Question: 1) Given the following information on a fixed-rate fully amortizing loan, determine the maximum amount that the lender will be willing to provide to the

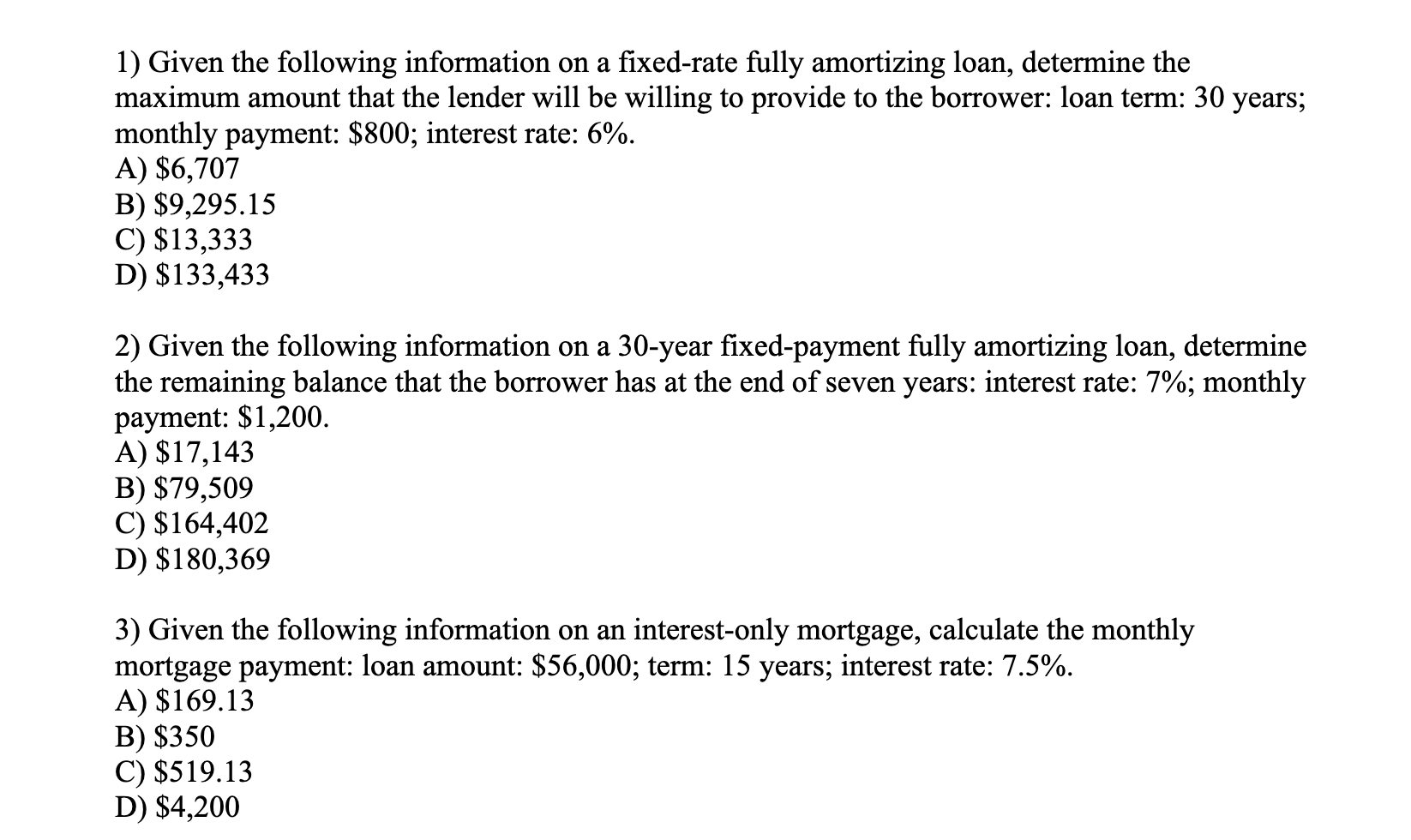

1) Given the following information on a fixed-rate fully amortizing loan, determine the maximum amount that the lender will be willing to provide to the borrower: loan term: 30 years; monthly payment: $800; interest rate: 6%. A) $6,707 B) $9,295.15 C) $13,333 D) $133,433 2) Given the following information on a 30-year fixed-payment fully amortizing loan, determine the remaining balance that the borrower has at the end of seven years: interest rate: 7%; monthly payment: $1,200. A) $17,143 B) $79,509 C) $164,402 D) $180,369 3) Given the following information on an interest-only mortgage, calculate the monthly mortgage payment: loan amount: $56,000; term: 15 years; interest rate: 7.5%. A) $169.13 B) $350 C) $519.13 D) $4,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts