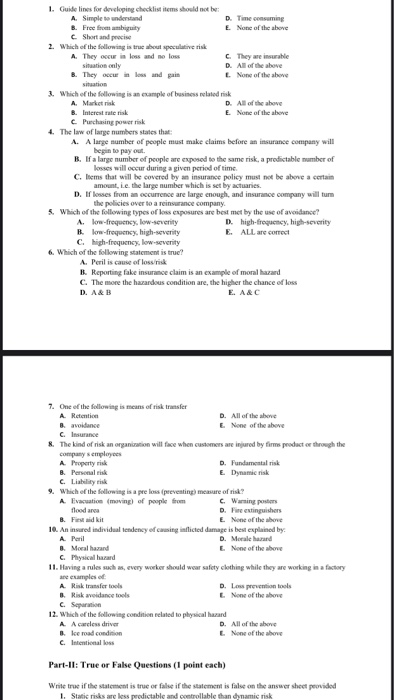

Question: 1. Guidelines for developing checklist items should not be A Simple to understand D. Time consuming 8. Free from ambiguity E. None of the above

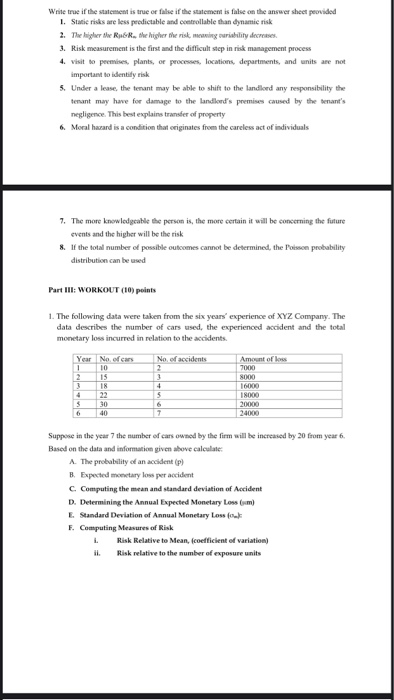

1. Guidelines for developing checklist items should not be A Simple to understand D. Time consuming 8. Free from ambiguity E. None of the above c Short and precise 2. Which of the following is t he speculative risk A. They occur in loss and no loss C. They are insurable situation only D. All of the above B. They is loss and gain None of the abowe situation 3. Which of the following is an example of business related risk A. Markt risk D. All of the above B. Interest rate risk E. None of the above c Purchasing power risk 4. The law of large number states that A. A large number of people must make claims before an insurance company will begin to pay out B. If a large number of people are exposed to the same risk, a predictable number of losses will occur during a given period of time C. Iems that will be covered by an insurance policy must not be above a certain amount, i.e. the large number which is set by actuaries. D. If losses from an occurrence are large enough, and insurance company will turn the policies over to a reinvurance company 5. Which of the following types of loss exposures are best met by the use of avoidance? A low-frequency, low-severity D. high-frequency, high-severity B low-frequency, high-severity E. ALL are correct c. high-frequency, low severity 6. Which of the following statement is true? A Peril is cause of loss risk B. Reporting fake insure claim is an example of moral hazard C. The more the hazardous condition are, the higher the chance of loss D. A&B E. A&C 7. One of the following is means of risk transfer A Retention D. All of the above Badanc E en of the show C. Insurance & The kind of risk an organization will face when customers are injured by forms product through the company employees A Property risk D. Fundamental risk B. Personal risk E Dynamic risk c. Liability risk 9. Which of the following is a pre loss preventing measure of risk? A. Evacuation (moving of people from Warning flood arga D. Fire extinguishers B. Fid kit E. None of the above 10. An insured individual tendency of causing indicted damage is best explained by D. Morale haard None of the above C. Physical hazard 11. Having a rules such as every worker should wear safety clothing while they are working in a factory are examples of A Risk transfer tools D. Low prevention tools 6. Risk avoidance tools LNone of the show c. Separation 12. Which of the following condition related to physical hazard A Access driver D. All of the above ke mad condition L. None of the show c. Intentional loss Part-II: True or False Questions (1 point each) Write true if the statement is true or false if the statement is false on the answer sheet provided 1. Static risks are less predictable and controllable than dynamic risk Write true if the statement is true or false if the statement is false on the answer sheet provided 1. Static risks are less predictable and strollable than dynamie risk 2. The higher the R&R the higher the risk, menninguriability decreases 3. Risk measurement is the first and the difficult step in risk management process 4. visit to peemises, plants, or processes, locations, departments, and units are not important to identify risk 5. Under a lease, the tenant may be able to shift to the landlord any responsibility the tenant may have for damage to the landlord's premies caused by the nant's negligence. This best explains transfer of property 6 Moral hazard is a condition that originates from the careless act of individuals 7. The more knowledgeable the person is the more certain it will be concerning the future events and the higher will be the risk 8. If the total number of possible outcomes cannot be determined, the Poisson probability distribution can be used Part III: WORKOUT (10) points 1. The following data were taken from the six years' experience of XYZ Company. The data describes the number of cars used, the experienced accident and the total monetary loss incurred in relation to the accidents Year of cars No of accidents Amount of los Suppose in the year 7 the number of cars owned by the firm will be increased by 20 from year 6. Based on the data and information given above calculate A. The probability of an accident (p) B. Expected monetary loss per accident C Computing the mean and standard deviation of Accident D. Determining the Annual Expected Monetary Loss (m) E Standard Deviation of Annual Monetary Loss for F. Computing Measures of Risk Risk Relative to Mean, coefficient of variation) il. Risk relative to the number of exposure units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts