Question: 1 . For 2 0 1 8 , the Sanchez family ( married family of five, which includes three children ) had a salary of

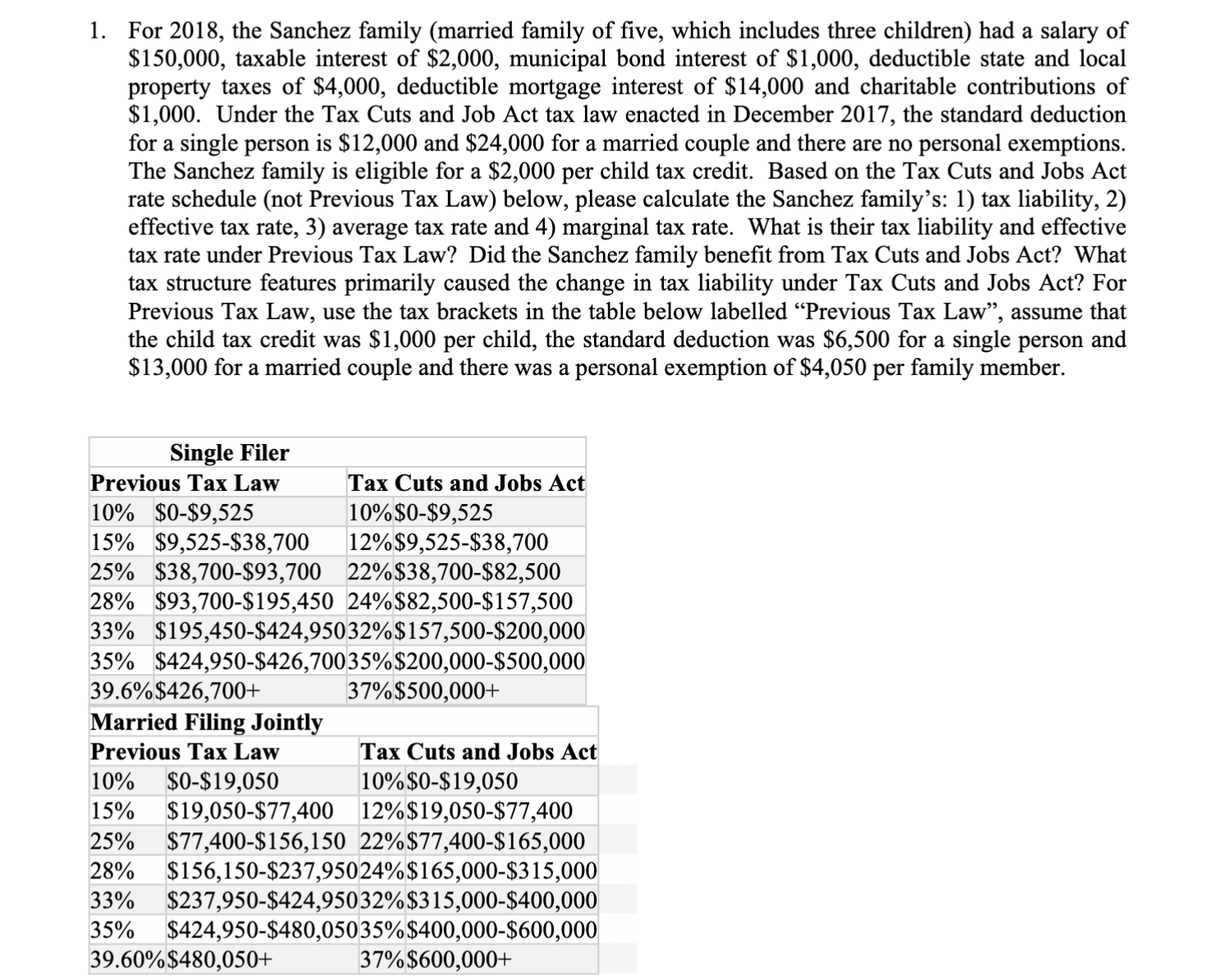

For the Sanchez family married family of five, which includes three children had a salary of $ taxable interest of $ municipal bond interest of $ deductible state and local property taxes of $ deductible mortgage interest of $ and charitable contributions of $ Under the Tax Cuts and Job Act tax law enacted in December the standard deduction for a single person is $ and $ for a married couple and there are no personal exemptions. The Sanchez family is eligible for a $ per child tax credit. Based on the Tax Cuts and Jobs Act rate schedule not Previous Tax Law below, please calculate the Sanchez family's: tax liability, effective tax rate, average tax rate and marginal tax rate. What is their tax liability and effective tax rate under Previous Tax Law? Did the Sanchez family benefit from Tax Cuts and Jobs Act? What tax structure features primarily caused the change in tax liability under Tax Cuts and Jobs Act? For Previous Tax Law, use the tax brackets in the table below labelled "Previous Tax Law", assume that the child tax credit was $ per child, the standard deduction was $ for a single person and $ for a married couple and there was a personal exemption of $ per family member.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock