Question: 1. Gordon Dividend Growth Model Basic (answered by all students) A. The company OldCo has a current stock price of $210 per share. Last year

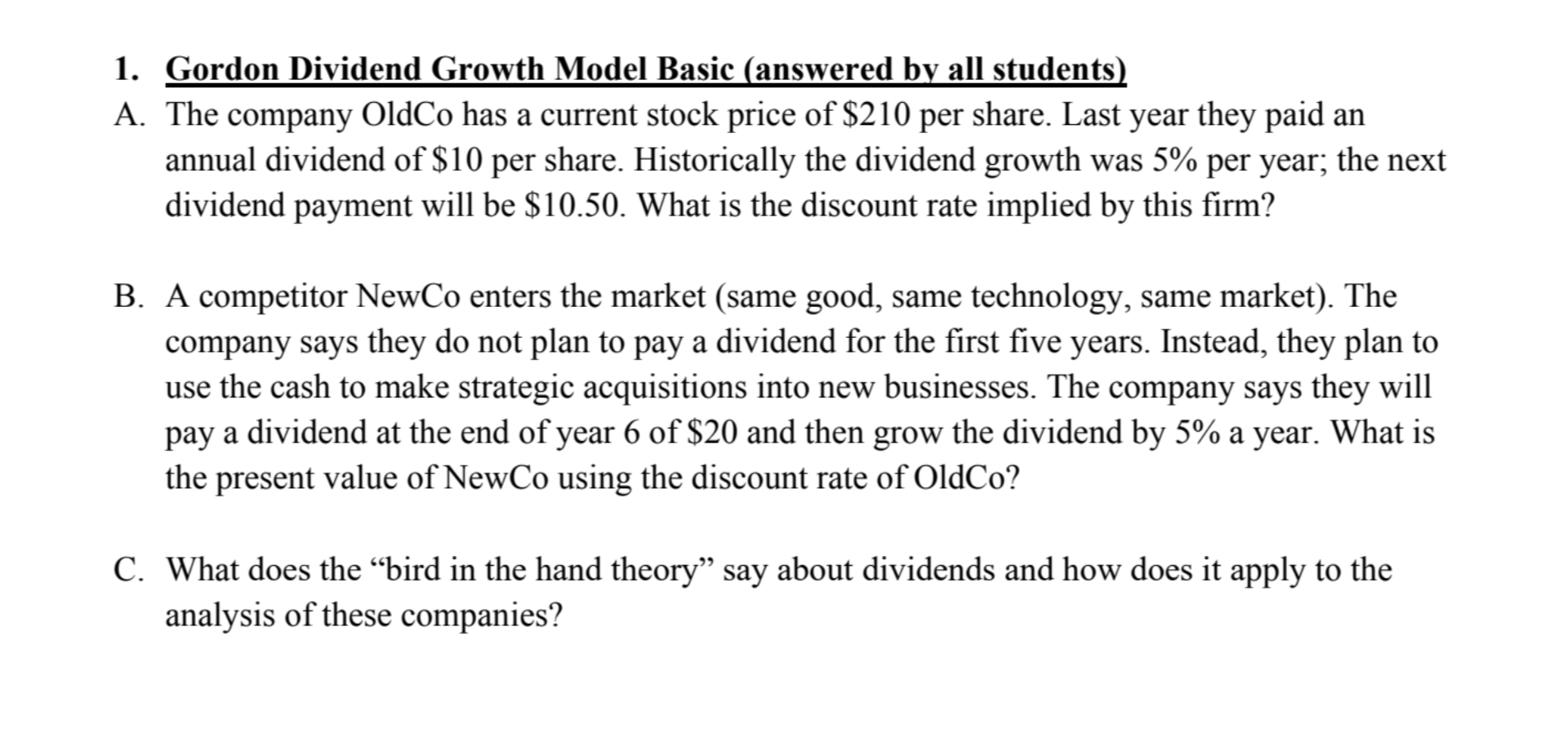

1. Gordon Dividend Growth Model Basic (answered by all students) A. The company OldCo has a current stock price of $210 per share. Last year they paid an annual dividend of $10 per share. Historically the dividend growth was 5% per year; the next dividend payment will be $10.50. What is the discount rate implied by this firm? B. A competitor NewCo enters the market (same good, same technology, same market). The company says they do not plan to pay a dividend for the first five years. Instead, they plan to use the cash to make strategic acquisitions into new businesses. The company says they will pay a dividend at the end of year 6 of $20 and then grow the dividend by 5% a year. What is the present value of NewCo using the discount rate of OldCo? C. What does the bird in the hand theory say about dividends and how does it apply to the analysis of these companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts