Question: 1. help make up and fill out the chart provided. 2. one-page discussion paper covering the following: You are writing the point of view of

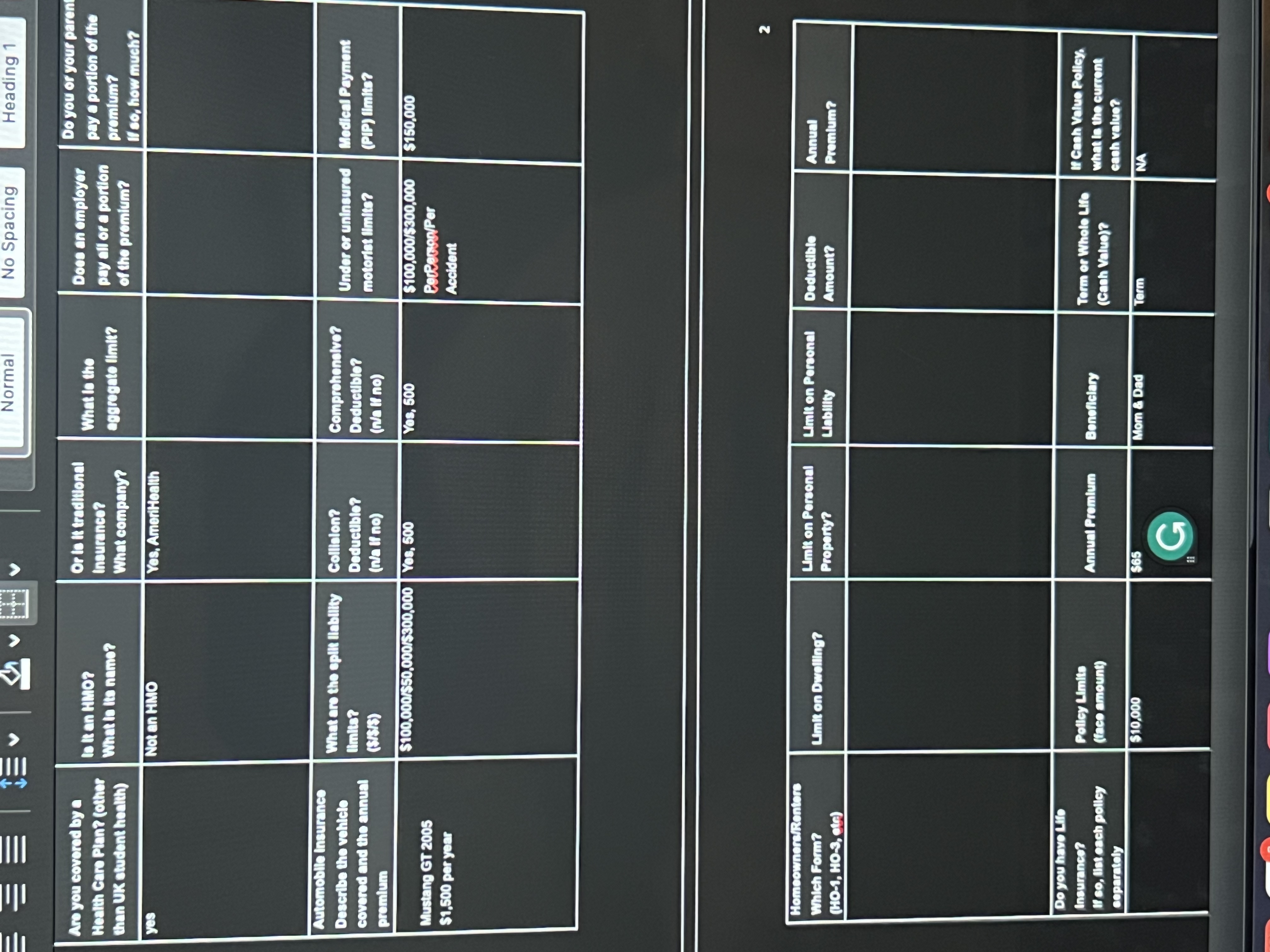

1. help make up and fill out the chart provided.

2. one-page discussion paper covering the following: You are writing the point of view of a college student. Are you adequately insured for auto, homeowners, health, and life insurance? Why or why not? Can you afford the additional insurance at this time? If yes, what are you planning to purchase? If not, what should you buy first, second, etc. when you do have the money? What did you learn from this project?

Also, included in Part 2, you MUST estimate your life insurance needs NOW and in 5 YEARS. To do so, go to

https://lifehappens.org/life-insurance-needs-calculator/

Base your input into the calculator on your life situation as it really is NOW. That means that for Item #1 under "estimate your family income needs" you only put in an amount if you have a spouse or dependents. In such cases you should put in the total annual income your family would need after your death. You should also envision what your life might be like in 5 years and then redo the calculation. When you get your results? please include the needs in the essay.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts