Question: 1. How do calculate the expected return on a security? 2. How do we calculate the variance of the expected return? 3. What is

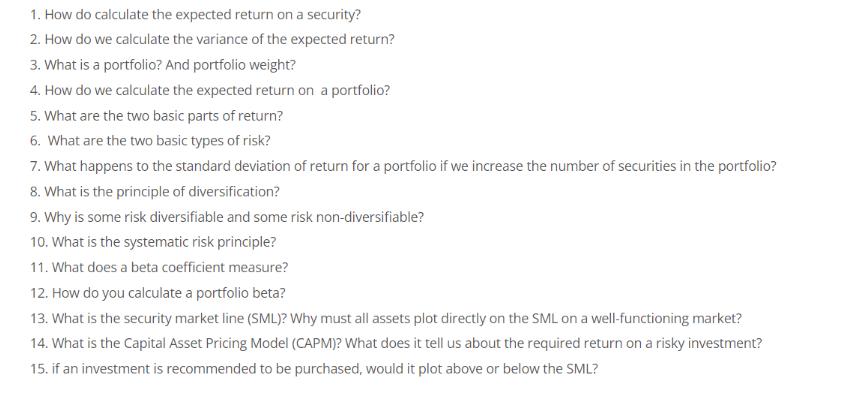

1. How do calculate the expected return on a security? 2. How do we calculate the variance of the expected return? 3. What is a portfolio? And portfolio weight? 4. How do we calculate the expected return on a portfolio? 5. What are the two basic parts of return? 6. What are the two basic types of risk? 7. What happens to the standard deviation of return for a portfolio if we increase the number of securities in the portfolio? 8. What is the principle of diversification? 9. Why is some risk diversifiable and some risk non-diversifiable? 10. What is the systematic risk principle? 11. What does a beta coefficient measure? 12. How do you calculate a portfolio beta? 13. What is the security market line (SML)? Why must all assets plot directly on the SML on a well-functioning market? 14. What is the Capital Asset Pricing Model (CAPM)? What does it tell us about the required return on a risky investment? 15. if an investment is recommended to be purchased, would it plot above or below the SML?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

1 Expected return of security ERjRfRmRf Bj where Rf risk free rate Rmmarket return Bj security beta 2 Variance of expected return The expected rate of ... View full answer

Get step-by-step solutions from verified subject matter experts