Question: 1. For HW 11, Problem 1, uncertainties associated with predicting the revenues and cost of manufacturing are estimated to be as follows: (solution for homework

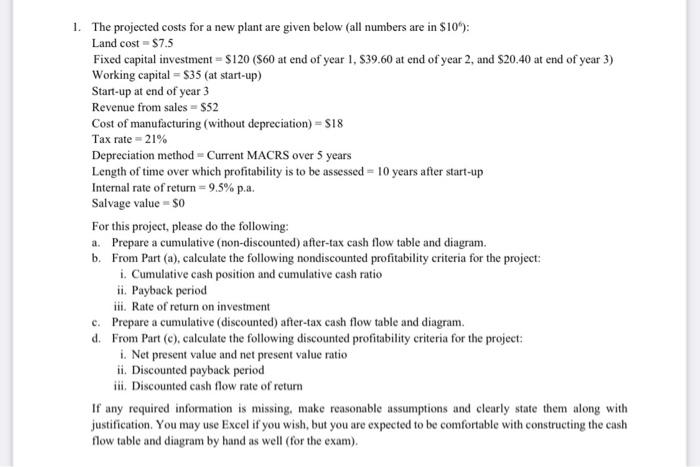

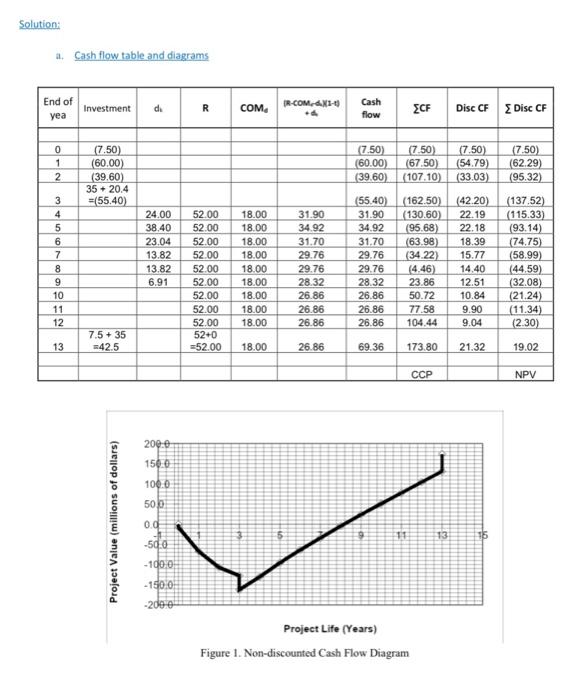

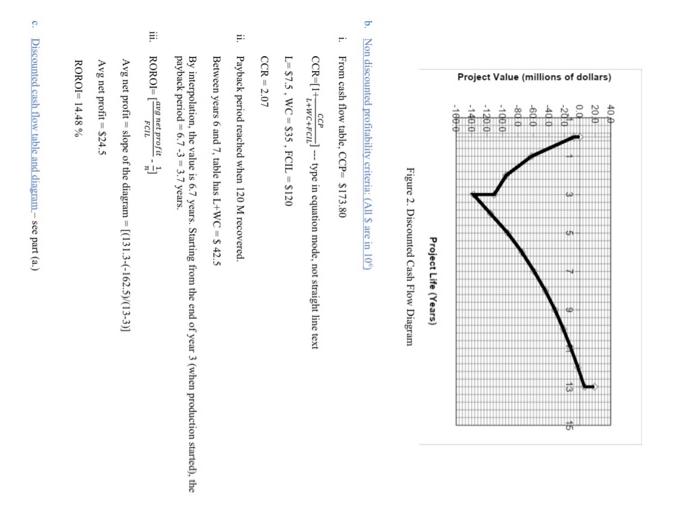

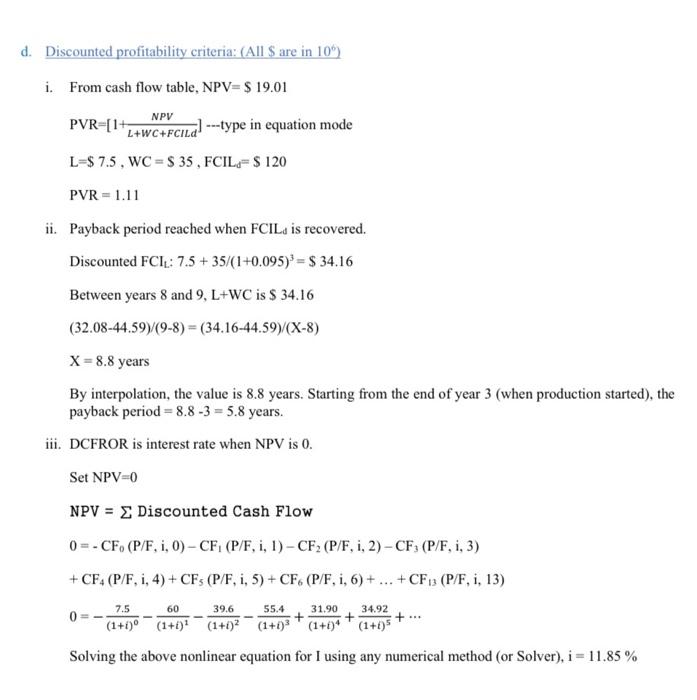

1. The projected costs for a new plant are given below (all numbers are in $106 ): Land cost =$7.5 Fixed capital investment =$120($60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year Working capital =$35( at start-up) Start-up at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =21% Depreciation method= Current MACRS over 5 years Length of time over which profitability is to be assessed =10 years after start-up Internal rate of return =9.5% p.a. Salvage value =$0 For this project, please do the following: a. Prepare a cumulative (non-discounted) after-tax cash flow table and diagram. b. From Part (a), calculate the following nondiscounted profitability criteria for the project: i. Cumulative cash position and cumulative cash ratio ii. Payback period iii. Rate of return on investment c. Prepare a cumulative (discounted) after-tax cash flow table and diagram. d. From Part (c), calculate the following discounted profitability criteria for the project: i. Net present value and net present value ratio ii. Discounted payback period iii. Discounted cash flow rate of return If any required information is missing. make reasonable assumptions and clearly state them along justification. You may use Excel if you wish, but you are expected to be comfortable with constructing the flow table and diagram by hand as well (for the exam). Solution: a. Cash flow table and diagrams Figure 1. Non-discounted Cash Flow Diagram b. Non discounted profitability criteria: (All $ are in 109 ) i. From cash flow table, CCP=$173.80 CCR=[1+L+WC+PCLCCP] type in equation mode, not straight line text L=$7.5,WC=$35,FClL=$120 CCR=2.07 ii. Payback period reached when 120M recovered. Between years 6 and 7, table has L+WC=$42.5 By interpolation, the value is 6.7 years. Starting from the end of year 3 (when production staried), the payback period =6.73=3.7 years. iii. ROROI =[FCILavgnetprofit=n1] Avg net profit = slope of the diagram =[(131.3(162.5)(133)] Avg net profit =$24.5 ROROI=14.48% c. Discounted cish flow table and diagnm- see part (a.) 1. Discounted profitability criteria: (All \$ are in 106 ) i. From cash flow table, NPV =$19.01 PVR=[1+L+WC+FCILdNPV] type in equation mode L=$7.5,WC=$35,FCILd=$120 PVR =1.11 ii. Payback period reached when FCILd is recovered. Discounted FClL::7.5+35/(1+0.095)3=$34.16 Between years 8 and 9,L+WC is $34.16 (32.0844.59)/(98)=(34.1644.59)/(X8) X=8.8 years By interpolation, the value is 8.8 years. Starting from the end of year 3 (when production started), the payback period =8.83=5.8 years. iii. DCFROR is interest rate when NPV is 0 . Set NPV=0 NPV = Discounted Cash Flow 0=CF0(P/F,i,0)CF1(P/F,i,1)CF2(P/F,i,2)CF3(P/F,i,3) +CF4(P/F,i,4)+CF5(P/F,i,5)+CF6(P/F,i,6)++CF13(P/F,i,13) 0=(1+i)07.5(1+i)160(1+i)239.6(1+i)355.4+(1+i)431.90+(1+i)534.92+ Solving the above nonlinear equation for I using any numerical method (or Solver), i=11.85% 1. The projected costs for a new plant are given below (all numbers are in $106 ): Land cost =$7.5 Fixed capital investment =$120($60 at end of year 1,$39.60 at end of year 2 , and $20.40 at end of year Working capital =$35( at start-up) Start-up at end of year 3 Revenue from sales =$52 Cost of manufacturing (without depreciation) =$18 Tax rate =21% Depreciation method= Current MACRS over 5 years Length of time over which profitability is to be assessed =10 years after start-up Internal rate of return =9.5% p.a. Salvage value =$0 For this project, please do the following: a. Prepare a cumulative (non-discounted) after-tax cash flow table and diagram. b. From Part (a), calculate the following nondiscounted profitability criteria for the project: i. Cumulative cash position and cumulative cash ratio ii. Payback period iii. Rate of return on investment c. Prepare a cumulative (discounted) after-tax cash flow table and diagram. d. From Part (c), calculate the following discounted profitability criteria for the project: i. Net present value and net present value ratio ii. Discounted payback period iii. Discounted cash flow rate of return If any required information is missing. make reasonable assumptions and clearly state them along justification. You may use Excel if you wish, but you are expected to be comfortable with constructing the flow table and diagram by hand as well (for the exam). Solution: a. Cash flow table and diagrams Figure 1. Non-discounted Cash Flow Diagram b. Non discounted profitability criteria: (All $ are in 109 ) i. From cash flow table, CCP=$173.80 CCR=[1+L+WC+PCLCCP] type in equation mode, not straight line text L=$7.5,WC=$35,FClL=$120 CCR=2.07 ii. Payback period reached when 120M recovered. Between years 6 and 7, table has L+WC=$42.5 By interpolation, the value is 6.7 years. Starting from the end of year 3 (when production staried), the payback period =6.73=3.7 years. iii. ROROI =[FCILavgnetprofit=n1] Avg net profit = slope of the diagram =[(131.3(162.5)(133)] Avg net profit =$24.5 ROROI=14.48% c. Discounted cish flow table and diagnm- see part (a.) 1. Discounted profitability criteria: (All \$ are in 106 ) i. From cash flow table, NPV =$19.01 PVR=[1+L+WC+FCILdNPV] type in equation mode L=$7.5,WC=$35,FCILd=$120 PVR =1.11 ii. Payback period reached when FCILd is recovered. Discounted FClL::7.5+35/(1+0.095)3=$34.16 Between years 8 and 9,L+WC is $34.16 (32.0844.59)/(98)=(34.1644.59)/(X8) X=8.8 years By interpolation, the value is 8.8 years. Starting from the end of year 3 (when production started), the payback period =8.83=5.8 years. iii. DCFROR is interest rate when NPV is 0 . Set NPV=0 NPV = Discounted Cash Flow 0=CF0(P/F,i,0)CF1(P/F,i,1)CF2(P/F,i,2)CF3(P/F,i,3) +CF4(P/F,i,4)+CF5(P/F,i,5)+CF6(P/F,i,6)++CF13(P/F,i,13) 0=(1+i)07.5(1+i)160(1+i)239.6(1+i)355.4+(1+i)431.90+(1+i)534.92+ Solving the above nonlinear equation for I using any numerical method (or Solver), i=11.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts