Question: 1. Give two examples to illustrate that a one-factor model is not sufficient in explaining stock return patterns. 2. How does Merton's (1973) two-factor model

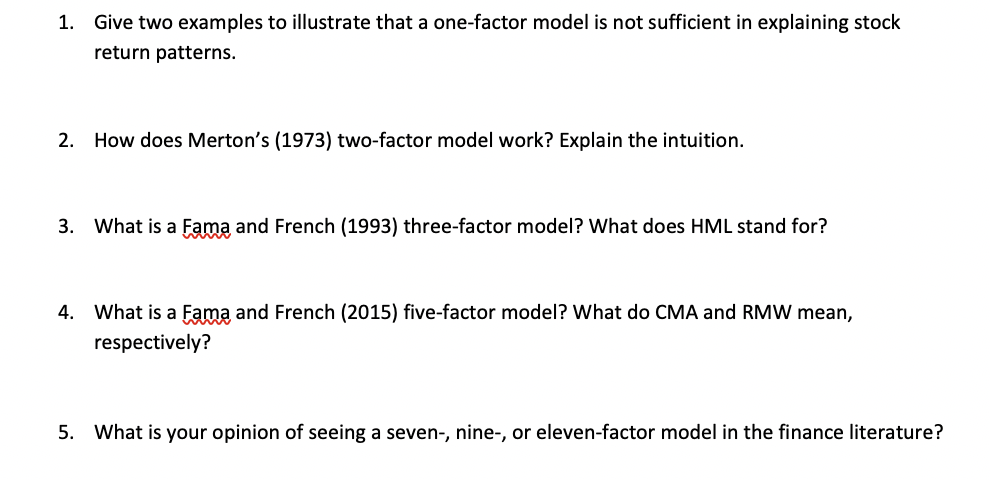

1. Give two examples to illustrate that a one-factor model is not sufficient in explaining stock return patterns. 2. How does Merton's (1973) two-factor model work? Explain the intuition. 3. What is a Fama and French (1993) three-factor model? What does HML stand for? 4. What is a Fama and French (2015) five-factor model? What do CMA and RMW mean, respectively? 5. What is your opinion of seeing a seven-, nine-, or eleven-factor model in the finance literature

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts