Question: 1 - How do comparable companies compare? USE To determine TERMINAL VALUE. (Use exhibit 8 and calculate multiples and compare them to Access Line, see

1 - How do comparable companies compare? USE To determine TERMINAL VALUE. (Use exhibit 8 and calculate multiples and compare them to Access Line, see guidance below.)

Now that we have Comps used to calculate TERMINAL VALUE, Perform Valuation using the template below to answer questions 2-5

Comparable Company Valuations

Guidance for Question 1 (calculate the multiples for 3 Com and Boston Technologies -public companies). Calculate in Yellow. - Hint Use Market Cap/Revenue & Net Income.

| 3Com | |||

| Recent Performance ($m) | 1994 | 1993 | 1992 |

| FY Revenue | 827.0 | 617.2 | 408.4 |

| FY Net Income | 19.5 | 68.2 | 5.2 |

| Market Capitalization at Calendar year end | 3320.0 | 1419.0 | 662.0 |

| Beta | 1.4 | ||

| Revenue Multiples |

|

|

|

| Net Income Multiples |

|

|

|

| Boston Technologies | |||

| Recent Performance ($m) | 1994 | 1993 | 1992 |

| FY Revenue | 70.3 | 49.5 | 36.4 |

| FY Net Income | 6.7 | 3.1 | -2.4 |

| Market Capitalization at Calendar year end | 364 | 199 | 180 |

| Beta | 2.03 | ||

| Revenue Multiples |

|

|

|

| Net Income Mulitples |

|

| NA |

Access Line Valuation

Average Revenue Multiples for 3 years from each of the companies above:

Avg Revenue Multiple From Comps Above:

Avg Net Income Multiple From Comps above:

Use the above multiples and multiply the Access line data , fill in the Yellow area. (Hint: E.g. if the average revenue multiple is 3.68, multiply 3.68 X 1997 Revenue of 120.3 to get a Terminal Value of $442 million.

| AccessLine | ||||||

| 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | |

| Revenue ($m) | 14.2 | 32.5 | 76.4 | 120.3 | 164.1 | 208.0 |

| Net Income/Revenue (%) | 7.3% | 14.7% | 22% | |||

| Net Income ($m) | 8.78 | 24.13 | 45.76 | |||

| TV using Revenue Multiples | 442.47 |

|

| |||

| TV using Net Income Multiples |

|

|

|

1)Identify a set of comparable companies

2)Calculate the multiples of comparable companies.

3)Times multiples with the corresponding financial terms of your company to get terminal value

Market Cap/Revenue

Market Cap/Net Income

Terminal Value = Multiple X Revenue

Terminal Value = Multiple X Net Income

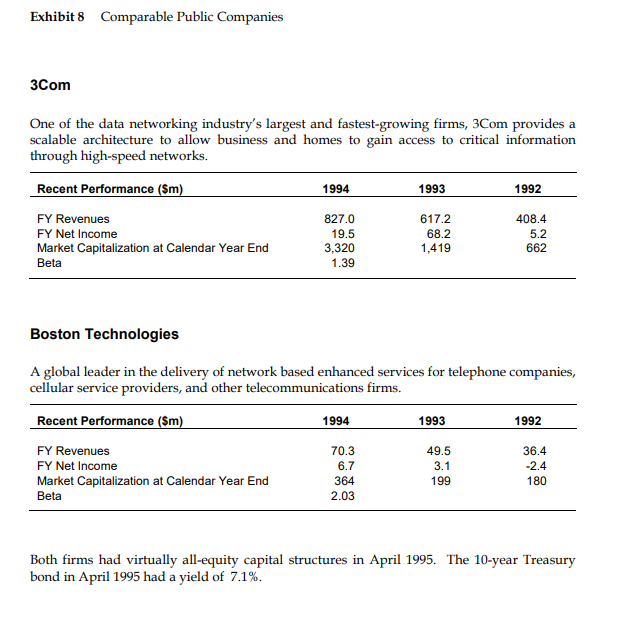

Exhibit 8 Comparable Public Companies 3Com One of the data networking industry's largest and fastest-growing firms, 3Com provides a scalable architecture to allow business and homes to gain access to critical information through high-speed networks. Recent Performance ($m) 1994 1993 1992 FY Revenues 827.0 6172 408.4 FY Net Income 19.5 68.2 5.2 Market Capitalization at Calendar Year End 3,320 1,419 Beta 1.39 662 Boston Technologies A global leader in the delivery of network based enhanced services for telephone companies, cellular service providers, and other telecommunications firms. Recent Performance ($m) 1994 1993 1992 FY Revenues FY Net Income Market Capitalization at Calendar Year End Beta 70.3 6.7 364 2.03 49.5 3.1 199 36.4 -2.4 180 Both firms had virtually all-equity capital structures in April 1995. The 10-year Treasury bond in April 1995 had a yield of 7.1%. Exhibit 8 Comparable Public Companies 3Com One of the data networking industry's largest and fastest-growing firms, 3Com provides a scalable architecture to allow business and homes to gain access to critical information through high-speed networks. Recent Performance ($m) 1994 1993 1992 FY Revenues 827.0 6172 408.4 FY Net Income 19.5 68.2 5.2 Market Capitalization at Calendar Year End 3,320 1,419 Beta 1.39 662 Boston Technologies A global leader in the delivery of network based enhanced services for telephone companies, cellular service providers, and other telecommunications firms. Recent Performance ($m) 1994 1993 1992 FY Revenues FY Net Income Market Capitalization at Calendar Year End Beta 70.3 6.7 364 2.03 49.5 3.1 199 36.4 -2.4 180 Both firms had virtually all-equity capital structures in April 1995. The 10-year Treasury bond in April 1995 had a yield of 7.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts