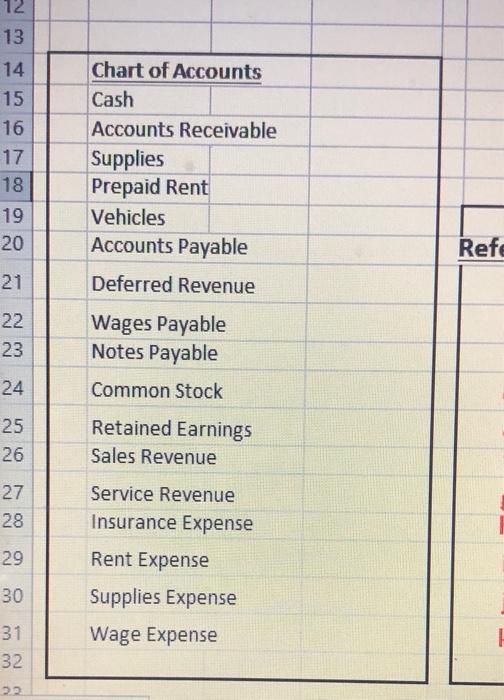

Question: 1) First, record the necessary journal entry (utilize the Chart of Accounts below). 2) After recording each entry, post the effects of the Journal Entry

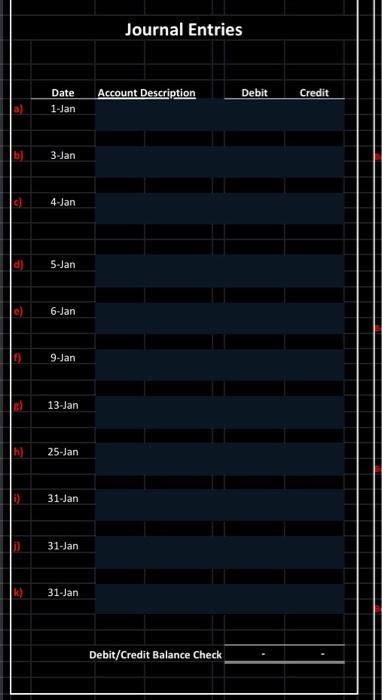

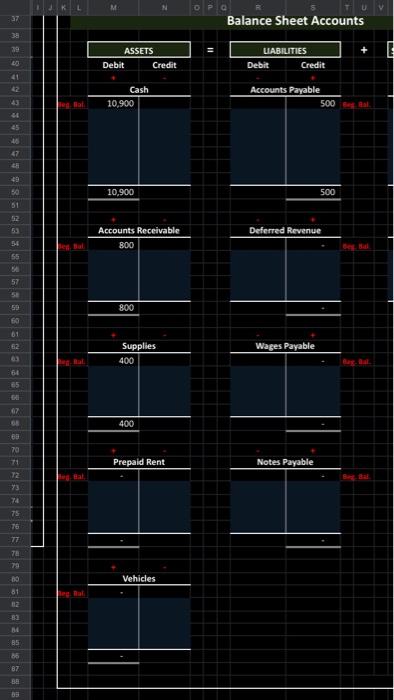

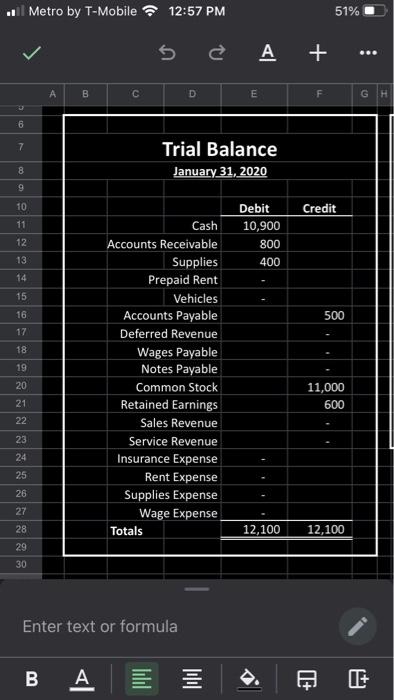

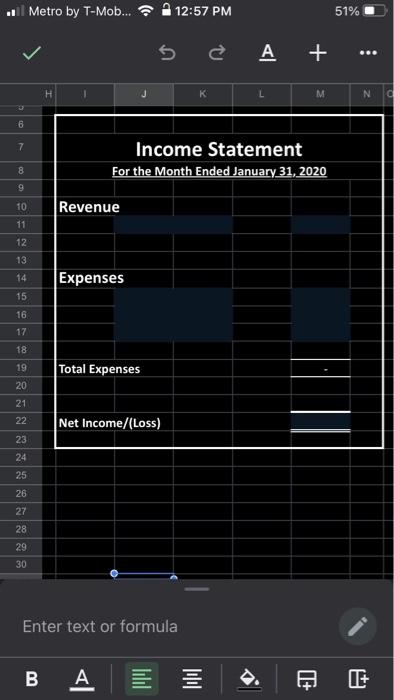

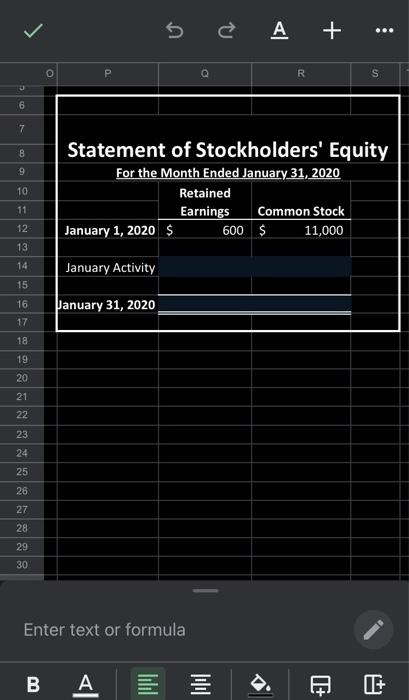

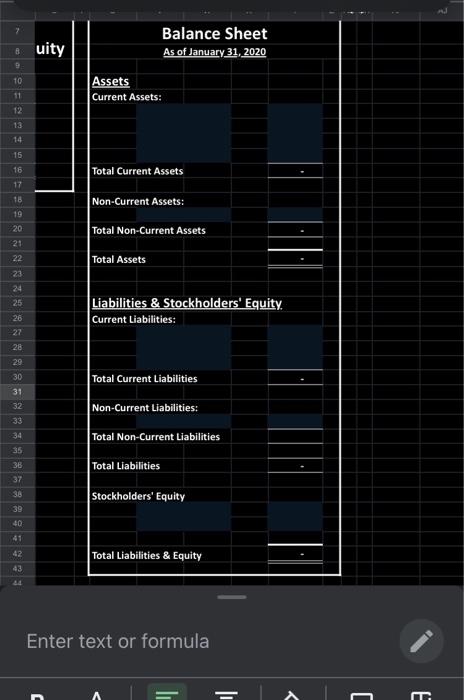

12 13 14 15 16 17 18 Chart of Accounts Cash Accounts Receivable Supplies Prepaid Rent Vehicles Accounts Payable 19 20 Ref 21 Deferred Revenue 22 23 Wages Payable Notes Payable 24 Common Stock 25 26 Retained Earnings Sales Revenue 27 28 29 Service Revenue Insurance Expense Rent Expense Supplies Expense Wage Expense 30 31 32 Journal Entries Account Description Debit Credit Date 1-Jan b) 3-Jan c) 4-Jan d) 5-Jan 6-Jan 9-Jan 13-Jan 25-Jan 31-Jan 31-Jan 31-Jan Debit/Credit Balance Check KL 37 DPG Balance Sheet Accounts 39 + ASSETS Debit Credit UABILITIES Debit Credit 23 41 42 Cash 10,900 Accounts Payable 500 0 45 46 47 49 50 10,900 500 51 12 Deferred Revenue Accounts Receivable 800 56 55 57 58 59 800 GO 61 62 Wages Payable Supplies 400 3 64 65 400 70 71 Prepaid Rent Notes Payable 72 Y3 75 75 77 TE 79 09 Vehicles 81 2 B2 ME B5 36 87 BE Metro by T-Mobile 12:56 PM 51% Ledger Accounts (T-Account Balance Sheet Accounts ASSETS Debit Credit LIABILITIES Debit Credit STOCKHOLDERS EQUITY Debit Credit Cash 10.900 Accounts Payable 500 g Common Stock 11,000 10,900 500 11,000 Deferred Revenue Accounts Receivable 800 Retained Earnings 600 800 600 Wapes Payable Supplies 400 400 M Prepaid Rent Notes Payable 13 13 TY Vehicles DO 01 2 31 04 39 AB AC AD AE AF AG AI Y Z AA ints) 36 37 Income Statement Accounts 38 39 REVENUE Debit Credit EXPENSES Debit Credit 40 41 42 Sales Revenue Insurance Expense 43 Bersal 44 45 46 47 48 49 50 51 52 53 Service Revenue Rent Expense 54 Bera 55 56 57 58 59 60 61 62 Supplies Expense 63 64 65 66 67 68 69 70 ZT Wage Expense 72 73 St. Bal. 74 75 76 77 Metro by T-Mobile 12:57 PM 51% U 5 A + be. A B C D E F G H 6 7 Trial Balance January 31, 2020 8 9 10 Credit 11 Debit 10,900 800 12 13 400 14 15 16 500 17 18 19 Cash Accounts Receivable Supplies Prepaid Rent Vehicles Accounts Payable Deferred Revenue Wages Payable Notes Payable Common Stock Retained Earnings Sales Revenue Service Revenue Insurance Expense Rent Expense Supplies Expense Wage Expense Totals 20 11,000 600 21 22 23 . 24 25 26 27 28 12,100 12,100 29 30 Enter text or formula B CE Metro by T-Mob... 12:57 PM 51% 5 A+ 2. K L M N 6 7 Income Statement For the Month Ended January 31, 2020 8 9 10 Revenue 11 12 13 14 Expenses 15 16 17 18 19 Total Expenses 20 21 22 Net Income/(Loss) 23 24 25 26 27 28 29 30 Enter text or formula B CE 5 A + ... R S 0 6 7 8 9 10 Statement of Stockholders' Equity For the Month Ended January 31, 2020 Retained Earnings Common Stock January 1, 2020 $ 600 $ 11,000 11 12 13 14 January Activity 15 16 January 31, 2020 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Enter text or formula . A TE+ E & uity Balance Sheet As of January 31, 2020 10 Assets Current Assets: 11 12 14 15 16 Total Current Assets 17 18 Non-Current Assets: 19 20 Total Non-Current Assets Total Assets 22 23 25 26 Liabilities & Stockholders' Equity Current Liabilities: 28 29 30 Total Current Liabilities 32 Non-Current Liabilities: SS SS SS SS SS SS SS3 Total Non-Current Liabilities 34 35 Total Liabilities 38 Stockholders' Equity 39 41 Total Liabilities & Equity 43 Enter text or formula IT )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts