Question: 1 - generated / destroyed 2 - positive / negative 3 - 405 / 344 / 486 / 522 Financial statements reflect only the book

1 - generated / destroyed

2 - positive / negative

3 - 405 / 344 / 486 / 522

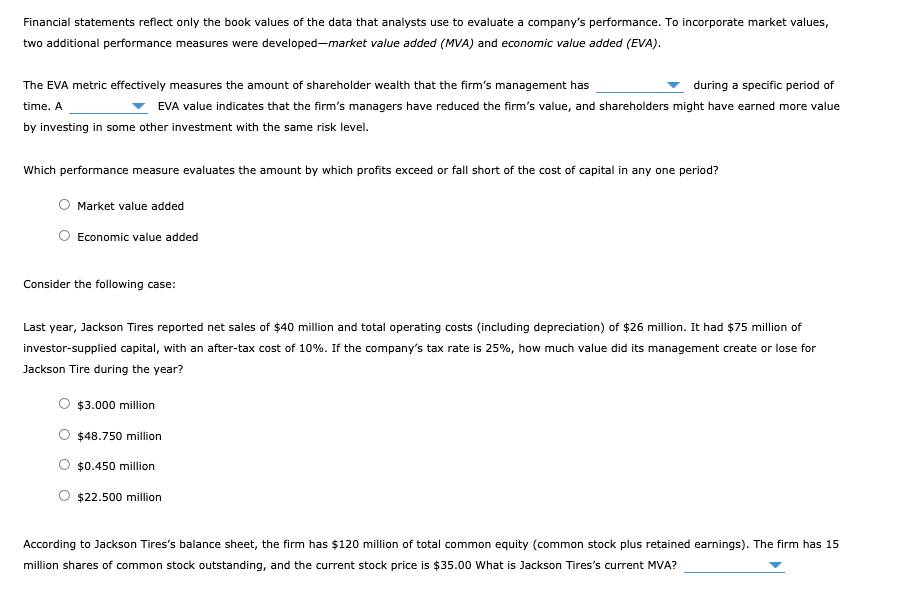

Financial statements reflect only the book values of the data that analysts use to evaluate a company's performance. To incorporate market values, two additional performance measures were developed-market value added (MVA) and economic value added (EVA). The EVA metric effectively measures the amount of shareholder wealth that the firm's management has during a specific period of time. A EVA value indicates that the firm's managers have reduced the firm's value, and shareholders might have earned more value by investing in some other investment with the same risk level. Which performance measure evaluates the amount by which profits exceed or fall short of the cost of capital in any one period? Market value added Economic value added Consider the following case: Last year, Jackson Tires reported net sales of $40 million and total operating costs (including depreciation) of $26 million. It had $75 million of investor-supplied capital, with an after-tax cost of 10%. If the company's tax rate is 25%, how much value did its management create or lose for Jackson Tire during the year? $3.000 million $48.750 million $0.450 million $22.500 million According to Jackson Tires's balance sheet, the firm has $120 million of total common equity (common stock plus retained earnings). The firm has 15 million shares of common stock outstanding, and the current stock price is $35.00 What is Jackson Tires's current MVA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts