Question: #1: Gelb & Co. currently makes a key part for its main product. Making this part incurs variable costs of $1.20 for direct materials, and

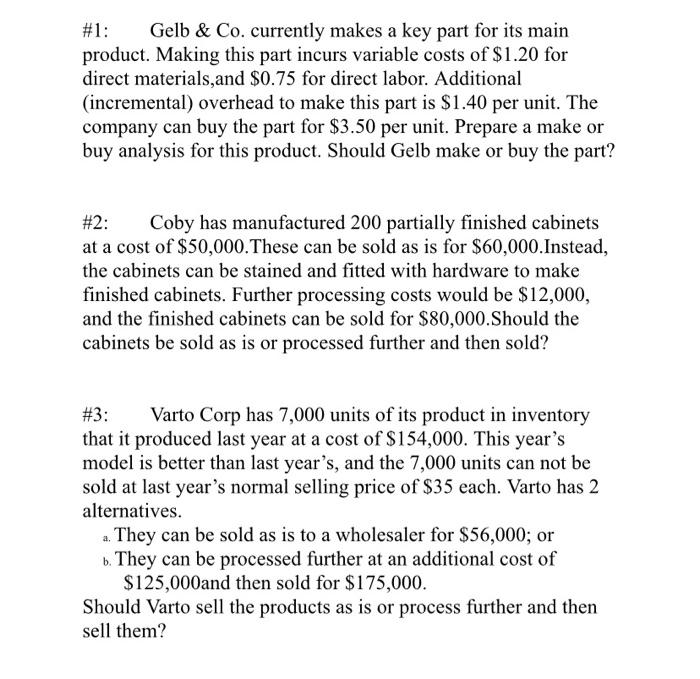

\#1: Gelb \& Co. currently makes a key part for its main product. Making this part incurs variable costs of $1.20 for direct materials, and $0.75 for direct labor. Additional (incremental) overhead to make this part is $1.40 per unit. The company can buy the part for $3.50 per unit. Prepare a make or buy analysis for this product. Should Gelb make or buy the part? \#2: Coby has manufactured 200 partially finished cabinets at a cost of $50,000. These can be sold as is for $60,000.Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $12,000, and the finished cabinets can be sold for $80,000. Should the cabinets be sold as is or processed further and then sold? \#3: Varto Corp has 7,000 units of its product in inventory that it produced last year at a cost of $154,000. This year's model is better than last year's, and the 7,000 units can not be sold at last year's normal selling price of $35 each. Varto has 2 alternatives. a. They can be sold as is to a wholesaler for $56,000; or b. They can be processed further at an additional cost of $125,000 and then sold for $175,000. Should Varto sell the products as is or process further and then sell them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts