Question: 1. Ghary is considering hiring a production manager while he, Ghary, becomes a residual claimant and does not draw a salary. The production manager has

1. Ghary is considering hiring a production manager while he, Ghary, becomes a residual claimant and does not draw a salary. The production manager has agreed to take on the job for a fixed salary of $45,000 a year plus a bonus if cost of goods manufactured per unit decreases by $1.00 compared with the cost of goods manufactured per unit in 2016. Assuming the cost per oz of metal, the cost per foot of webbing, the cost per box, and the rent remain the same, will the new production manager earn a bonus if she produces 3,050 belts?

A. Yes

B. No

2. Ghary is considering hiring a production manager while he, Ghary, becomes a residual claimant and does not draw a salary. The production manager has agreed to take on the job for a fixed salary of $45,000 a year plus a bonus if cost of goods manufactured per unit decreases by $1.00 compared with the cost of goods manufactured per unit in 2016. Assuming the cost per oz of metal, the cost per foot of webbing, the cost per box, and the rent remain the same, will the new production manager earn a bonus if she produces 3,250 belts?

A. Yes

B. No

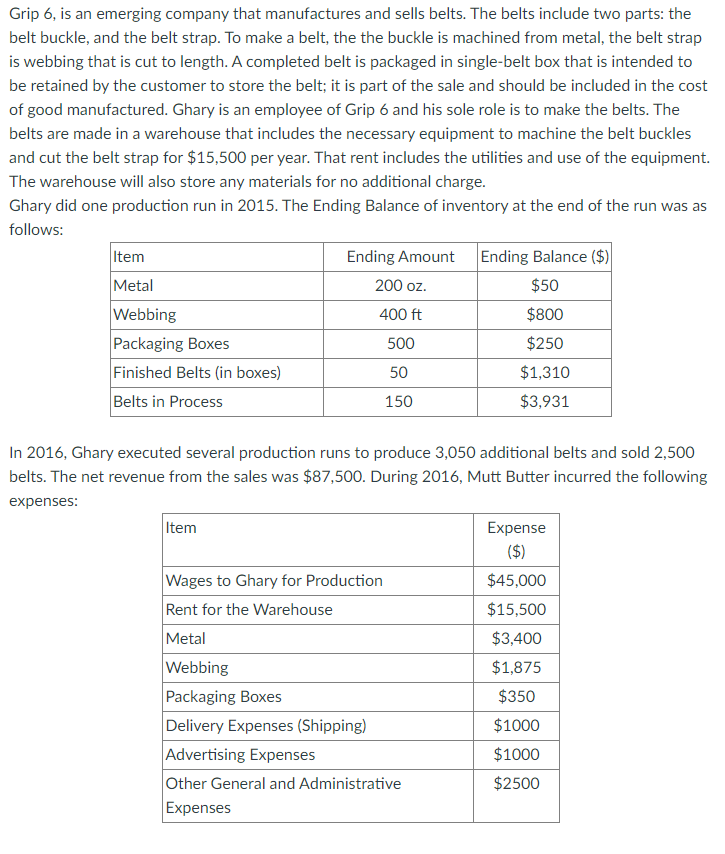

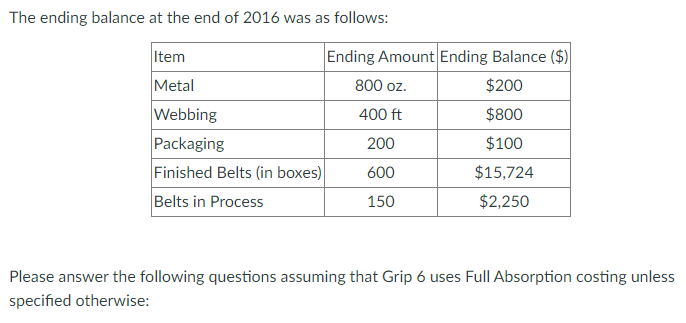

Grip 6, is an emerging company that manufactures and sells belts. The belts include two parts: the belt buckle, and the belt strap. To make a belt, the the buckle is machined from metal, the belt strap is webbing that is cut to length. A completed belt is packaged in single-belt box that is intended to be retained by the customer to store the belt; it is part of the sale and should be included in the cost of good manufactured. Ghary is an employee of Grip 6 and his sole role is to make the belts. The belts are made in a warehouse that includes the necessary equipment to machine the belt buckles and cut the belt strap for $15,500 per year. That rent includes the utilities and use of the equipment. The warehouse will also store any materials for no additional charge. Ghary did one production run in 2015. The Ending Balance of inventory at the end of the run was as follows: Item Ending Amount Ending Balance ($) Metal 200 oz. $50 Webbing 400 ft $800 Packaging Boxes 500 $250 Finished Belts (in boxes) 50 $1,310 Belts in Process 150 $3,931 In 2016, Ghary executed several production runs to produce 3,050 additional belts and sold 2,500 belts. The net revenue from the sales was $87,500. During 2016, Mutt Butter incurred the following expenses: Item Expense ($) $45,000 Wages to Ghary for Production Rent for the Warehouse Metal Webbing Packaging Boxes Delivery Expenses (Shipping) Advertising Expenses Other General and Administrative Expenses $15,500 $3,400 $1,875 $350 $1000 $1000 $2500 The ending balance at the end of 2016 was as follows: Item Ending Amount Ending Balance ($) Metal 800 oz. $200 Webbing 400 ft $800 Packaging 200 $100 Finished Belts (in boxes) 600 $15,724 Belts in Process 150 $2,250 Please answer the following questions assuming that Grip 6 uses Full Absorption costing unless specified otherwise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts