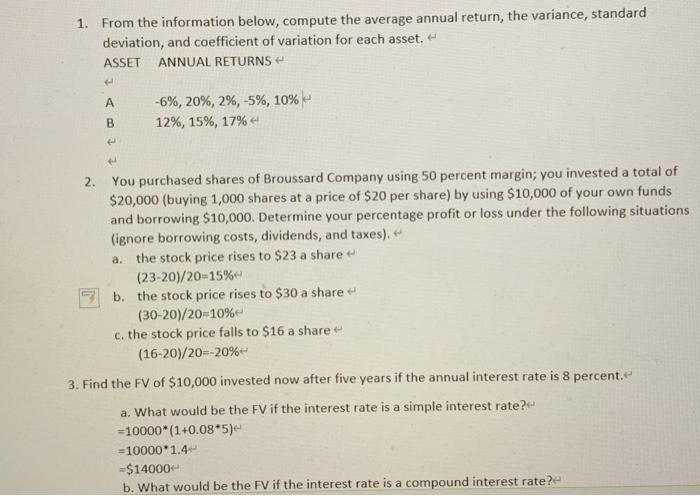

Question: 1. From the information below, compute the average annual return, the variance, standard deviation, and coefficient of variation for each asset. ASSET ANNUAL RETURNS -6%,

1. From the information below, compute the average annual return, the variance, standard deviation, and coefficient of variation for each asset. ASSET ANNUAL RETURNS -6%, 20%, 2%, -5%, 10%- 12%, 15%, 17% B 2. You purchased shares of Broussard Company using 50 percent margin; you invested a total of $20,000 (buying 1,000 shares at a price of $20 per share) by using $10,000 of your own funds and borrowing $10,000. Determine your percentage profit or loss under the following situations (ignore borrowing costs, dividends, and taxes), a. the stock price rises to $23 a share (23-20)/20-15% b. the stock price rises to $30 a share (30-20)/20=10% c. the stock price falls to $16 a share (16-20)/20=-20% 3. Find the FV of $10,000 invested now after five years if the annual interest rate is 8 percent. a. What would be the FV if the interest rate is a simple interest rate? =10000*(1+0.08*5) =10000 1.4 =$14000 b. What would be the FV if the interest rate is a compound interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts