Question: 1. Hedging with Futures: a) What is the difference between a stock and a strip hedge? b) How do Beta and hedge ratio relate to

1. Hedging with Futures:

a) What is the difference between a stock and a strip hedge?

b) How do Beta and hedge ratio relate to each other?

c) Determine the hedge ratio for a stock portfolio that has a beta of 0.80 relative to the S&P 500. The S&P 500 is currently at 3800 and pays a 2.5% dividend yield. The hedge will be for six months (1/2 year) and the current annual risk-free rate is 1.00%.

d) Using the information from above, if the S&P 500 Futures contract is trading at 3800 (contract value = $50 x current price) and the portfolio holds $60,000,000 in stocks what would be the number of S&P 500 Futures contracts sold to hedge the portfolio?

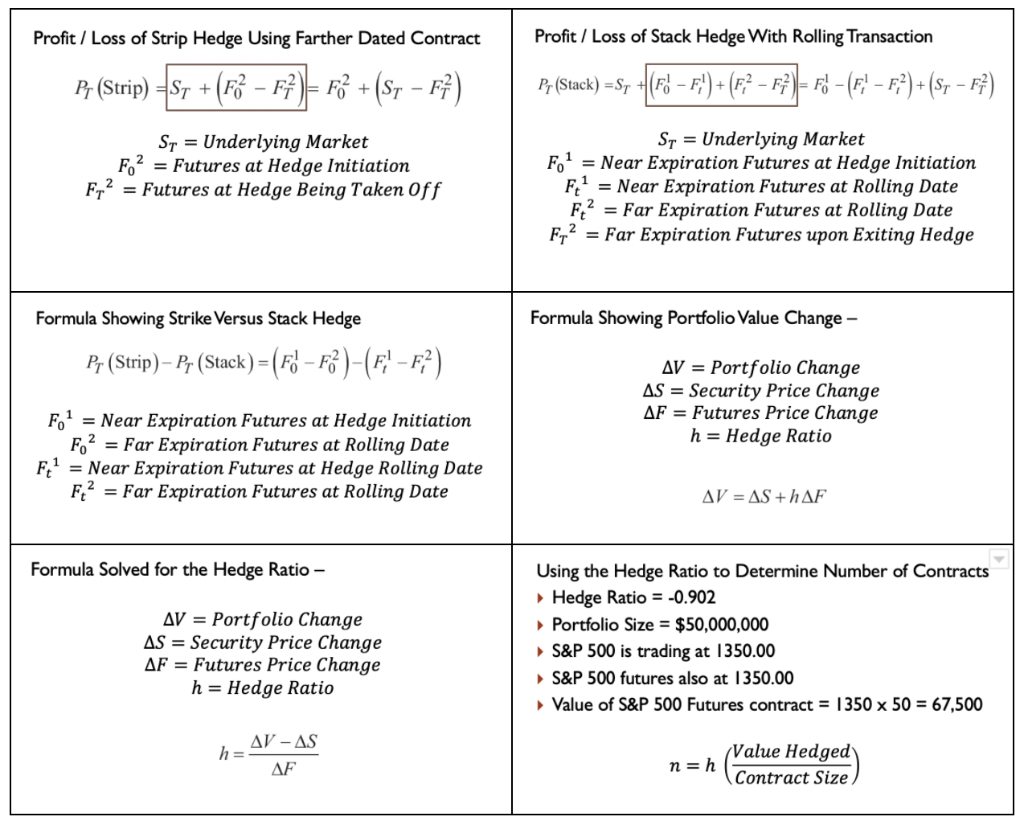

PROVIDED FORMULAS:

Profit / Loss of Strip Hedge Using Farther Dated Contract Profit / Loss of Stack Hedge With Rolling Transaction Af (strip) +57 + (83 F})= 23 + (57 F) Pr (Stack) =S; +(F) F') + (F? - F})= Fo - (F' F?)+ (S7 F7) Sy = Underlying Market F.2 = Futures at Hedge Initiation Fr? = Futures at Hedge Being Taken off ST = Underlying Market 1 Fo? = Near Expiration Futures at Hedge Initiation F1= Near Expiration Futures at Rolling Date Ft? = Far Expiration Futures at Rolling Date Fr2 = Far Expiration Futures upon Exiting Hedge Formula Showing Portfolio Value Change - Formula Showing Strike Versus Stack Hedge Pr (Strip) Pr (Stack) = (F F7 )-(F' -F?) AV = Portfolio Change AS = Security Price Change AF = Futures Price Change h = Hedge Ratio Fo? = Near Expiration Futures at Hedge Initiation Fo? = Far Expiration Futures at Rolling Date Ft? = Near Expiration Futures at Hedge Rolling Date F? = Far Expiration Futures at Rolling Date AV = AS +hAF Formula Solved for the Hedge Ratio - AV = Portfolio Change AS = Security Price Change AF = Futures Price Change h = Hedge Ratio Using the Hedge Ratio to Determine Number of Contracts Hedge Ratio = -0.902 Portfolio Size = $50,000,000 S&P 500 is trading at 1350.00 S&P 500 futures also at 1350.00 Value of S&P 500 Futures contract = 1350 x 50 = 67,500 AV - AS h= AF n=h (Value Hedged Contract Size Profit / Loss of Strip Hedge Using Farther Dated Contract Profit / Loss of Stack Hedge With Rolling Transaction Af (strip) +57 + (83 F})= 23 + (57 F) Pr (Stack) =S; +(F) F') + (F? - F})= Fo - (F' F?)+ (S7 F7) Sy = Underlying Market F.2 = Futures at Hedge Initiation Fr? = Futures at Hedge Being Taken off ST = Underlying Market 1 Fo? = Near Expiration Futures at Hedge Initiation F1= Near Expiration Futures at Rolling Date Ft? = Far Expiration Futures at Rolling Date Fr2 = Far Expiration Futures upon Exiting Hedge Formula Showing Portfolio Value Change - Formula Showing Strike Versus Stack Hedge Pr (Strip) Pr (Stack) = (F F7 )-(F' -F?) AV = Portfolio Change AS = Security Price Change AF = Futures Price Change h = Hedge Ratio Fo? = Near Expiration Futures at Hedge Initiation Fo? = Far Expiration Futures at Rolling Date Ft? = Near Expiration Futures at Hedge Rolling Date F? = Far Expiration Futures at Rolling Date AV = AS +hAF Formula Solved for the Hedge Ratio - AV = Portfolio Change AS = Security Price Change AF = Futures Price Change h = Hedge Ratio Using the Hedge Ratio to Determine Number of Contracts Hedge Ratio = -0.902 Portfolio Size = $50,000,000 S&P 500 is trading at 1350.00 S&P 500 futures also at 1350.00 Value of S&P 500 Futures contract = 1350 x 50 = 67,500 AV - AS h= AF n=h (Value Hedged Contract Size

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts