Question: 1. How could Ye's team know that Venucia customers differ from Nissan customers? What were the characteristics of Venucia customers? 2. What are the ways

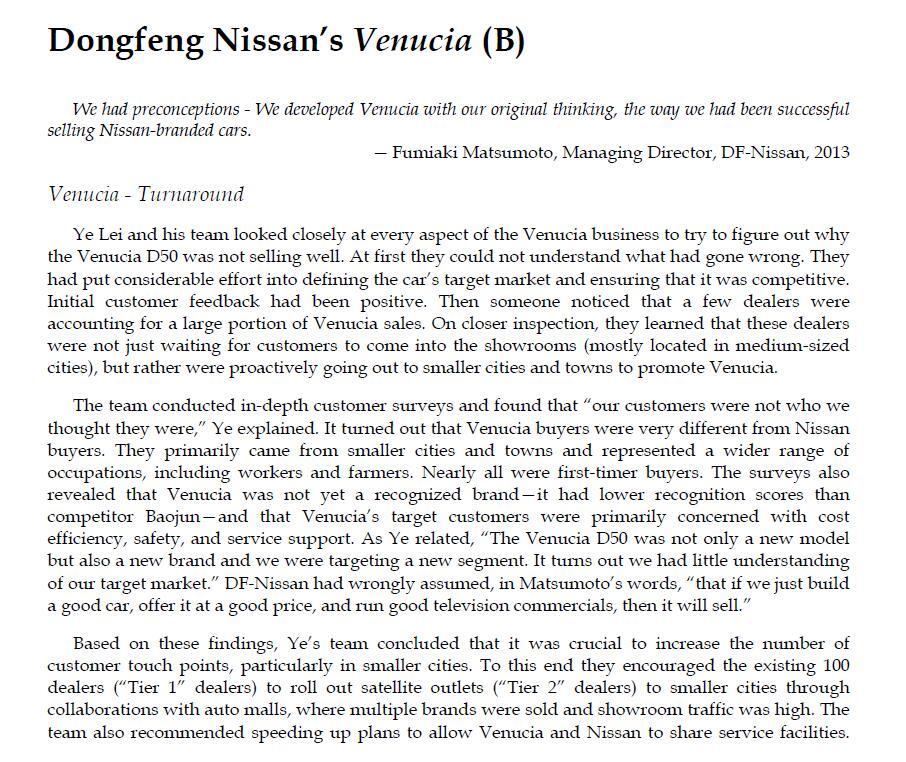

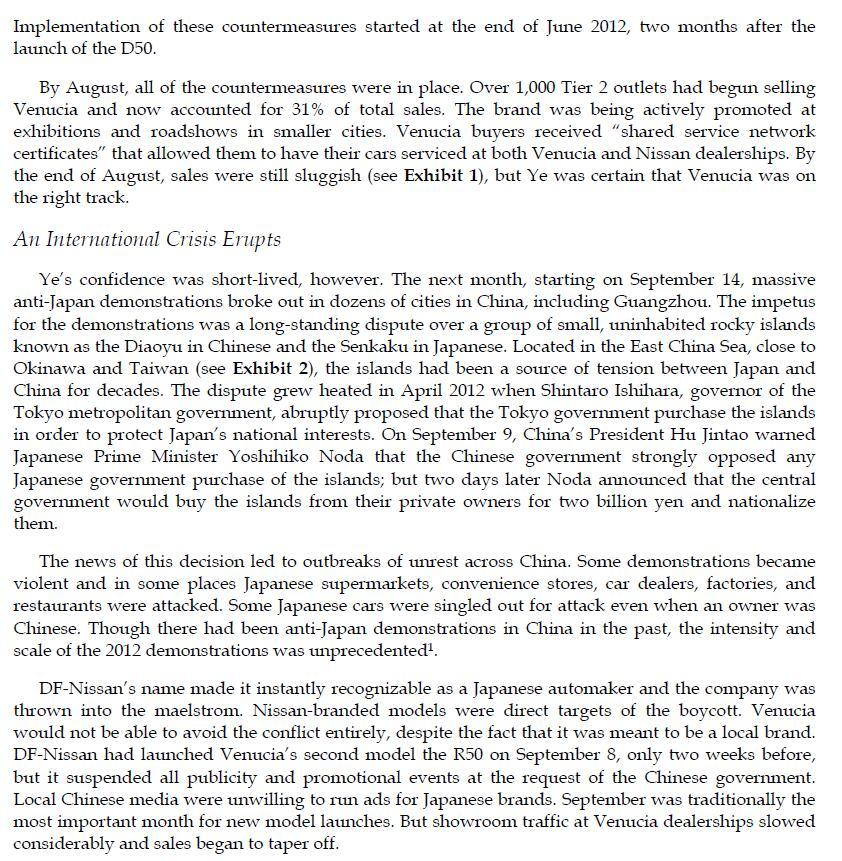

1. How could Ye's team know that Venucia customers differ from Nissan customers? What were the characteristics of Venucia customers? 2. What are the ways to increase the number of customer touch points for communication efficiency? 3. What was the major reason of sales decrease and how did it influence Venucia's marketing communications? Dongfeng Nissan's Venucia (B) We had preconceptions - We developed Venucia with our original thinking, the way we had been successful selling Nissan-branded cars. - Fumiaki Matsumoto, Managing Director, DF-Nissan, 2013 Venicia - Turnaround Ye Lei and his team looked closely at every aspect of the Venucia business to try to figure out why the Venucia D50 was not selling well. At first they could not understand what had gone wrong. They had put considerable effort into defining the car's target market and ensuring that it was competitive. Initial customer feedback had been positive. Then someone noticed that a few dealers were accounting for a large portion of Venucia sales. On closer inspection, they learned that these dealers were not just waiting for customers to come into the showrooms (mostly located in medium-sized cities), but rather were proactively going out to smaller cities and towns to promote Venucia. The team conducted in-depth customer surveys and found that "our customers were not who we thought they were," Ye explained. It turned out that Venucia buyers were very different from Nissan buyers. They primarily came from smaller cities and towns and represented a wider range of occupations, including workers and farmers. Nearly all were first-timer buyers. The surveys also revealed that Venucia was not yet a recognized brand-it had lower recognition scores than competitor Baojun-and that Venucia's target customers were primarily concerned with cost efficiency, safety, and service support. As Ye related, The Venucia D50 was not only a new model but also a new brand and we were targeting a new segment. It turns out we had little understanding of our target market." DF-Nissan had wrongly assumed, in Matsumoto's words, "that if we just build a good car, offer it at a good price, and run good television commercials, then it will sell." Based on these findings, Ye's team concluded that it was crucial to increase the number of customer touch points, particularly in smaller cities. To this end they encouraged the existing 100 dealers ("Tier 1" dealers) to roll out satellite outlets (Tier 2" dealers) to smaller cities through collaborations with auto malls, where multiple brands were sold and showroom traffic was high. The team also recommended speeding up plans to allow Venucia and Nissan to share service facilities. Implementation of these countermeasures started at the end of June 2012, two months after the launch of the D50. By August, all of the countermeasures were in place. Over 1,000 Tier 2 outlets had begun selling Venucia and now accounted for 31% of total sales. The brand was being actively promoted at exhibitions and roadshows in smaller cities. Venucia buyers received "shared service network certificates" that allowed them to have their cars serviced at both Venucia and Nissan dealerships. By the end of August, sales were still sluggish (see Exhibit 1), but Ye was certain that Venucia was on the right track. An International Crisis Erupts Ye's confidence was short-lived, however. The next month, starting on September 14, massive anti-Japan demonstrations broke out in dozens of cities in China, including Guangzhou. The impetus for the demonstrations was a long-standing dispute over a group of small, uninhabited rocky islands known as the Diaoyu in Chinese and the Senkaku in Japanese. Located in the East China Sea, close to Okinawa and Taiwan (see Exhibit 2), the islands had been a source of tension between Japan and China for decades. The dispute grew heated in April 2012 when Shintaro Ishihara, governor of the Tokyo metropolitan government, abruptly proposed that the Tokyo government purchase the islands in order to protect Japan's national interests. On September 9, China's President Hu Jintao warned Japanese Prime Minister Yoshihiko Noda that the Chinese government strongly opposed any Japanese government purchase of the islands; but two days later Noda announced that the central government would buy the islands from their private owners for two billion yen and nationalize them. The news of this decision led to outbreaks of unrest across China. Some demonstrations became violent and in some places Japanese supermarkets, convenience stores, car dealers, factories, and restaurants were attacked. Some Japanese cars were singled out for attack even when an owner was Chinese. Though there had been anti-Japan demonstrations in China in the past, the intensity and scale of the 2012 demonstrations was unprecedented!. DF-Nissan's name made it instantly recognizable as a Japanese automaker and the company was thrown into the maelstrom. Nissan-branded models were direct targets of the boycott. Venucia would not be able to avoid the conflict entirely, despite the fact that it was meant to be a local brand. DF-Nissan had launched Venucia's second model the R50 on September 8, only two weeks before, but it suspended all publicity and promotional events at the request of the Chinese government. Local Chinese media were unwilling to run ads for Japanese brands. September was traditionally the most important month for new model launches. But showroom traffic at Venucia dealerships slowed considerably and sales began to taper off