Question: 1 Find the mean sample return 2 Find the standard deviation of sample return 3 Find the maximum sample return 4 Find the minimum sample

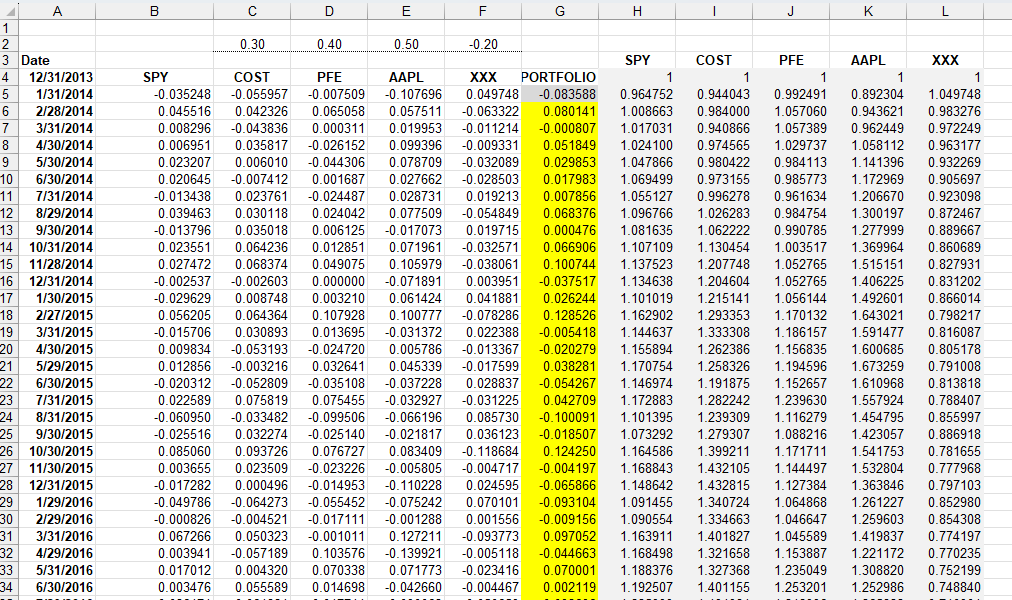

Find the mean sample return Find the standard deviation of sample return Find the maximum sample return Find the minimum sample return Find the correlation of each stock return with the market SPY Find the beta of each stock Find the alpha of each stock Find the systematic risk of each stock Variance Attributable to the Market Find the unsystematic or residual risk of each stock Variance Attributable to none Market events What percentage of the variation Risk NOT explained by the market What part of the expected return is attributed to the market Systematic Return What part of the expected return is attributable to stock specific events and nonmarket events Unsystematic Return Assuming a Singel Factor Model SIM with SPY is the single factor, The covariance between the return on COST and the return on PFE is Hint: You need to use the SIM assumptions to answer this question According to the SIM as in Question the correlation between COST and PFE is C Using the historical returns in the data table, the correlation between COST and and PFE is

Fill out the yellow highlighted sections of the table, preferrably with excel formulas.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock