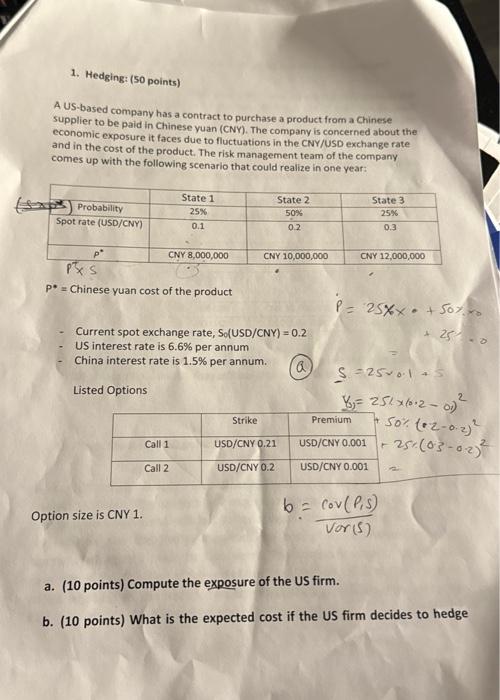

Question: 1. Hedging: ( 50 points) A US-based company has a contract to purchase a product from a Chinese supplier to be paid in Chinese yuan

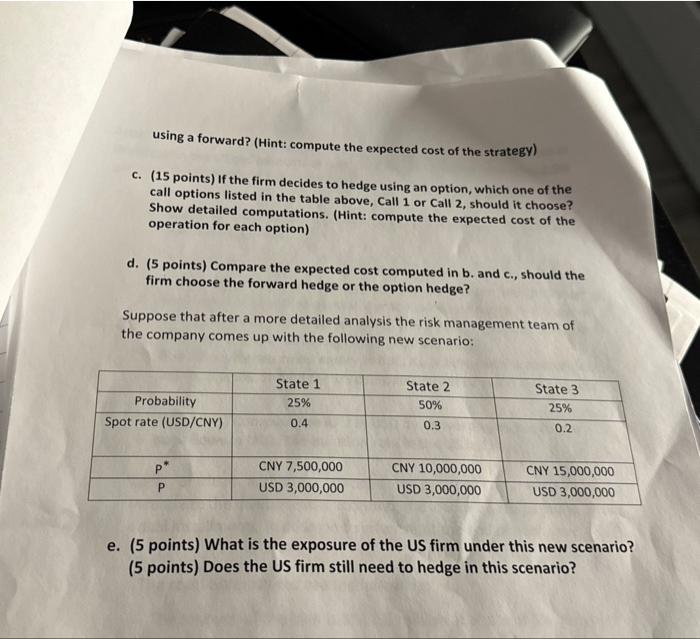

1. Hedging: ( 50 points) A US-based company has a contract to purchase a product from a Chinese supplier to be paid in Chinese yuan (CNY). The company is concerned about the economic exposure it faces due to fluctuations in the CNY/USD exchange rate and in the cost of the product. The risk management team of the company comes up with the following scenario that could realize in one year: P= Chinese yuan cost of the product P=25x=+50%=0+25=0 - Current spot exchange rate, S0(USD/CNY)=0.2 - US interest rate is 6.6% per annum - China interest rate is 1.5% per annum. Listed Options (a) S=2500.1+5 V1=251(0.20.1)2 50:(20:2)2 +25(030.2)2 Option size is CNY 1. b=vor(S)cov(P,S) a. (10 points) Compute the exposure of the US firm. b. (10 points) What is the expected cost if the US firm decides to hedge using a forward? (Hint: compute the expected cost of the strategy) c. (15 points) If the firm decides to hedge using an option, which one of the call options listed in the table above, Call 1 or Call 2, should it choose? Show detailed computations. (Hint: compute the expected cost of the operation for each option) d. (5 points) Compare the expected cost computed in b. and c., should the firm choose the forward hedge or the option hedge? Suppose that after a more detailed analysis the risk management team of the company comes up with the following new scenario: e. ( 5 points) What is the exposure of the US firm under this new scenario? ( 5 points) Does the US firm still need to hedge in this scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts