Question: 1- How many notes have been issued by SAP regarding the new legal requirement? 2-List the pilot version that has been released to customer? 3-In

1- How many notes have been issued by SAP regarding the new legal requirement?

2-List the pilot version that has been released to customer?

3-In your opinion, how the company can benefits from SAP system while implementing VAT.

plz write the answer that i can copy and paste

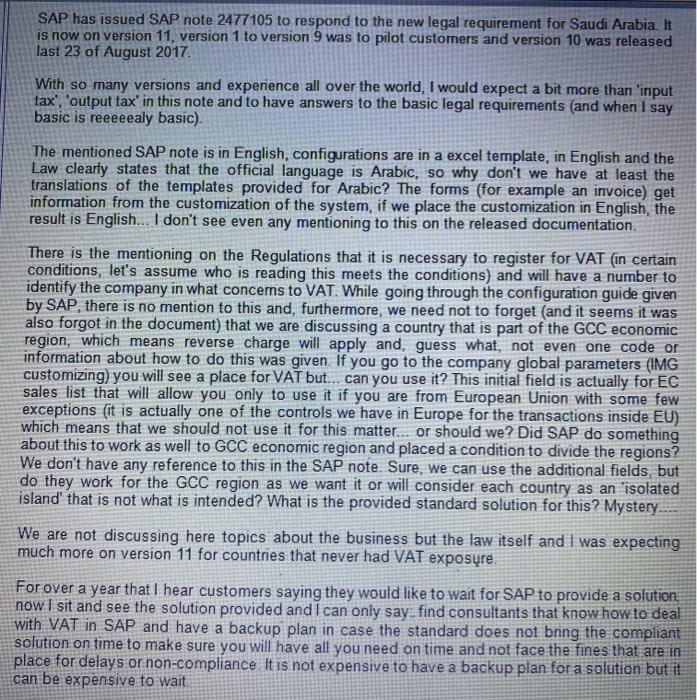

SAP has issued SAP note 2477105 to respond to the new legal requirement for Saudi Arabia. It is now on version 11, version 1 to version 9 was to pilot customers and version 10 was released last 23 of August 2017 With so many versions and experience all over the world, I would expect a bit more than 'input tax', 'output tax' in this note and to have answers to the basic legal requirements (and when I say basic is reeeeealy basic). The mentioned SAP note is in English, configurations are in a excel template, in English and the Law clearly states that the official language is Arabic, so why don't we have at least the translations of the templates provided for Arabic? The forms (for example an invoice) get information from the customization of the system, if we place the customization in English, the result is English... I don't see even any mentioning to this on the released documentation. There is the mentioning on the Regulations that it is necessary to register for VAT (in certain conditions, let's assume who is reading this meets the conditions) and will have a number to identify the company in what concerns to VAT. While going through the configuration guide given by SAP, there is no mention to this and, furthermore, we need not to forget (and it seems it was also forgot in the document) that we are discussing a country that is part of the GCC economic region, which means reverse charge will apply and, guess what, not even one code or information about how to do this was given. If you go to the company global parameters (IMG customizing) you will see a place for VAT but... can you use it? This initial field is actually for EC sales list that will allow you only to use it if you are from European Union with some few exceptions (it is actually one of the controls we have in Europe for the transactions inside EU) which means that we should not use it for this matter... or should we? Did SAP do something about this to work as well to GCC economic region and placed a condition to divide the regions? We don't have any reference to this in the SAP note. Sure, we can use the additional fields, but do they work for the GCC region as we want it or will consider each country as an 'isolated island' that is not what is intended? What is the provided standard solution for this? Mystery. We are not discussing here topics about the business but the law itself and I was expecting much more on version 11 for countries that never had VAT exposre For over a year that I hear customers saying they would like to wait for SAP to provide a solution, noW I sit and see the solution provided and I can only say: find consultants that know how to deal with VAT in SAP and have a backup plan in case the standard does not bring the compliant solution on time to make sure you will have all you need on time and not face the fines that are in place for delays or non-compliance It is not expensive to have a backup plan for a solution but it can be expensive to wait

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts