Question: 1. Given the compounded annual rate is 7%. Which do you most prefer out of the following cash flows? (4 Marks) Cash flow.1 : receive

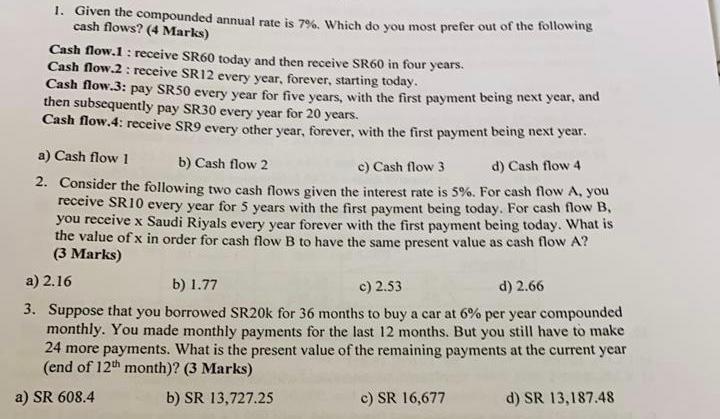

1. Given the compounded annual rate is 7%. Which do you most prefer out of the following cash flows? (4 Marks) Cash flow.1 : receive SR60 today and then receive SR60 in four years. Cash flow.2: receive SR12 every year, forever, starting today. Cash flow.3: pay SR50 every year for five years, with the first payment being next year, and then subsequently pay SR30 every year for 20 years. Cash flow.4: receive SR9 every other year, forever, with the first payment being next year. a) Cash flow 1 b) Cash flow 2 c) Cash flow 3 d) Cash flow 4 2. Consider the following two cash flows given the interest rate is 5%. For cash flow A, you receive SR10 every year for 5 years with the first payment being today. For cash flow B. you receive x Saudi Riyals every year forever with the first payment being today. What is the value of x in order for cash flow B to have the same present value as cash flow A? (3 Marks) a) 2.16 b) 1.77 c) 2.53 d) 2.66 3. Suppose that you borrowed SR20k for 36 months to buy a car at 6% per year compounded monthly. You made monthly payments for the last 12 months. But you still have to make 24 more payments. What is the present value of the remaining payments at the current year (end of 12th month)? (3 Marks) a) SR 608.4 b) SR 13,727.25 c) SR 16,677 d) SR 13,187.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts