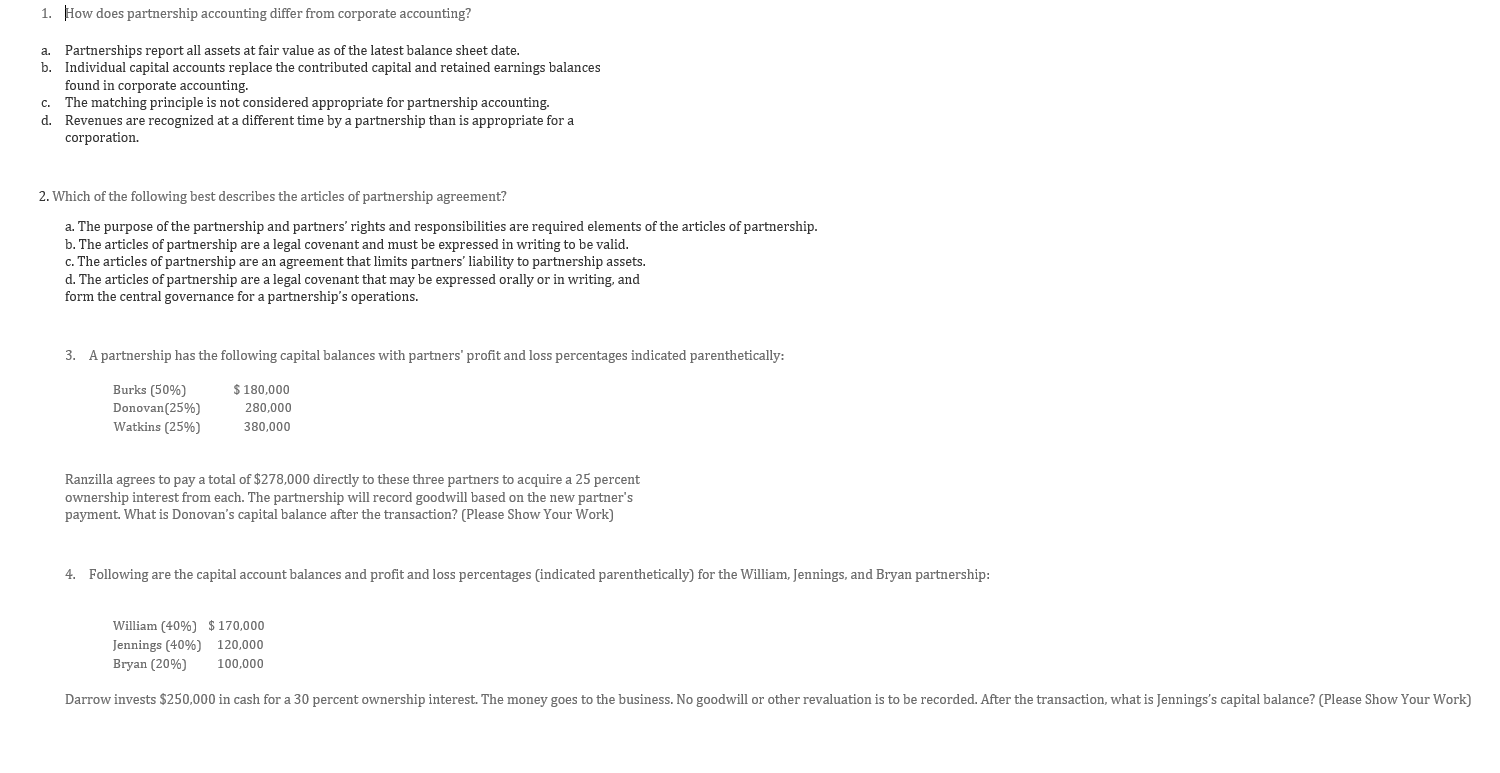

Question: 1. How does partnership accounting differ from corporate accounting? a. Partnerships report all assets at fair value as of the latest balance sheet date. b.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts