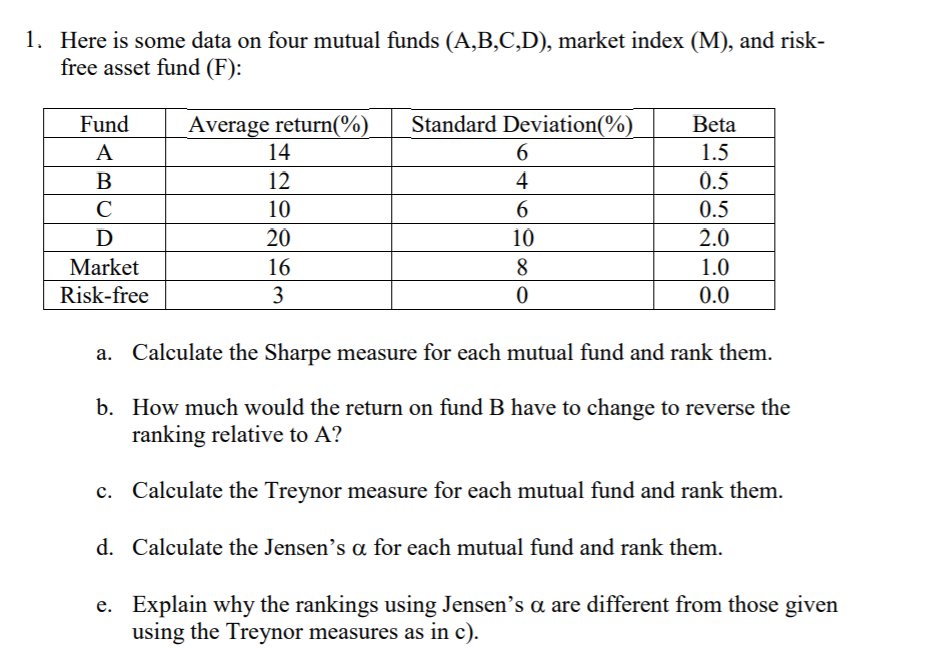

Question: 1. Here is some data on four mutual funds (A,B,C,D), market index (M), and risk- free asset fund (F) Fund Average return(% 14 12 10

1. Here is some data on four mutual funds (A,B,C,D), market index (M), and risk- free asset fund (F) Fund Average return(% 14 12 10 20 16 Standard Deviation(% 4 10 Beta 1.5 0.5 0.5 2.0 Market Risk-free 0.0 a. Calculate the Sharpe measure for each mutual fund and rank them b. How much would the return on fund B have to change to reverse the ranking relative to A? Calculate the Trevnor measure for each mutual fund and rank them Calculate the Jensen's for each mutual fund and rank them Explain why the rankings using Jensen's are different from those given c. d. e. using the Treynor measures as in c) 1. Here is some data on four mutual funds (A,B,C,D), market index (M), and risk- free asset fund (F) Fund Average return(% 14 12 10 20 16 Standard Deviation(% 4 10 Beta 1.5 0.5 0.5 2.0 Market Risk-free 0.0 a. Calculate the Sharpe measure for each mutual fund and rank them b. How much would the return on fund B have to change to reverse the ranking relative to A? Calculate the Trevnor measure for each mutual fund and rank them Calculate the Jensen's for each mutual fund and rank them Explain why the rankings using Jensen's are different from those given c. d. e. using the Treynor measures as in c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts