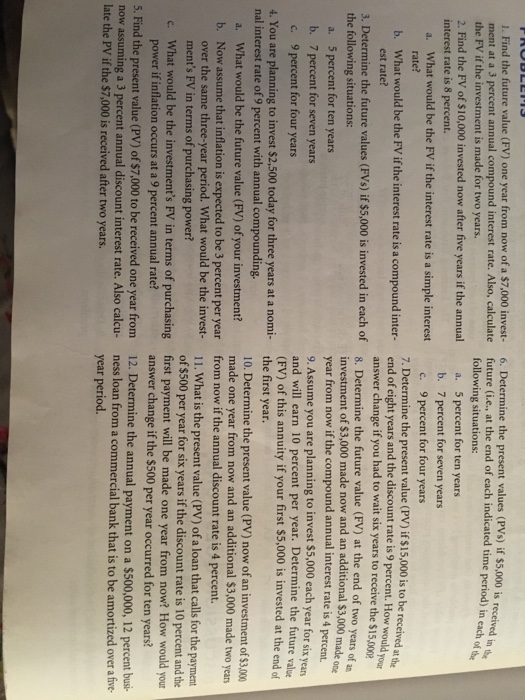

Question: 1. Find the future value (FV) one year from now of a $7,000 invest 6. Determine the present values (PVs) if $5,000 is ment at

1. Find the future value (FV) one year from now of a $7,000 invest 6. Determine the present values (PVs) if $5,000 is ment at a 3 percent annual compound interest rate. Also, calculate future (i.e., at the end of each indicated time the FV if the investment is made for two years 2. Find the FV of $10,000 invested now after five years if the annual interest rate is 8 percent. period)in each ot t following situations: 5 percent for ten years 7 percent for seven years 9 percent for four years a. b. c. What would be the FV if the interest rate is a simple interest 7. Determine the present value (PV) if $15,000 is to be received at the end of eight years and the discount rate is 9 percent. How would What would be the FV if the interest est rate? rate is a compound inter- b. answer change if you had to wait six years to receive the $15,00P 3. Determine the future values (FVs) if $5,000 is invested in each of the following situations: Determine the future value (FV) at the end of two years of investment of $3,000 made now and an additional $3,000 made year from now if the compound annual interest rate is 4 percent. 9. Assume you are planning to invest $5,000 each year for six and will earn 10 percent per year. Determine the future (FV) of this annuity if your first $5,000 is invested at the end of the first year. 10. Determine the present value (PV) now of an investment of $3,000 made one year from now and an additional $3,000 made two from now if the annual discount rate is 4 percent. 11. What is the present value (PV) of a loan that calls for the paymert of $500 per year for six years if the discount rate is 10 percent and the first payment will be made one year from now? How would your answer change if the $500 per year occurred for ten years? 12. an 5 percent for ten years a. b. 7 percent for seven years 9 percent for four years c. 4. You are planning to invest $2,500 today for three years at a nomi- nal interest rate of 9 percent with annual compounding. What would be the future value (FV) of your investment? Now assume that inflation is expected to be 3 percent per year years b. ver the same three-year period. What would be the invest- What would be the investment's FV in terms of purchasing 5. Find the present value (PV) of $7,000 to be received one year from ment's FV in terms of purchasing power? power if inflation occurs at a 9 percent annual rate? Determine the annual payment on a $500,000, 12 percent busi- ness loan from a commercial bank that is to be year period now assuming a 3 percent annual discount interest rate. Also calcu- late the PV if the $7,000 is received after two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts