Question: 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. 2. Assume the $70,000 cost savings are

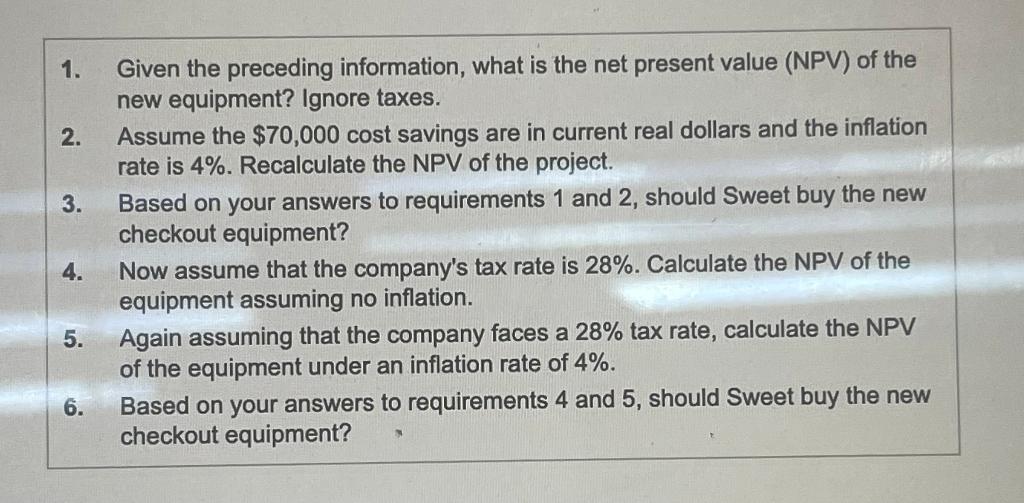

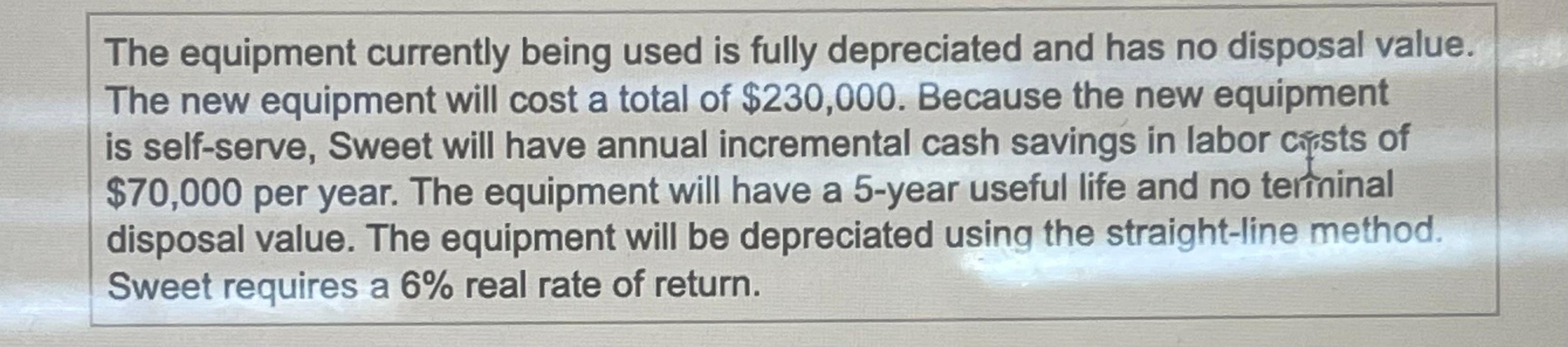

1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. 2. Assume the $70,000 cost savings are in current real dollars and the inflation rate is 4%. Recalculate the NPV of the project. 3. Based on your answers to requirements 1 and 2 , should Sweet buy the new checkout equipment? 4. Now assume that the company's tax rate is 28%. Calculate the NPV of the equipment assuming no inflation. 5. Again assuming that the company faces a 28% tax rate, calculate the NPV of the equipment under an inflation rate of 4%. 6. Based on your answers to requirements 4 and 5 , should Sweet buy the new checkout equipment? The equipment currently being used is fully depreciated and has no disposal value. The new equipment will cost a total of $230,000. Because the new equipment is self-serve, Sweet will have annual incremental cash savings in labor crists of $70,000 per year. The equipment will have a 5-year useful life and no terininal disposal value. The equipment will be depreciated using the straight-line method. Sweet requires a 6% real rate of return. Sweet is considering replacing 20 of their checkout registers with new self-checkout equipment. (Click the icon to view additional information.) Read the requirements. Requirement 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. (Round intermediary ca to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investmer The net present value is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts