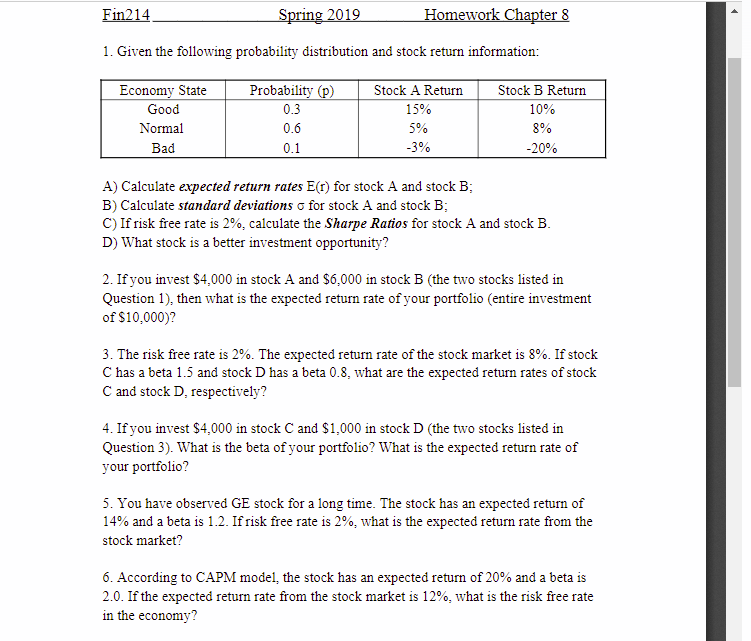

Question: 1. Given the following probability distribution and stock return information: Economy State Good Normal Bad Probability (p) 0.3 0.6 0.1 Stock A Return 15% 590

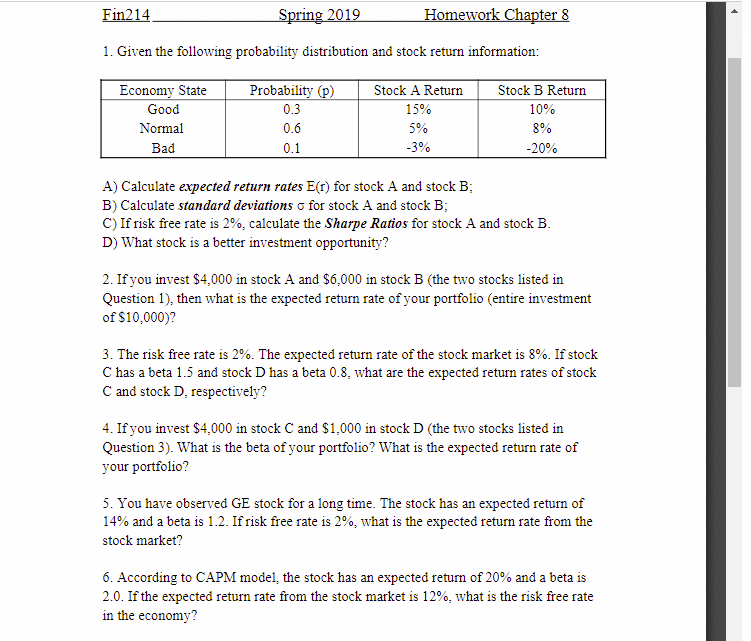

1. Given the following probability distribution and stock return information: Economy State Good Normal Bad Probability (p) 0.3 0.6 0.1 Stock A Return 15% 590 -3% Stock B Return 10% 8% A) Calculate expected return rates E(r) for stock A and stock B B) Calculate standard deviations for stock A and stock B C) If risk free rate is 2%, calculate the Sharpe Ratios for stock A and stock B D) What stock is a better investment opportunity? 2. Ifyou invest $4,000 in stock A and S6,000 in stock B (the two stocks listed in Question 1), then what is the expected return rate of your portfolio (entire investment of $10,000)? 3. The risk free rate is 2%. The expected return rate of the stock market is 8%. If stock C has a beta 1.5 and stock D has a beta 0.8, what are the expected return rates of stock C and stock D, respectively? 4. Ifyou invest $4,000 in stock C and $1,000 in stock D (the two stocks listed in Question 3). What is the beta of your portfolio? What is the expected return rate of your portfolio? 5. You have observed GE stock for a long time. The stock has an expected return of 14% and a beta is 1.2. If risk free rate is 2%, what is the expected return rate from the stock market? 6. According to CAPM model, the stock has an expected return of 20% and a beta is 2.0. If the expected return rate from the stock market is 12%, what is the risk free rate in the economy? 1. Given the following probability distribution and stock return information: Economy State Good Normal Bad Probability (p) 0.3 0.6 0.1 Stock A Return 15% 590 -3% Stock B Return 10% 8% A) Calculate expected return rates E(r) for stock A and stock B B) Calculate standard deviations for stock A and stock B C) If risk free rate is 2%, calculate the Sharpe Ratios for stock A and stock B D) What stock is a better investment opportunity? 2. Ifyou invest $4,000 in stock A and S6,000 in stock B (the two stocks listed in Question 1), then what is the expected return rate of your portfolio (entire investment of $10,000)? 3. The risk free rate is 2%. The expected return rate of the stock market is 8%. If stock C has a beta 1.5 and stock D has a beta 0.8, what are the expected return rates of stock C and stock D, respectively? 4. Ifyou invest $4,000 in stock C and $1,000 in stock D (the two stocks listed in Question 3). What is the beta of your portfolio? What is the expected return rate of your portfolio? 5. You have observed GE stock for a long time. The stock has an expected return of 14% and a beta is 1.2. If risk free rate is 2%, what is the expected return rate from the stock market? 6. According to CAPM model, the stock has an expected return of 20% and a beta is 2.0. If the expected return rate from the stock market is 12%, what is the risk free rate in the economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts