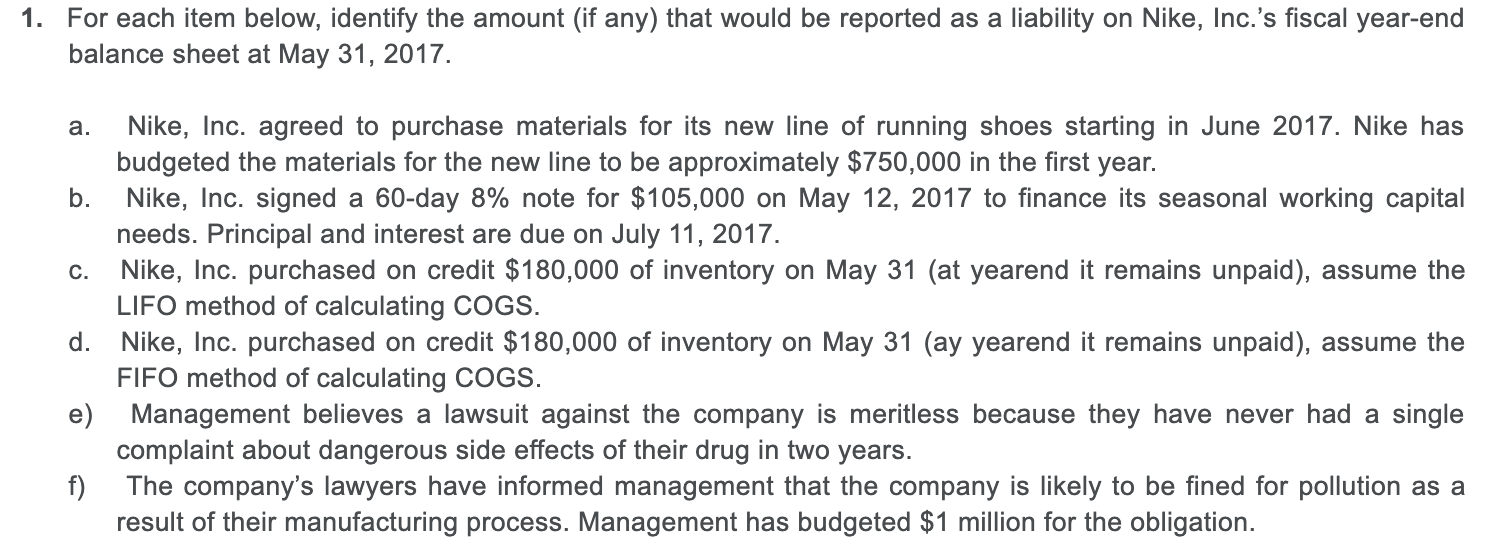

Question: 1. For each item below, identify the amount (if any) that would be reported as a liability on Nike, Inc.'s fiscal year-end balance sheet at

1. For each item below, identify the amount (if any) that would be reported as a liability on Nike, Inc.'s fiscal year-end balance sheet at May 31, 2017. a. Nike, Inc. agreed to purchase materials for its new line of running shoes starting in June 2017. Nike has budgeted the materials for the new line to be approximately $750,000 in the first year. b. Nike, Inc. signed a 60-day 8% note for $105,000 on May 12, 2017 to finance its seasonal working capital needs. Principal and interest are due on July 11, 2017. C. Nike, Inc. purchased on credit $180,000 of inventory on May 31 (at yearend it remains unpaid), assume the LIFO method of calculating COGS. d. Nike, Inc. purchased on credit $180,000 of inventory on May 31 (ay yearend it remains unpaid), assume the FIFO method of calculating COGS. e) Management believes a lawsuit against the company is meritless because they have never had a single complaint about dangerous side effects of their drug in two years. f) The company's lawyers have informed management that the company is likely to be fined for pollution as a result of their manufacturing process. Management has budgeted $1 million for the obligation. 1. For each item below, identify the amount (if any) that would be reported as a liability on Nike, Inc.'s fiscal year-end balance sheet at May 31, 2017. a. Nike, Inc. agreed to purchase materials for its new line of running shoes starting in June 2017. Nike has budgeted the materials for the new line to be approximately $750,000 in the first year. b. Nike, Inc. signed a 60-day 8% note for $105,000 on May 12, 2017 to finance its seasonal working capital needs. Principal and interest are due on July 11, 2017. C. Nike, Inc. purchased on credit $180,000 of inventory on May 31 (at yearend it remains unpaid), assume the LIFO method of calculating COGS. d. Nike, Inc. purchased on credit $180,000 of inventory on May 31 (ay yearend it remains unpaid), assume the FIFO method of calculating COGS. e) Management believes a lawsuit against the company is meritless because they have never had a single complaint about dangerous side effects of their drug in two years. f) The company's lawyers have informed management that the company is likely to be fined for pollution as a result of their manufacturing process. Management has budgeted $1 million for the obligation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts