Question: 1. From the answer to the prior six problems using the resulting range of outcome after making the 5% changes to the variables, which variable

1. From the answer to the prior six problems using the resulting range of outcome after making the 5% changes to the variables, which variable has the greatest influence on the net present value of this project?

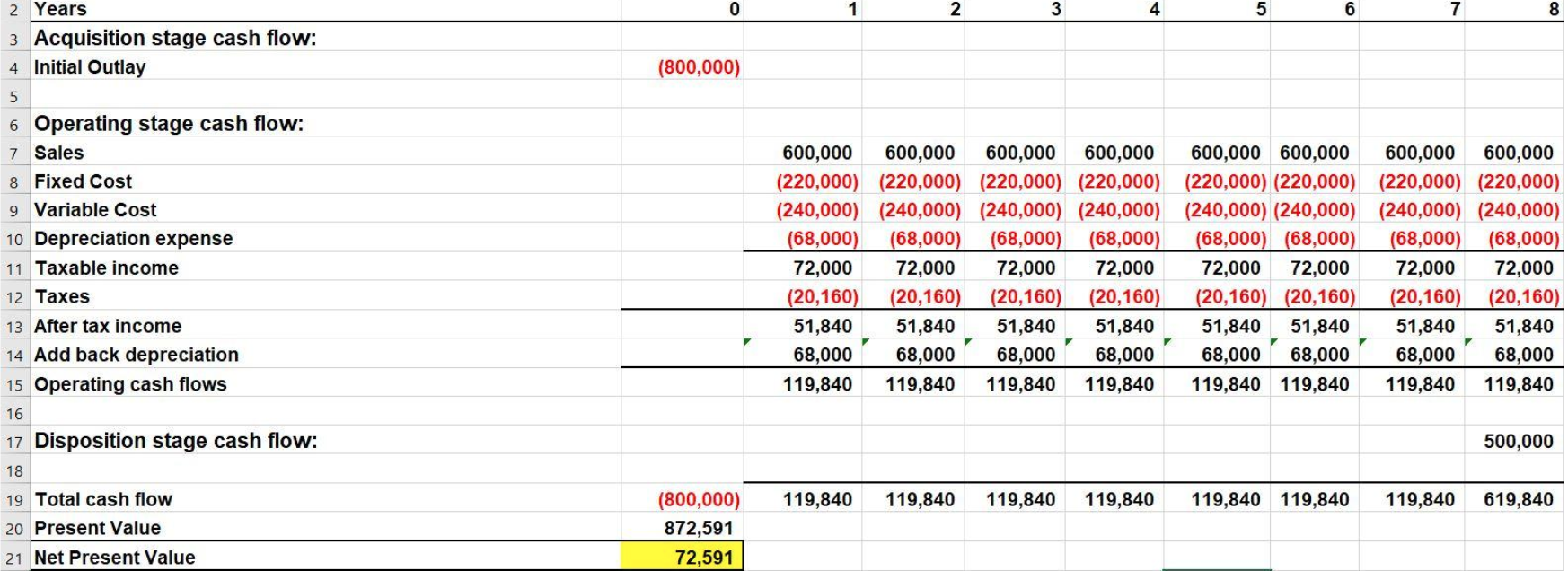

2. Please go back to the original spreadsheet numbers the original net present value is $72,591. Please run a net present value breakeven using this original data and record the net present value level of sales here ___________. Prior to beginning this project, the company can increase the initial outlay by $150,000. This additional upfront acquisition stage cost would lower the variable costs to 30% of sales and increase the disposition value to $550,000. What is the new net present value____________, and the new net present value breakeven level of sales___________, and would this be a good move for the company?

3. Please go back to the original spreadsheet numbers. As an alternative before beginning this project, the company can reduce the initial outlay by $300,000. This would increase the variable costs to 50% of sales and decrease the disposition value to $400,000. What is the new net present value____________, and the new net present value breakeven level of sales___________, and would this be a good move for the company?

4. Going back to the prior two problems which of these alternatives is better for the company? The original method, the modification suggested in problem 8, or the modification in problem 9? Why?

0 1 2 3 4 5 6 8 (800,000) 2 Years 3. Acquisition stage cash flow: 4. Initial Outlay 5 6 Operating stage cash flow: 7 Sales 8 Fixed Cost 9 Variable Cost 10 Depreciation expense 11 Taxable income 12 Taxes 13 After tax income 14 Add back depreciation 15 Operating cash flows 16 17 Disposition stage cash flow: 18 19 Total cash flow 20 Present Value 21 Net Present Value 600,000 600,000 600,000 600,000 (220,000) (220,000) (220,000) (220,000) (240,000) (240,000) (240,000) (240,000) (68,000) (68,000) (68,000) (68,000) 72,000 72,000 72,000 72,000 (20,160) (20,160) (20,160) (20,160) 51,840 51,840 51,840 51,840 68,000 68,000 68,000 68,000 119,840 119,840 119,840 119,840 600,000 600,000 600,000 600,000 (220,000) (220,000) (220,000) (220,000) (240,000) (240,000) (240,000) (240,000) (68,000) (68,000) (68,000) (68,000) 72,000 72,000 72,000 72,000 (20,160) (20,160) (20,160) (20,160) 51,840 51,840 51,840 51,840 68,000 68,000 68,000 68,000 119,840 119,840 119,840 119,840 500,000 119,840 119,840 119,840 119,840 119,840 119,840 119,840 619,840 (800,000) 872,591 72,591 0 1 2 3 4 5 6 8 (800,000) 2 Years 3. Acquisition stage cash flow: 4. Initial Outlay 5 6 Operating stage cash flow: 7 Sales 8 Fixed Cost 9 Variable Cost 10 Depreciation expense 11 Taxable income 12 Taxes 13 After tax income 14 Add back depreciation 15 Operating cash flows 16 17 Disposition stage cash flow: 18 19 Total cash flow 20 Present Value 21 Net Present Value 600,000 600,000 600,000 600,000 (220,000) (220,000) (220,000) (220,000) (240,000) (240,000) (240,000) (240,000) (68,000) (68,000) (68,000) (68,000) 72,000 72,000 72,000 72,000 (20,160) (20,160) (20,160) (20,160) 51,840 51,840 51,840 51,840 68,000 68,000 68,000 68,000 119,840 119,840 119,840 119,840 600,000 600,000 600,000 600,000 (220,000) (220,000) (220,000) (220,000) (240,000) (240,000) (240,000) (240,000) (68,000) (68,000) (68,000) (68,000) 72,000 72,000 72,000 72,000 (20,160) (20,160) (20,160) (20,160) 51,840 51,840 51,840 51,840 68,000 68,000 68,000 68,000 119,840 119,840 119,840 119,840 500,000 119,840 119,840 119,840 119,840 119,840 119,840 119,840 619,840 (800,000) 872,591 72,591

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts