Question: - = !!! 1 HEM 2 4 5 6 QUESTION 26 Angel, who is head of household, sold his main home on January 1, Year

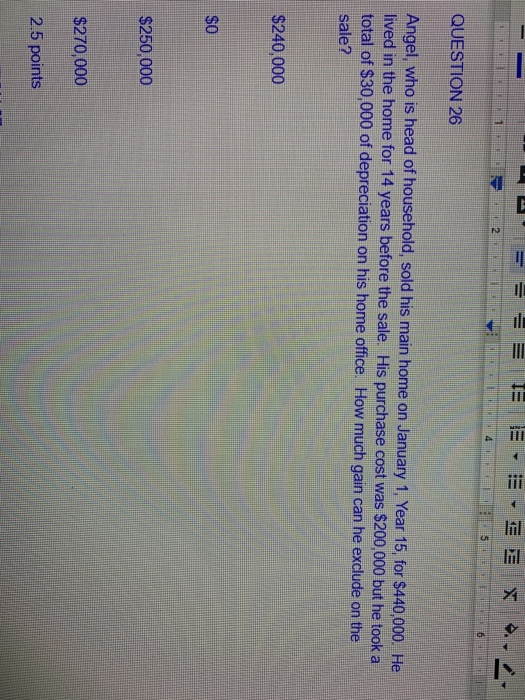

- = !!! 1 HEM 2 4 5 6 QUESTION 26 Angel, who is head of household, sold his main home on January 1, Year 15, for $440,000. He lived in the home for 14 years before the sale. His purchase cost was $200,000 but he took a total of $30,000 of depreciation on his home office. How much gain can he exclude on the sale? $240,000 $0 $250,000 $270,000 2.5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts