Question: 1 , Hamlet College recently purchased new computing equipment for its library. The following information refers to the purchase and installation of this equipment. 1.

1

,

,

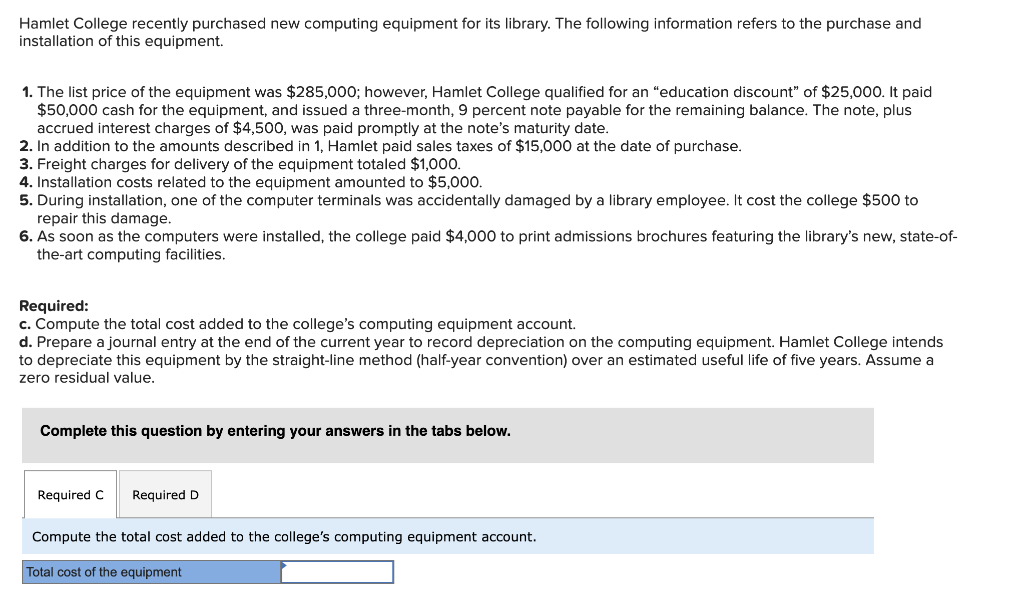

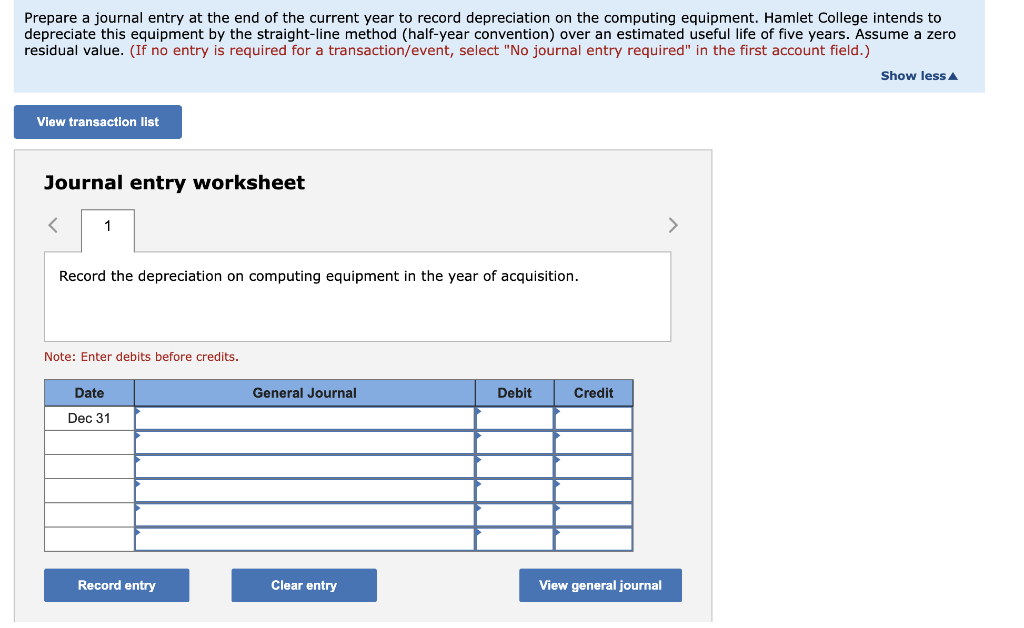

Hamlet College recently purchased new computing equipment for its library. The following information refers to the purchase and installation of this equipment. 1. The list price of the equipment was $285,000; however, Hamlet College qualified for an "education discount" of $25,000. It paid $50,000 cash for the equipment, and issued a three-month, 9 percent note payable for the remaining balance. The note, plus accrued interest charges of $4,500, was paid promptly at the note's maturity date. 2. In addition to the amounts described in 1 , Hamlet paid sales taxes of $15,000 at the date of purchase. 3. Freight charges for delivery of the equipment totaled $1,000. 4. Installation costs related to the equipment amounted to $5,000. 5. During installation, one of the computer terminals was accidentally damaged by a library employee. It cost the college $500 to repair this damage. 6. As soon as the computers were installed, the college paid $4,000 to print admissions brochures featuring the library's new, state-ofthe-art computing facilities. Required: c. Compute the total cost added to the college's computing equipment account. d. Prepare a journal entry at the end of the current year to record depreciation on the computing equipment. Hamlet College intends to depreciate this equipment by the straight-line method (half-year convention) over an estimated useful life of five years. Assume a zero residual value. Complete this question by entering your answers in the tabs below. Compute the total cost added to the college's computing equipment account. Prepare a journal entry at the end of the current year to record depreciation on the computing equipment. Hamlet College intends to depreciate this equipment by the straight-line method (half-year convention) over an estimated useful life of five years. Assume a zero residual value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less A Journal entry worksheet Record the depreciation on computing equipment in the year of acquisition. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts