Question: 1. Hedge and store deeision (with basis risk): (1) Opening basis and closing basis Date Cash Futures 1-Oct Cash Price $2.30 May Futures $2.75 Cost

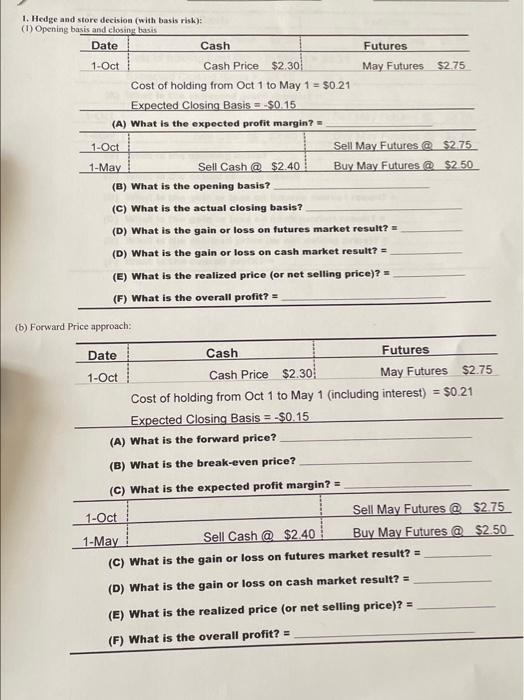

1. Hedge and store deeision (with basis risk): (1) Opening basis and closing basis Date Cash Futures 1-Oct Cash Price $2.30 May Futures $2.75 Cost of holding from Oct 1 to May 1 = $0.21 Expected Closing Basis = $0.15 (A) What is the expected profit margin? 1-Oct Sell May Futures @ $275 1-May Sell Cash @ $2.40 Buy May Futures @ $2.50 (B) What is the opening basis? (C) What is the actual closing basis? (D) What is the gain or loss on futures market result? (D) What is the gain or loss on cash market result? = (E) What is the realized price (or net selling price)? = (F) What is the overall profit? = (b) Forward Price approach: Date Cash Futures 1-Oct Cash Price $2.30 May Futures $2.75 Cost of holding from Oct 1 to May 1 (including interest) = $0.21 Expected Closing Basis = $0.15 (A) What is the forward price? (B) What is the break-even price? (C) What is the expected profit margin? = 1-Oct Sell May Futures @ $2.75 1-May Sell Cash @ $2.40 Buy May Futures @ $2.50 (C) What is the gain or loss on futures market result? = (D) What is the gain or loss on cash market result? = (E) What is the realized price (or net selling price)? = (F) What is the overall profit? =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts