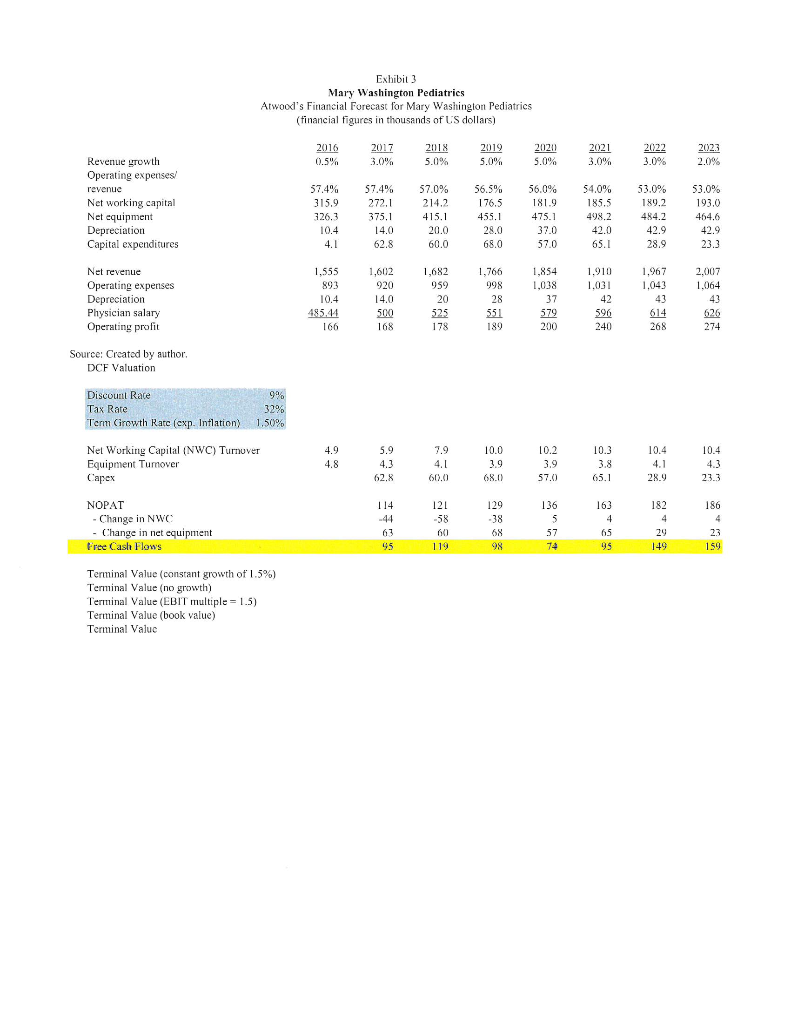

Question: 1- How could you use a DCF-based estimate for the practice value? a. Based on case Exhibit 3, what is the free cash flow expected

1- How could you use a DCF-based estimate for the practice value?

a. Based on case Exhibit 3, what is the free cash flow expected for each year?

b. How would you estimate a terminal value for the practice in 2023?

Exhibit3 Mary Washington Pediatrics Atwood's Financial Forecast for Mary Washington Pediatrics (financial figures in thousands of US dollars) 2016 0.5% 2017 3.0% 2018 5.0% 2019 5.0% 20211 5.0% 2021 3.0% 2022 3.0% 2023 2.0% Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures 57.4% 315.9 126.3 10.4 57.4% 272.1 375,1 14.0 62.8 57.0% 214.2 415.1 20.0 60.0 56.5% 176.5 455.1 28.0 68.0 56.0% 181.9 475.1 37.0 57.0 54.0% 185.5 498.2 42.0 65.1 53.0% 189.2 484.2 53.0% 193.0 464.6 42.9 23.3 42.9 28.9 1.682 959 1,766 998 1,854 1,038 2,007 1.064 Net revenue Operating expenses Depreciation Physician salary Operating profit 1.555 893 10.4 485.14 166 1,602 920 14.0 500 168 1.967 1,043 43 614 20 1.910 1.031 42 596 240 28 626 325 178 551 189 579 200 268 274 Source: Created by author, DCF Valuation 996 Discount Rate Tax Rate Ter Growth Rate (exp. Inflation) 32% 1.50% 5.9 10.0 10.2 10.4 Net Working Capital (NWC) Turnover Equipment Tumover Capex 19 10.4 4.1 28.9 23.3 114 121 129 136 163 182 186 NOPAT - Change in NWC - Change in net equipment Free Cash Flow's -58 -38 63 68 29 149 23 159 45 119 98 74 95 Terminal Value (constant growth of 1.5%) Terminal Value (no growth) Terminal Value (EBIT multiple = 1.5) Terminal Value (book value) Terminal Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts