Question: 1) General Environment analysis: What are the most important 1-2 general environment factors to be considered for the INDUSTRY and what is their effect (positive-negative-neutral)?

1) General Environment analysis: What are the most important 1-2 general environment factors to be considered for the INDUSTRY and what is their effect (positive-negative-neutral)? What is your evidence for the importance of these factors?

2) FIVE FORCES analysis: What are the most important 1-2 of the five industry forces affecting the INDUSTRY and what is their effect (high-moderate-low)? What are the 1-2 factors that evidence the importance of these forces? Is the industry attractive for new entrants AND for incumbents? Why?

3) STRATEGIC GROUP: List TWO major strategic group competitors and briefly predict the significant future action(s) of EACH competitor. What is your evidence for their importance?

4) VALUE CHAIN analysis: What are the most important 1-2 of the eight value chain areas for the company? What is your evidence for their importance? Are they superior, inferior or neutral vs. EACH of the two major competitors and why (be specific but concise)?

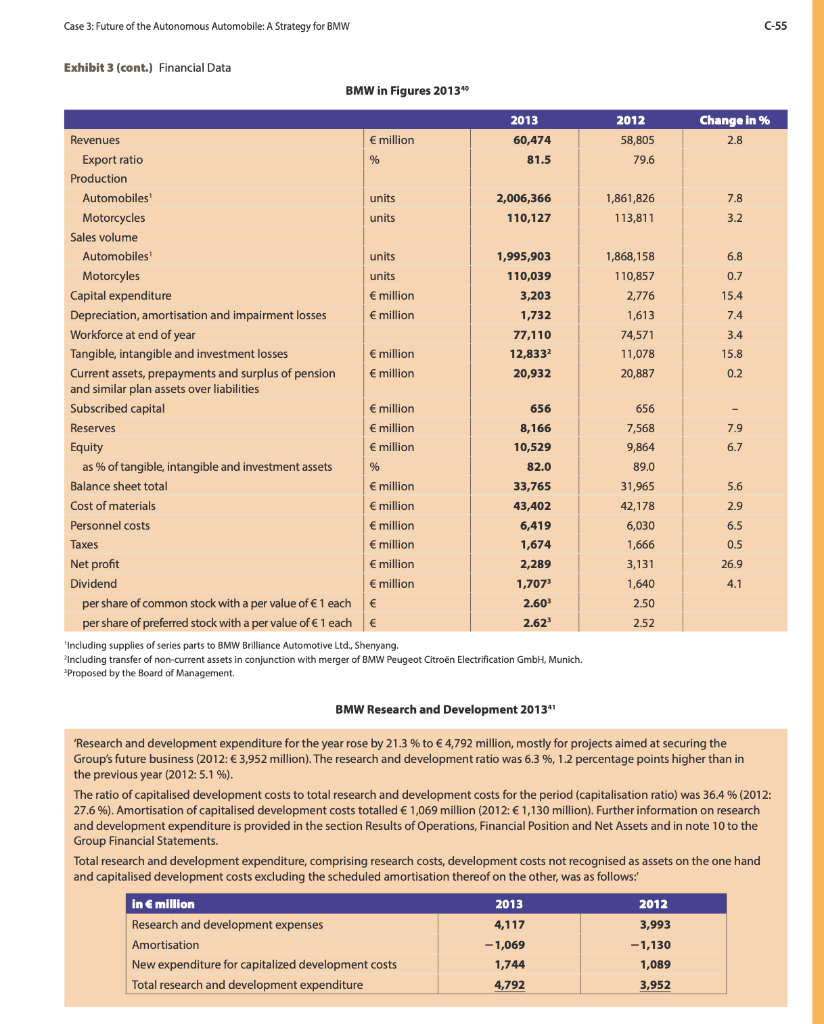

5) FINANCIAL/NON-FINANCIAL analysis: Discuss the most significant financial factor(s) (be specific, calculating and presenting in a three-year line chart the most important 1-2 ratios in the profitability, leverage and/or activity areas compared to your two strategic group competitors (or the industry) and non-financial factor(s) (leadership, culture, ethics/social responsibility) for the company? What is your evidence for their importance?

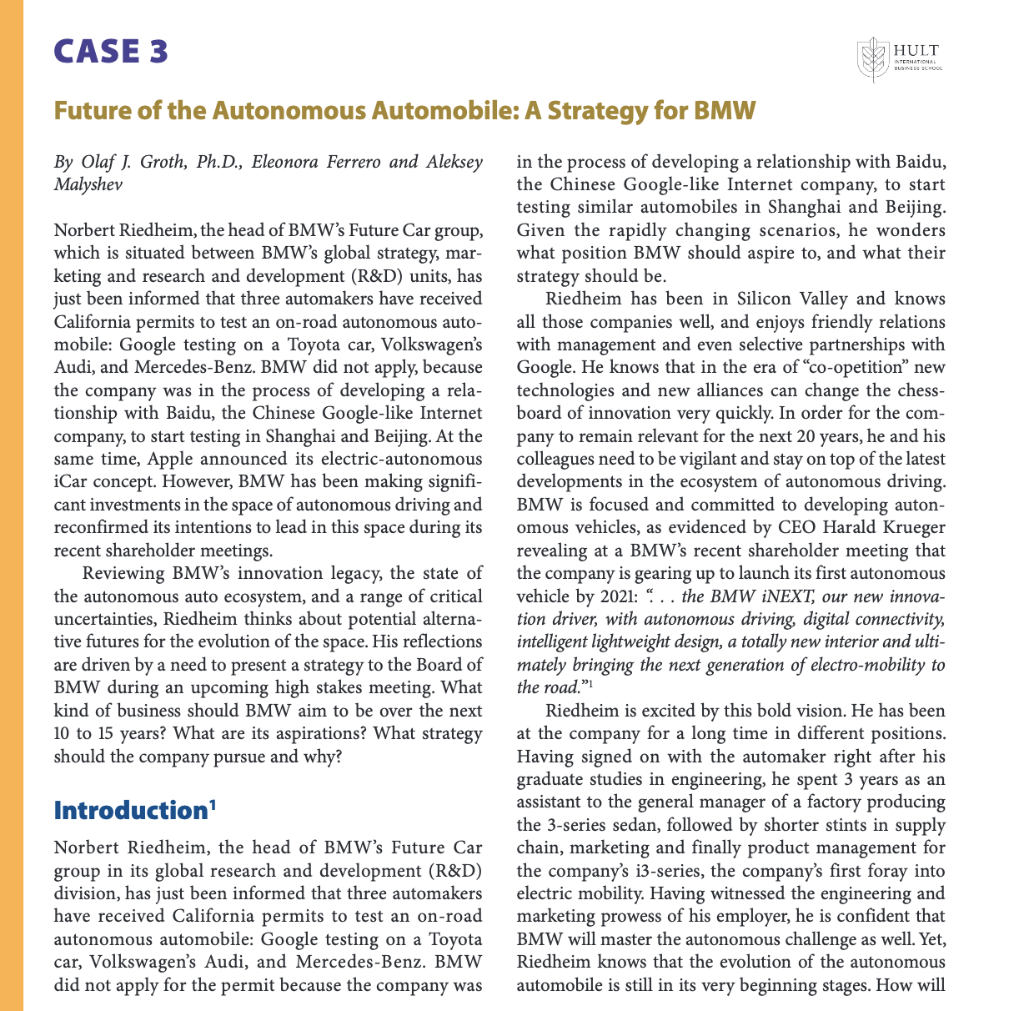

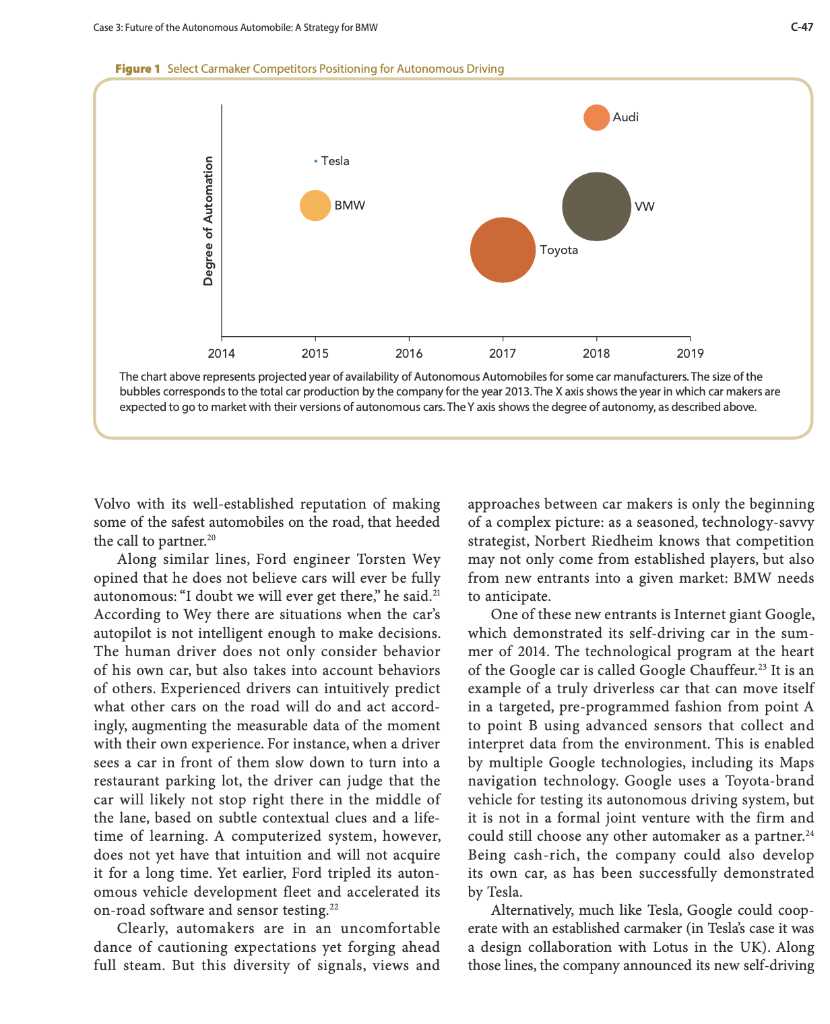

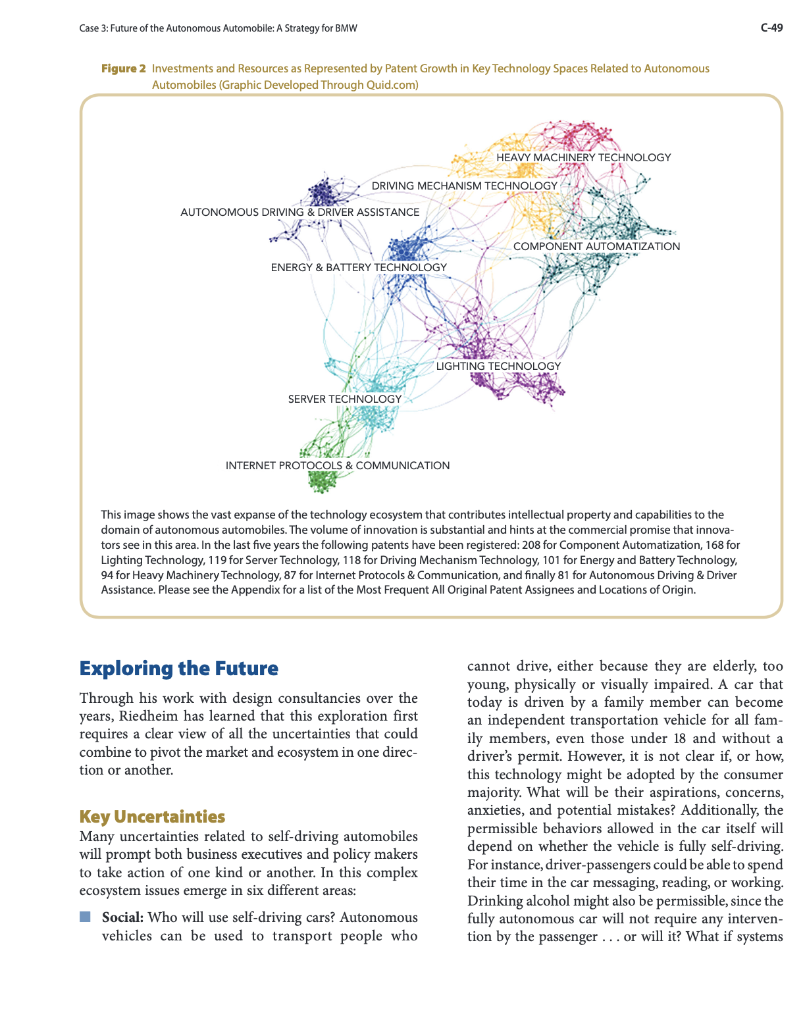

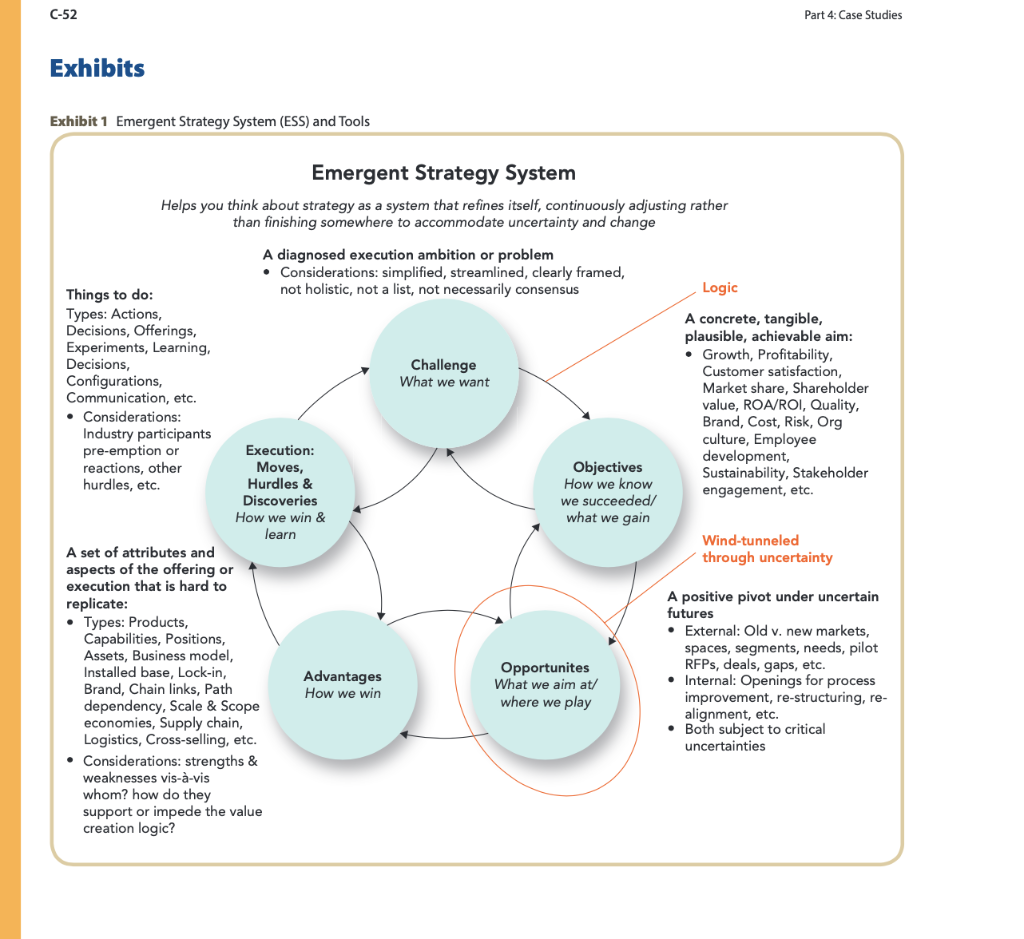

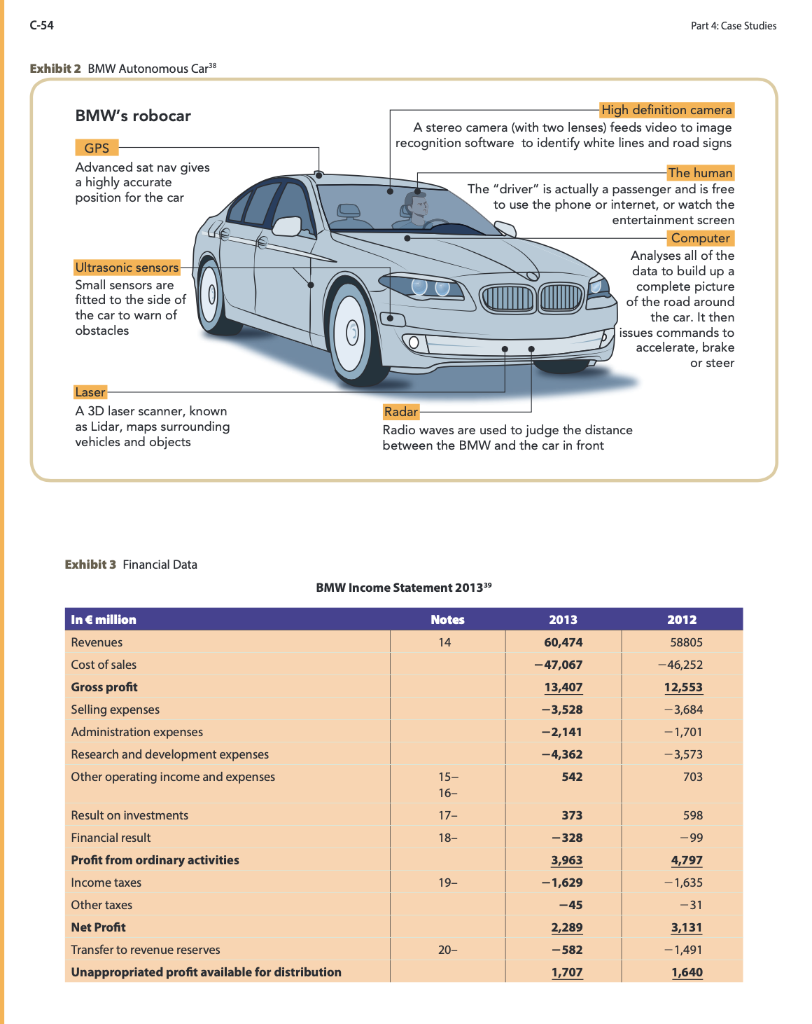

CASE 3 HULT Future of the Autonomous Automobile: A Strategy for BMW By Olaf J. Groth, Ph.D., Eleonora Ferrero and Aleksey Malyshev Norbert Riedheim, the head of BMW's Future Car group, which is situated between BMW's global strategy, mar- keting and research and development (R&D) units, has just been informed that three automakers have received California permits to test an on-road autonomous auto- mobile: Google testing on a Toyota car, Volkswagen's Audi, and Mercedes-Benz. BMW did not apply, because the company was in the process of developing a rela- tionship with Baidu, the Chinese Google-like Internet company, to start testing in Shanghai and Beijing. At the same time, Apple announced its electric-autonomous iCar concept. However, BMW has been making signifi- cant investments in the space of autonomous driving and reconfirmed its intentions to lead in this space during its recent shareholder meetings. Reviewing BMW's innovation legacy, the state of the autonomous auto ecosystem, and a range of critical uncertainties, Riedheim thinks about potential alterna- tive futures for the evolution of the space. His reflections are driven by a need to present a strategy to the Board of BMW during an upcoming high stakes meeting. What kind of business should BMW aim to be over the next 10 to 15 years? What are its aspirations? What strategy should the company pursue and why? in the process of developing a relationship with Baidu, the Chinese Google-like Internet company, to start testing similar automobiles in Shanghai and Beijing. Given the rapidly changing scenarios, he wonders what position BMW should aspire to, and what their strategy should be. Riedheim has been in Silicon Valley and knows all those companies well, and enjoys friendly relations with management and even selective partnerships with Google. He knows that in the era of co-opetition new technologies and new alliances can change the chess- board of innovation very quickly. In order for the com- pany to remain relevant for the next 20 years, he and his colleagues need to be vigilant and stay on top of the latest developments in the ecosystem of autonomous driving. BMW is focused and committed to developing auton- omous vehicles, as evidenced by CEO Harald Krueger revealing at a BMW's recent shareholder meeting that the company is gearing up to launch its first autonomous vehicle by 2021: ... the BMW INEXT, our new innova- tion driver, with autonomous driving digital connectivity, intelligent lightweight design, a totally new interior and ulti- mately bringing the next generation of electro-mobility to the road." Riedheim is excited by this bold vision. He has been at the company for a long time in different positions. Having signed on with the automaker right after his graduate studies in engineering, he spent 3 years as an assistant to the general manager of a factory producing the 3-series sedan, followed by shorter stints in supply chain, marketing and finally product management for the company's i3-series, the company's first foray into electric mobility. Having witnessed the engineering and marketing prowess of his employer, he is confident that BMW will master the autonomous challenge as well. Yet, Riedheim knows that the evolution of the autonomous automobile is still in its very beginning stages. How will Introduction" Norbert Riedheim, the head of BMW's Future Car in its global research and development (R&D) division, has just been informed that three automakers have received California permits to test an on-road autonomous automobile: Google testing on a Toyota car, Volkswagen's Audi, and Mercedes-Benz. BMW did not apply for the permit because the company was Case 3: Future of the Autonomous Automobile: A Strategy for BMW C-45 this new world evolve and how will BMW evolve its position in it? What will he say about BMW's emerg- ing strategy in his upcoming briefing with an important BMW board member? He goes back to his desk, and reviews the facts once more. as A Brief History of BMW The automaker got its start as a manufacturer of aircraft engines in Munich, Germany, in March 1916 and turned into a motorcycle and automobile company in 1928.2 Since then, BMW has manufactured motorcycles and cars. It is most well known for its high-quality cars in the upper segment of the market. After WWII the company had to restore its manufacture and reputation. The first car that started a new era for BMW was the 501 model, a famous classic today that quickly established the com- pany as a producer of high-quality, technically advanced cars. Most prominent among its superior engineering capabilities are its engines, which many experts attribute to its early legacy in aero-turbines ("turbine still being the nickname of its 6-cylinder car engines). In 1973 the factory in Munich started building the BMW 2002 turbo engine. This was the same year that the first oil crisis hit the western world, which had become dependent on cheap gas. Sales of gas-guzzling volume-produced per- formance cars slumped and BMW started to develop a strong skillset in more fuel-efficient turbo-diesel engines. In 1990 the Bavarians, leveraging their competency in making high-agility, precision steering, introduced a new kind of rear axle that allows the rear wheels to turn a few degrees in the same direction as the front wheel. This improved car stability in turns at high speed, as well as the fun of the driving experience by a BMW driver, which is central to BMW's value proposition. Since then, few other manufacturers have managed to match this active handling experience, which today is a hallmark of the BMW brand. In 2001 the company built another competency, this time pioneering cutting edge electronics: a new kind of "head unit" (the control and entertainment console that sits in the center of a dashboard). It was called iDrive" and it allowed operating the unit easily with a joystick-like knob giving tactile feedback to the driver, without having to take his or her eyes off the road. iDrive had been developed in collaboration with BMW's Technology Office in Palo Alto, at the heart of Silicon Valley. After an initial period of drivers' adjustment to the new technology and user interface, the iDrive and various iDrive-like derivatives quickly became a common feature in luxury and performance automobiles of many brands. Finally, on January 8th 2014 during the Consumer Electronic Show in Las Vegas, BMW demonstrated its first fully automated car prototypes based on its regular car models. The car uses 360 degree radar technology, as well as a set of other sensors including cameras and ultrasound to accelerate, steer, and brake without driver intervention. The company also demonstrated another feature called Emergency Stop Assistant," which will pull the vehicle to the side of the road, stop, and acti- vate an emergency call in case the driver experiences an unexpected health condition, such as fainting, a heart attack or a stroke. These advancements demonstrated the ability of BMW to stay on top of the new technology. A litany of prizes and awards recognized BMW's strengths: Brand reputation: BMW is acknowledged worldwide successful carmaker. In 2012, Forbes elected BMW as the most reputable business in the world, and in 2016 it became the second most valuable brand in the auto- motive industry, with a market value of $26.4 billion. Handling, engines and traction motors: BMW was able to become a market leader in the production of engines, which led the company to win several fengine of the year' awards, in an industry where technology is a top priority and competition is fierce. Information technology integration: BMW was able to integrate technology innovation in its vehicles, winning international prizes such as the Berthold Leibinger Innovation award in 2014 for its laser-light technology and the Autoblog's 2014 Technology of the Year award for the whole technology suite work- ing together on the BMW i8. Environmentally friendly vehicles: BMW researched dual fuel engines, hydrogen-driven cars, and hybrid electric cars. Furthermore, 80% of its automobiles are made from recycled and recyclable materials. The Brand won the World Green Car of the Year Award in 2015 at the New York International Auto Show and at the 2014 Los Angeles Auto Show, BMW was presented with the Green Car of the Year Award from the Green Car Journal for the BMWi3. The Ecosystem of Autonomous Driving Today The idea of cars driving themselves has existed for a few decades, since the early days of Tsukuba Lab in Japan in 1977 and the European EUREKA Prometheus project C-46 Part 4: Case Studies Lane control: Helps the driver to steer though curv- ing highway roads. This is mainly a security feature that helps drivers to avoid potentially dangerous accidents like the car driving into oncoming traffic or veering off the road. Speed control in heavy traffic: This feature goes a bit further by allowing the driver to let the car nav- igation system accelerate and slow down the vehi- cle when the car moves in a traffic jam. This adds the driver some relief to an otherwise tiring journey through tough traffic conditions. Fully automated car: The highest level of automa- tion is achieved when the car can drive itself in any conditions, including driving through crossroads and crosswalks with or through traffic lights, making turns, changing lanes, keeping distance with other vehicles, and responding to any kind of emergency situations. In this case the driver inputs the desti- nation into the navigation system and allows it to drive. This feature has been widely discussed as the future of mobility. Most drivers would spend their time being entertained, being social, or being pro- ductive in their cars. in 1987. But only recently, with the advances in com- puter technology, has it become a reality. The 2004, 2005, and 2007 Urban Challenges conducted by the Defense Advanced Research Projects Agency (DARPA) in the U.S. yielded significant advances, with cars eventually completing a 132-mile course successfully as exemplified by the winner of the 2005 DARAP Urban Challenge: Stanford University's VW Touareg "Stanley." The domain of autonomous driving promises stun- ning prospects as well as some key uncertainties. It is at the intersection of large opportunity and the uncertainty of a number of future trends that could affect the domain to take a turn in one direction or another. According to Navigant Research, annual sales of autonomous vehicles could reach nearly 95 million by 2035. Morgan Stanley analysts also believe that self-driving cars will change the auto industry." At the core of the self-driving car is state-of-the- art microprocessors, i.e., computer chips called Central Processing Units (CPU) or Graphical Processing Units (GPU). GPUs are CPUs that have special capabilities related to processing imagery or graphics. Two major players in the microprocessor technology market are working on the hardware for self-driving cars-Intel, 12 maker of CPUs and NVIDIA, maker of GPUs. Recently, through cooperation with these Silicon Valley stars, car manufacturers globally have obtained processing tech- nology that powers critical components to allow them to build self-driving cars. Several companies and research centers are working on an even more powerful type of processor-Quantum Computers that will be able to handle massive computational tasks in parallel-a quality essential for the artificial intelligence needed for autonomous driving. With Google recently joining the effort," the prospect of creating one (quantum com- puter?) becomes more realistic. There are different levels of self-driving, which means 'autonomous automobile can mean different things to different people. For BMW to craft a more nuanced strategy, the company will need to draw the distinction between the different modes of the car's autonomous assistance for the driver: Self-parking: A car with this feature can park itself without driver intervention. This is primarily a convenience feature for most drivers, but can also aid drivers that are physically impaired. It can help avoiding fender-bender accidents that may increase car insurance costs. Fully Automated Cars: The Competitive Landscape While BMW and Audi' have already presented proto- types of fully automated cars, other car manufacturers are developing and testing partial autonomy approaches. Toyota/Lexus are working on the concept of assisted driving. Tesla recently announced that it is already installing navigation hardware on its cars," although its system is not intended to take full control either, but rather provide assistance for the driver to improve safety. GM first invested $500M in ride-hailing company Lyft and then the two companies announced plans to test a fleet of autonomous Chevrolet Bolt electric taxis on the road within a year. Other players are more skeptical: Volvo's head of R&D, Peter Mertens, has been very direct in saying that the prospect of a driver reading a newspaper or answer- ing e-mails while driving "is a very, very long term vision."19 The carmaker is concentrated on safety instead, such as object avoidance and more traditional protection such as material strength. Yet, in a surprising twist, that same year, (which year?) Uber's Founder and Co-CEO Travis Kalanick, started to hire dozens of autonomous auto experts at leading technical institutions, and it was Case 3: Future of the Autonomous Automobile: A Strategy for BMW C-47 Figure 1 Select Carmaker Competitors Positioning for Autonomous Driving Audi Tesla BMW ww Degree of Automation Toyota 2015 2016 2017 2014 2018 2019 The chart above represents projected year of availability of Autonomous Automobiles for some car manufacturers. The size of the bubbles corresponds to the total car production by the company for the year 2013. The X axis shows the year in which car makers are expected to go to market with their versions of autonomous cars. The Yaxis shows the degree of autonomy, as described above. Volvo with its well-established reputation of making some of the safest automobiles on the road, that heeded the call to partner.20 Along similar lines, Ford engineer Torsten Wey opined that he does not believe cars will ever be fully autonomous: I doubt we will ever get there," he said.21 According to Wey there are situations when the car's autopilot is not intelligent enough to make decisions. The human driver does not only consider behavior of his own car, but also takes into account behaviors of others. Experienced drivers can intuitively predict what other cars on the road will do and act accord- ingly, augmenting the measurable data of the moment with their own experience. For instance, when a driver sees a car in front of them slow down to turn into a restaurant parking lot, the driver can judge that the car will likely not stop right there in the middle of the lane, based on subtle contextual clues and a life- time of learning. A computerized system, however, does not yet have that intuition and will not acquire it for a long time. Yet earlier, Ford tripled its auton- omous vehicle development fleet and accelerated its on-road software and sensor testing. 22 Clearly, automakers are in an uncomfortable dance of cautioning expectations yet forging ahead full steam. But this diversity of signals, views and approaches between car makers is only the beginning of a complex picture: as a seasoned, technology-savvy strategist, Norbert Riedheim knows that competition may not only come from established players, but also from new entrants into a given market: BMW needs to anticipate. One of these new entrants is Internet giant Google, which demonstrated its self-driving car in the sum- mer of 2014. The technological program at the heart of the Google car is called Google Chauffeur. It is an example of a truly driverless car that can move itself in a targeted, pre-programmed fashion from point A to point B using advanced sensors that collect and interpret data from the environment. This is enabled by multiple Google technologies, including its Maps navigation technology. Google uses a Toyota-brand vehicle for testing its autonomous driving system, but it is not in a formal joint venture with the firm and could still choose any other automaker as a partner. 24 Being cash-rich, the company could also develop its own car, as has been successfully demonstrated by Tesla. Alternatively, much like 'Tesla, Google could coop- erate with an established carmaker (in Tesla's case it was a design collaboration with Lotus in the UK). Along those lines, the company announced its new self-driving C-48 Part 4: Case Studies technology development center in Novi, Michigan, in May 2016 and one of the first projects at the new facility will be the self-driving Chrysler Pacifica hybrid minivan, developed in-house.25 But given its deep pockets, Google could conceiv- ably also still buy an ailing carmaker, such as Saab, still struggling to recover after its purchase by National Electric Vehicles Sweden (NEVS), which is owned by Hong Kong-based energy company National Modern Energy Holdings. Or it could approach Volkswagen to take over the Seat or Skoda subsidiary, which seem to be duplicating each other's offerings in the VW brands family. To further complicate things, it is not just in the visible corners of the technology world that prominent companies like Google are working on autonomous automobiles and from which sudden advances could emerge. In start-ups, universities, and R&D centers around the world, leading technologists are work- ing on pre-commercial solutions. In early 2013 there were multiple reports about companies and individ- uals who were working on an affordable self-driving feature. One of them is Professor Paul Newman from Oxford University who works on self-driving technol- ogy that utilizes cheap sensors.26 Also, Intel awarded the top prize in its Gordon E. Moore competition to a Romanian teenager for using artificial intelligence to create a viable model for a low-cost, self-driving car. One company took it a step further and designed a commercial self-driving accessory that can be installed on selected models of compatible cars with sensors mounted on the rooftop. It is a startup called Cruise, 28 which emerged from a Silicon Valley incubator, Y-Combinator, and started accepting pre-orders for it assisted driving system in mid-2014. In March 2016, Cruise was acquired by GM, which appears to be interested in integrating the system into the design of its own cars. Another critical element of autonomous driving- mapping and location servicesis also flourishing glob- ally, especially in Europe. Nokia Corporation's former mapping business, HERE-based in Berlin-provides an open platform for cloud-based maps. HERE is not only the main alternative to Google Maps, but also the market leader in built-in car navigation systems. According to Nokia's website, 29 four out of five cars in North America and Europe feature HERE integrated in-dash navigation. Not surprisingly, in August 2015 BMW, Audi, and Daimler announced their acquisition of HERE.30 These 3 automobile companies will be directly controlling an essential part of the autono- mous automobiles' value chain-mapping and location services-while securing the supply of critical geo- location data in their automobiles. It would be wrong to limit the ecosystem view to traditional geographies, like Silicon Valley in the U.S., or other entrepreneurial hubs like Berlin in Europe and R&D labs in Japan that have been strong in auto- motive or IT innovation for decades. A look into the future of the automobile has to take into account developments in Asia. For instance, autonomous taxi startup nuTonomy announced a pilot in Singapore that it could become the first company to operate Level-4 driverless taxis commercially in a city. And, as men- tioned, BMW selected Baidu as its partner in the Chinese market when, in the fall of 2014, it needed a high- resolution GPS system to start testing in Shanghai and Beijing, two of the most demanding, densely populated, and vast automotive markets in the world. And now Baidu claims it is developing its own automated car, but unlike Google, it works on driver assistance and is not a fully self-driving car. The Chinese market is already the largest and the fastest growing in the world, with 18 million cars sold in 2013,2 a compound annual growth rate (CAGR) between 2005 and 2012 of 18.1%, and an expected 6.3% average year-over-year growth through 2020 making it a tremendously important market for BMW. Luckily, BMW made an early, courageous decision to enter the Chinese market, benefiting from the excellent relationships held by a former BMW board member and former government executive in charge of the compa- ny's government relations. The effort bore fruit: in 2013 BMW sold 390,713 cars in China, up 20% from a year earlier. This meant that China had officially overtaken the U.S. (375,782 cars sold) as the group's biggest market and had outpaced the overall company's market growth of 13.9 percent." As Riedheim leans back in his sleek BMW carbon fiber chair, he wonders how this ecosystem might evolve and how should BMW position itself within it? What are some plausible, alternative futures? Having stud- ied disruptive innovation and strategy throughout the years, Riedheim knows that big bets often don't pay off because too many variables in a market forecast change. So, understanding these alternative futures first will help him to craft a strategy that is robust against different market states. Case 3: Future of the Autonomous Automobile: A Strategy for BMW C-49 Figure 2 Investments and Resources as Represented by Patent Growth in Key Technology Spaces Related to Autonomous Automobiles (Graphic Developed through Quid.com) HEAVY MACHINERY TECHNOLOGY DRIVING MECHANISM TECHNOLOGY AUTONOMOUS DRIVING & DRIVER ASSISTANCE SV 9. COMPONENT AUTOMATIZATION ENERGY & BATTERY TECHNOLOGY LIGHTING TECHNOLOGY SERVER TECHNOLOGY INTERNET PROTOCOLS & COMMUNICATION This image shows the vast expanse of the technology ecosystem that contributes intellectual property and capabilities to the domain of autonomous automobiles. The volume of innovation is substantial and hints at the commercial promise that innova- tors see in this area. In the last five years the following patents have been registered: 208 for Component Automatization, 168 for Lighting Technology, 119 for Server Technology, 118 for Driving Mechanism Technology, 101 for Energy and Battery Technology, 94 for Heavy Machinery Technology, 87 for Internet Protocols & Communication, and finally 81 for Autonomous Driving & Driver Assistance. Please see the Appendix for a list of the Most Frequent All Original Patent Assignees and Locations of Origin. Exploring the Future Through his work with design consultancies over the years, Riedheim has learned that this exploration first requires a clear view of all the uncertainties that could combine to pivot the market and ecosystem in one direc- tion or another. cannot drive, either because they are elderly, too young, physically or visually impaired. A car that today is driven by a family member can become an independent transportation vehicle for all fam- ily members, even those under 18 and without a driver's permit. However, it is not clear if, or how, this technology might be adopted by the consumer majority. What will be their aspirations, concerns, anxieties, and potential mistakes? Additionally, the permissible behaviors allowed in the car itself will depend on whether the vehicle is fully self-driving. For instance, driver-passengers could be able to spend their time in the car messaging, reading, or working, Drinking alcohol might also be permissible, since the fully autonomous car will not require any interven- tion by the passenger ... or will it? What if systems Key Uncertainties Many uncertainties related to self-driving automobiles will prompt both business executives and policy makers to take action of one kind or another. In this complex ecosystem issues emerge in six different areas: Social: Who will use self-driving cars? Autonomous vehicles can be used to transport people who C-50 Part 4: Case Studies fail and driver-passengers are required to become active drivers? Technological: Today self-driving cars are possible because of the existing hardware and software tech- nology. However, as described, there are both cars with fully self-driving features pre-installed (such as Google's car), and systems like Cruise, which can allow other cars to become self-driving. The devel- opment cost of these technologies differs widely and will influence pricing to consumers and hence the adoption response by consumers: for instance, a survey by JD Power and Associates found that only 20% of Americans currently would definitely or 'probably buy a self-driving car if the price was only $30.000.34 Economic: Firstly, there are of course various crises in Asia, the U.S. and Europe that have depressed consumer spending over the past two decades. Will the global and regional economies recover suffi- ciently to enable consumers to replace their vehicles with new, unproven autonomous ones, or would they resort to buying pre-owned vehicles that are cheaper and use more established technologies? Secondly, self-driving vehicles will impact different market players. Insurance companies might change their business models based on a lower rate of acci- dents. Driverless vehicles may allow some com- panies to save money on drivers (such as taxi or bus companies). Also at the national level, research from The University of Texas 5 estimated that if just 10% of vehicles were self-driving, a country such as the U.S. could save about $37 billion a year on healthcare and environmental costs. For the same reason, the U.K. government has announced its commitment to spend 10 million on a test-bed for self-driving cars.36 Finally, the cost and purchasing power in different regions will weigh into the mar- ket economics in different ways, since self-driving cars will change the current production process and countries will facilitate autonomous automobile adoption among consumers in different ways and along different timelines. Environmental: Pollution regulations will change, considering the new emissions generated by self-driving cars, which may be lower than the emissions generated by cars today. This assumption is based on two main factors: first, autonomous vehicles will be able to optimize their consumption by themselves based on road conditions as well as acceleration and breaking behavior, and sec- ond, electric cars and smart charging infrastruc- ture may at some point converge on autonomous automobiles, such that gasoline could become obsolete. Legal: Self-driving cars have to be explicitly legal and encouraged by regulators, not just be toler- ated as a dubious "gray area." Bad or lagging leg- islation could slow down the investment required and therefore the development of the technol- ogy. Furthermore, authorities have to develop new liability frameworks to answer the following questions: who has what kind of influence over autonomous cars "misbehaving" and who will therefore bear the legal and financial responsibil- ity? Would it be the driver, the software or the IT hardware provider, the data processing companies, the telecom companies linking cars wirelessly, the application providers for different functionalities hat may have little do to with driving but could interfere with behavior in the car, the car manu- facturer, or the company responsible for the car's maintenance? Ethical: Two main aspects represent key uncertain- ties in this area. The first issue concerns privacy: what information will be collected by autonomous automobiles, and who has access to it? The second point regards safety. How can autonomous cars be prevented from being hacked, getting virus-infected, and being used for remote criminal activities such as terrorist attack or drug delivery? How does society address computer-savvy minors hacking into cars and sending them on remote joy rides? Will physi- cally or visually impaired passengers be at the mercy of malfunctioning autonomous driving intelligence? To get more information about these and many other uncertainties and assumptions, both governments and private companies have started to experiment. In the U.S., California, Nevada, and Florida allow com- panies to use self-driving cars on the road for testing purposes. Meanwhile, BMW has tested its self-driving car in Europe, and recently also got permission from the Chinese government to test its cars in Shanghai and Beijing. Case 3: Future of the Autonomous Automobile: A Strategy for BMW C-51 Figure 3 Map of "Hot Topics" Related to Autonomous Driving that Gained Public Attention on the Internet (Graphic Developed Through Quid.com) CAR ACCIDENTS & ROAD SAFETY QUALITY ASSURANCE & TESTING INSURANCE & LEGAL ISSUES ETHICAL ISSUES PRIVACY & BIG DATA LEGISLATION RELIABILTY IT SECURITY & ILLEGAL ACTIVITIES ROAD SAFETY This graphic shows some of the key uncertainties from a public perspective, as articulated through news and other coverage on the Internet. It demonstrates that many of the issue areas are interconnected, supporting the point that the autonomous car is a complex system of systems with 2nd and 3rd order effects that could be undesirable and are on the minds of consumers and legislators, i.e., potential buyers, for that reason. But Riedheim knows time is critical: the Board will feel that BMW has to make the strategic investment, partnering, and positioning decisions now, even absent perfect information, if they are to be at the forefront. Questions he'll need to be ready to answer: 1. Strategic challenge/aspiration: Given the chang- ing scenario, what kind of business should BMW aim to be over the next 10 to 15 years? What are its aspirations? 2. Objectives: What are the key metrics that would indicate BMW met the challenge and achieved its goal? 3. Opportunity: What is the size of the opportunity for BMW? 4. Competitive advantages: Given BMW's current competencies, (e.g., internal capabilities, market positions), which ones will be hard to replicate in the emerging automobile industry ecosystem? (carmak- ers, Internet companies, technology startups, R&D labs, governments, insurance companies, suppliers, etc.)? Which ones does it still need to build and develop, and why? 5. Moves: What concrete immediate actions should BMW take now to build external positions and internal capabilities? What types of hurdles or failures are possible and should be accepted as part of the entrepreneurial path? What kind of learning milestones should the company set for itself? As Riedheim sits down to start work on these ques- tions, he knows the burden on him is considerable: the future of this iconic company is at stake. "The authors wish to thank the helpful people of Quid.com for making their technology available for this case and for their tireless counsel on its use and value. DO YOU NEED THIS HERE SINCE YOU HAVE AT THE START? WOULD ELIMINATE. C-52 Part 4: Case Studies Exhibits Exhibit 1 Emergent Strategy System (ESS) and Tools Emergent Strategy System Helps you think about strategy as a system that refines itself, continuously adjusting rather than finishing somewhere to accommodate uncertainty and change Logic A concrete, tangible, plausible, achievable aim: Growth, Profitability, Customer satisfaction, Market share, Shareholder value, ROA/ROI, Quality, Brand, Cost, Risk, Org culture, Employee development, Sustainability, Stakeholder engagement, etc. A diagnosed execution ambition or problem Considerations: simplified, streamlined, clearly framed, Things to do: not holistic, not a list, not necessarily consensus Types: Actions, Decisions, Offerings, Experiments, Learning, Decisions, Challenge Configurations, What we want Communication, etc. Considerations: Industry participants pre-emption or Execution: reactions, other Moves, Objectives hurdles, etc. Hurdles & How we know Discoveries we succeeded/ How we win & what we gain learn A set of attributes and aspects of the offering or execution that is hard to replicate: Types: Products, Capabilities, Positions, Assets, Business model, Installed base, Lock-in, Advantages Opportunites What we aim at/ Brand, Chain links, Path How we win dependency, Scale & Scope where we play economies, Supply chain, Logistics, Cross-selling, etc. Considerations: strengths & weaknesses vis--vis whom? how do they support or impede the value creation logic? Wind-tunneled through uncertainty A positive pivot under uncertain futures External: Old v. new markets, spaces, segments, needs, pilot RFPs, deals, gaps, etc. Internal: Openings for process improvement, re-structuring, re- alignment, etc. Both subject to critical uncertainties C-54 Part 4: Case Studies Exhibit 2 BMW Autonomous Cara BMW's robocar GPS Advanced sat nav gives a a highly accurate position for the car -High definition camera A stereo camera (with two lenses) feeds video to image recognition software to identify white lines and road signs The human The "driver" is actually a passenger and is free to use the phone or internet, or watch the entertainment screen - Computer Analyses all of the data to build up a complete picture of the road around the car. It then issues commands to accelerate, brake or steer O Ultrasonic sensors Small sensors are fitted to the side of the car to warn of obstacles Laser A 3D laser scanner, known as Lidar, maps surrounding vehicles and objects Radar Radio waves are used to judge the distance between the BMW and the car in front Exhibit 3 Financial Data BMW Income Statement 201339 2013 2012 Notes 14 60,474 58805 -47,067 - 46,252 In million Revenues Cost of sales Gross profit Selling expenses Administration expenses Research and development expenses Other operating income and expenses 13,407 -3,528 -2,141 -4,362 542 12,553 -3,684 - 1,701 -3,573 703 15- 16 373 17- 18- -328 598 -99 4,797 - 1,635 3,963 -1,629 19- Result on investments Financial result Profit from ordinary activities Income taxes Other taxes Net Profit Transfer to revenue reserves Unappropriated profit available for distribution -45 -31 2,289 20- -582 3,131 -1,491 1,640 1,707 Case 3: Future of the Autonomous Automobile: A Strategy for BMW C-55 Exhibit 3 (cont.) Financial Data ) BMW in Figures 2013 2012 58,805 79.6 Change in % 2.8 7.8 1,861,826 113,811 3.2 6.8 0.7 15.4 1,868,158 110,857 2,776 1,613 74,571 11,078 20,887 7.4 3.4 15.8 0.2 2013 Revenues million 60,474 Export ratio % 81.5 Production Automobiles units 2,006,366 Motorcycles units 110,127 Sales volume Automobiles units 1,995,903 Motorcyles units 110,039 Capital expenditure million 3,203 Depreciation, amortisation and impairment losses million 1,732 Workforce at end of year 77,110 Tangible, intangible and investment losses million 12,8332 Current assets, prepayments and surplus of pension million 20,932 and similar plan assets over liabilities Subscribed capital million 656 Reserves million 8,166 Equity million 10,529 as % of tangible, intangible and investment assets 96 82.0 Balance sheet total million 33,765 Cost of materials million 43,402 Personnel costs million 6,419 Taxes million 1,674 Net profit million Dividend million 1,707 per share of common stock with a per value of 1 each 2.60 per share of preferred stock with a per value of 1 each 2.62 Including supplies of series parts to BMW Brilliance Automotive Ltd., Shenyang. Including transfer of non-current assets in conjunction with merger of BMW Peugeot Citron Electrification GmbH, Munich. *Proposed by the Board of Management. 7.9 656 7,568 9,864 89.0 6.7 5.6 2.9 6.5 31,965 42,178 6,030 1,666 3,131 1,640 2.50 0.5 2,289 26.9 4.1 2.52 BMW Research and Development 2013" 'Research and development expenditure for the year rose by 21.3 % to 4,792 million, mostly for projects aimed at securing the Group's future business (2012: 3,952 million). The research and development ratio was 6.3 %, 1.2 percentage points higher than in the previous year (2012: 5.1 %). The ratio of capitalised development costs to total research and development costs for the period (capitalisation ratio) was 36.4 % (2012: 27.6 %). Amortisation of capitalised development costs totalled 1,069 million (2012: 1,130 million). Further information on research and development expenditure is provided in the section Results of Operations, Financial Position and Net Assets and in note 10 to the Group Financial Statements. Total research and development expenditure, comprising research costs, development costs not recognised as assets on the one hand and capitalised development costs excluding the scheduled amortisation thereof on the other, was as follows: in million 2013 2012 Research and development expenses 4,117 3,993 Amortisation - 1,069 -1,130 New expenditure for capitalized development costs 1,744 1,089 Total research and development expenditure 4,792 3,952Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts