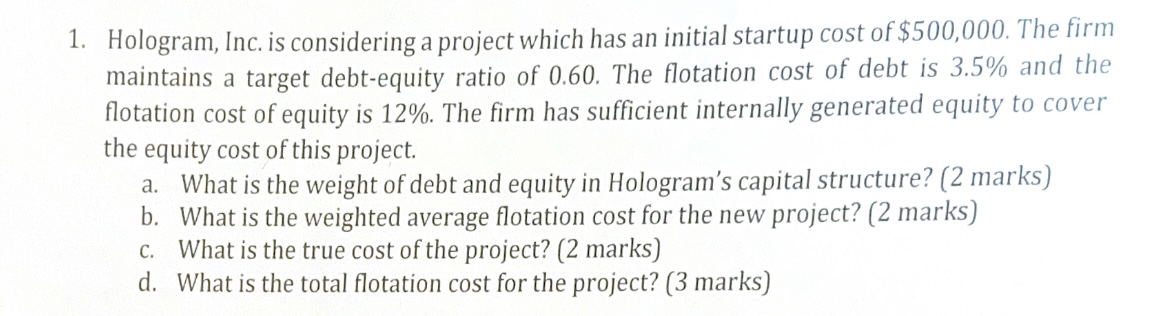

Question: 1. Hologram, Inc. is considering a project which has an initial startup cost of $500,000. The firm maintains a target debt-equity ratio of 0.60.

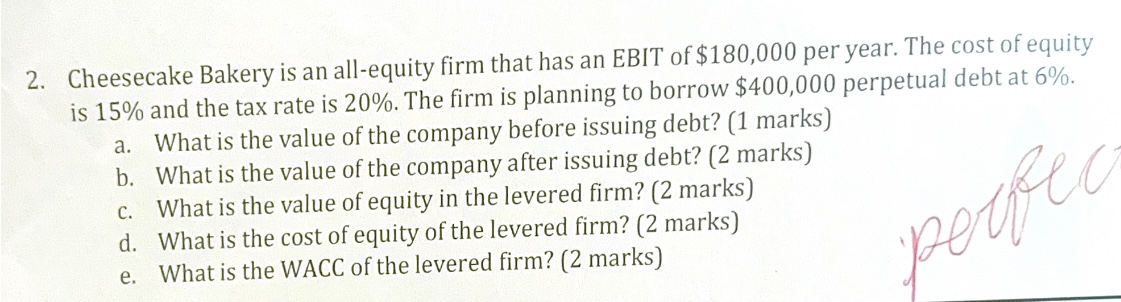

1. Hologram, Inc. is considering a project which has an initial startup cost of $500,000. The firm maintains a target debt-equity ratio of 0.60. The flotation cost of debt is 3.5% and the flotation cost of equity is 12%. The firm has sufficient internally generated equity to cover the equity cost of this project. a. What is the weight of debt and equity in Hologram's capital structure? (2 marks) b. What is the weighted average flotation cost for the new project? (2 marks) c. What is the true cost of the project? (2 marks) d. What is the total flotation cost for the project? (3 marks) 2. Cheesecake Bakery is an all-equity firm that has an EBIT of $180,000 per year. The cost of equity is 15% and the tax rate is 20%. The firm is planning to borrow $400,000 perpetual debt at 6%. a. What is the value of the company before issuing debt? (1 marks) b. What is the value of the company after issuing debt? (2 marks) C. What is the value of equity in the levered firm? (2 marks) d. What is the cost of equity of the levered firm? (2 marks) e. What is the WACC of the levered firm? (2 marks) perfec

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Hologram Inc a Weight of Debt and Equity Let E market value of equity and D market value of debt We ... View full answer

Get step-by-step solutions from verified subject matter experts