Question: 1. Fun & Flair Berhad (FFB) is considering a project that requires an initial investment of RM40 000. It is depreciated over four years using

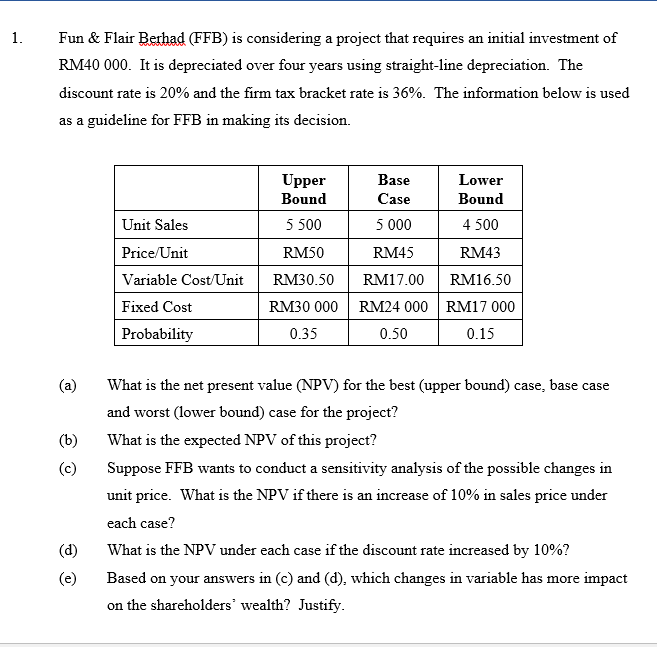

1. Fun & Flair Berhad (FFB) is considering a project that requires an initial investment of RM40 000. It is depreciated over four years using straight-line depreciation. The discount rate is 20% and the firm tax bracket rate is 36%. The information below is used as a guideline for FFB in making its decision. Upper Bound 5 500 Unit Sales RM50 Price/Unit Variable Cost/Unit Fixed Cost Probability Base Lower Case Bound 5 000 4 500 RM45 RM43 RM16.50 RM24 000 RM17 000 0.50 0.15 RM30.50 RM17.00 RM30 000 0.35 (a) (b) What is the net present value (NPV) for the best (upper bound) case, base case and worst (lower bound) case for the project? What is the expected NPV of this project? Suppose FFB wants to conduct a sensitivity analysis of the possible changes in unit price. What is the NPV if there is an increase of 10% in sales price under each case? What is the NPV under each case if the discount rate increased by 10%? Based on your answers in (C) and (d), which changes in variable has more impact on the shareholders' wealth? Justify. (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts