Question: 1. Here are the two cash flow forecasts for two mutually exclusive projects. Find out each project's discounted payback, NPV, IRR, and MIRR at a

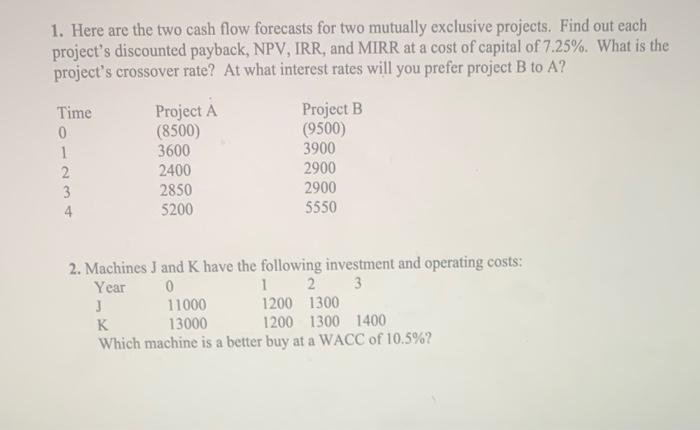

1. Here are the two cash flow forecasts for two mutually exclusive projects. Find out each project's discounted payback, NPV, IRR, and MIRR at a cost of capital of 7.25%. What is the project's crossover rate? At what interest rates will you prefer project B to A? Time Project A Project B 0 (8500) (9500) 1 3600 3900 2 2400 2900 3 2850 2900 4 5200 5550 2. Machines J and K have the following investment and operating costs: Year 0 1 2 3 11000 1200 1300 K 13000 1200 1300 1400 Which machine is a better buy at a WACC of 10.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts