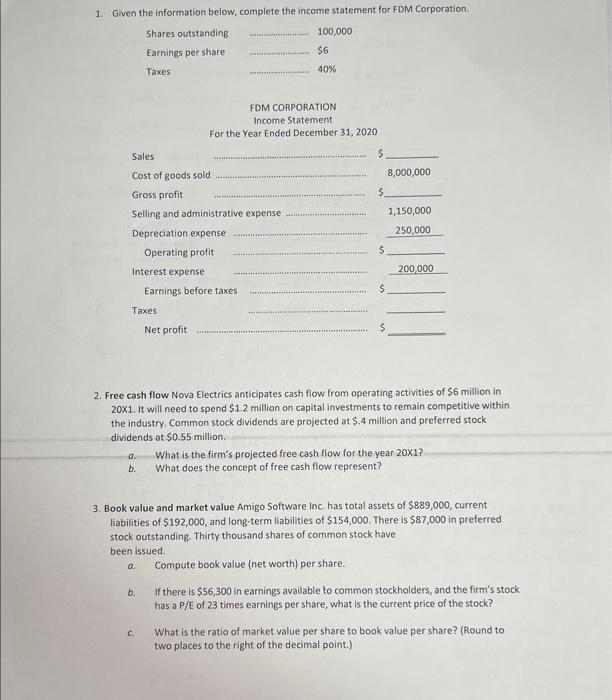

Question: 1. Given the information below, complete the income statement for FDM Corporation. FDM CORPORATION Income Statement 2. Free cash flow Nova Electrics anticipates cash flow

1. Given the information below, complete the income statement for FDM Corporation. FDM CORPORATION Income Statement 2. Free cash flow Nova Electrics anticipates cash flow from operating activities of $6 million in 20X1. It will need to spend $1.2 million on capital investments to remain competitive within the industry. Common stock dividends are projected at $.4 million and preferred stock dividends at $0.55 million. a. What is the firm's projected free cash flow for the year 201 ? b. What does the concept of free cash flow represent? 3. Book value and market value Amigo Software Inc. has total assets of $889,000, current liabilities of $192,000, and long-term liabilities of $154,000. There is $87,000 in preferred stock outstanding. Thirty thousand shares of common stock have been issued. a. Compute book value (net worth) per share. b. If there is $56,300 in earnings available to common stockholders, and the firm's stock has a P/E of 23 times earnings per share, what is the current price of the stock? c. What is the ratio of market value per share to book value per share? (Round to two places to the right of the decimal point.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts